Canadian Dollar is broadly lower in early US trading following weaker-than-expected inflation data. With CPI decelerating further than anticipated, this set of data provides BoC some breathing room to ease monetary policy more aggressively if necessary. The spotlight now shifts to the upcoming September employment report, which will be crucial in determining whether BoC sticks to its current pace of a 25bps rate cut at its October 24 meeting, or more.

Meanwhile, Dollar is edging slightly higher after stronger-than-expected ex-auto sales data. Euro remains mixed despite poor German economic sentiment figures. Overall, market movements are relatively muted as traders appear to be holding their major bets ahead of tomorrow’s FOMC rate decision. While Fed is widely expected to begin its policy loosening cycle, the uncertainty remains around whether the rate cut will be 25bps or a larger 50bps reduction.

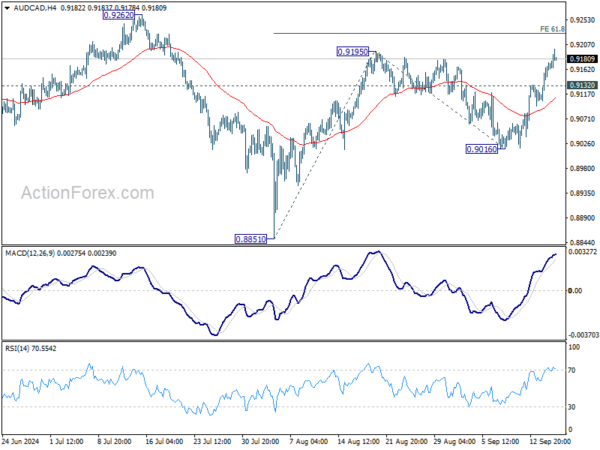

Technically, AUD/CAD’s breach of 0.9195 resistance suggest that rise from 0.8851 is resuming. Further rally is expected as long as 0.9132 support holds, towards 61.8% projection of 0.8851 to 0.9195 from 0.9016 at 0.9226. However, strong resistance might emerge at 0.9262 to limit upside, at least on first attempt.

In Europe at the time of writing, FTSE is up 0.60%. DAX is up 0.86%. CAC is up 0.95%. UK 10-year yield is up 0.0146 at 3.778. Germany 10-year yield is up 0.0099 at 2.134. Earlier in Asia,Nikkei fell -1.03%. Hong Kong HSI rose 1.37% China Shanghai SSE fell -0.48%. Singapore Strait Times rose 0.64%. Japan 10-year JGB yield fell -0.0158 to 0.830.

US retail sales rises 0.1% mom in Aug, ex-auto sales up 0.1% mom

US retail sales rose 0.1% mom to USD 710.7B in August, above expectation of -0.1% mom. Ex-auto sales rose 0.1% mom to USD 576.4B, below expectation of 0.2% mom. Ex-gasoline sales rose 0.1% mom to USD 658.8B. Ex-auto, gasoline sales rose 0.2% mom to USD 524.5B.

Total sales for the June through August period were up 2.3% from the same period a year ago.

Canada’s CPI slows to 2% in Aug, lowest since Feb 2021

Canada’s CPI growth slowed to 2.0% yoy in August, down from 2.5% yoy in July, and below market expectations of 2.1%—marking the slowest pace since February 2021. This deceleration is largely attributed to decline in gasoline prices, driven by a combination of lower fuel prices and a base-year effect. Excluding gasoline, CPI still eased to 2.2% yoy from 2.5% yoy, indicating broad softening in inflation.

On a month-to-month basis, CPI fell by -0.2% mom, significantly below the expected 0.2% mom increase, and following a 0.4% mom rise in July. The lower-than-anticipated figures could strengthen the case for BoC to ease monetary policy more aggressively if economic data continues to signal softness.

Core inflation measures also showed signs of cooling. CPI median dipped to 2.3% yoy, slightly higher than expectations of 2.2% yoy, but CPI trimmed dropped to 2.4% yoy from 2.7%yoy, missing forecasts. CPI common index fell from 2.2% yoy to 2.0% yoy, also below expectations of 2.2% yoy.

The overall decline in inflation, especially in the core metrics, offers BoC more room to consider faster rate cuts should economic activity continue to falter. Given Governor Tiff Macklem’s recent dovish remarks, these latest inflation figures could push the central bank toward more decisive easing in the near term.

German ZEW plummets to 3.6 as optimism evaporates, Eurozone follows

Germany’s ZEW Economic Sentiment dropped sharply in September, falling from 19.2 to 3.6, significantly missing expectations of 18.6. Current Situation Index also saw a stark decline from -77.3 to -84.5, its lowest level since May 2020.

In the broader Eurozone, ZEW Economic Sentiment fell to 9.3, down from 17.9, while Current Situation Index dropped -8 points to -40.4. The data suggests that confidence across the region is waning, though Germany’s drop was notably more severe.

ZEW President Achim Wambach highlighted that “the hope for a swift improvement in the economic situation is visibly fading,” adding that the balance between optimists and pessimists is now evenly split.

The sharp fall in expectations for Germany signals that economic pessimism is growing faster than elsewhere in the Eurozone. Wambach also noted that most respondents seem to have already accounted for ECB’s recent interest rate decision in their expectations.

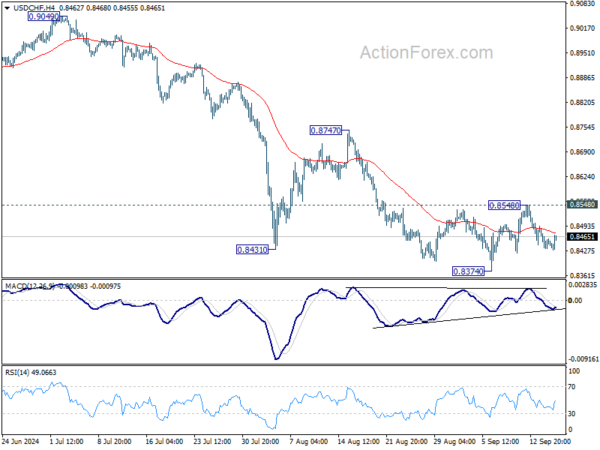

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8426; (P) 0.8457; (R1) 0.8479; More…

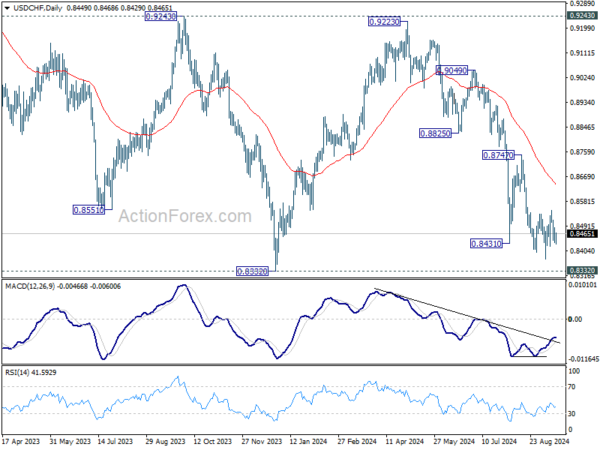

USD/CHF is still bounded in range trading and intraday bias remains neutral for the moment. With 0.8548 resistance intact, further decline is still expected. On the downside, break of 0.8374 will resume the fall from 0.9223 to retest 0.8332 low. Decisive break there will indicate larger down trend resumption. However, considering bullish convergence condition in 4H MACD, break of 0.8548 resistance will confirm short term bottoming, and turn bias back to the upside for 0.8747 resistance.

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M Jul | 1.40% | 1.00% | -1.30% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Sep | 3.6 | 18.6 | 19.2 | |

| 09:00 | EUR | Germany ZEW Current Situation Sep | -84.5 | -77.3 | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Sep | 9.3 | 17.6 | 17.9 | |

| 12:15 | CAD | Housing Starts Y/Y Aug | 217K | 246K | 280K | |

| 12:30 | CAD | CPI M/M Aug | -0.20% | 0.20% | 0.40% | |

| 12:30 | CAD | CPI Y/Y Aug | 2.00% | 2.10% | 2.50% | |

| 12:30 | CAD | CPI Median Y/Y Aug | 2.30% | 2.20% | 2.40% | |

| 12:30 | CAD | CPI Trimmed Y/Y Aug | 2.40% | 2.50% | 2.70% | |

| 12:30 | CAD | CPI Common Y/Y Aug | 2.00% | 2.20% | 2.20% | |

| 12:30 | USD | Retail Sales M/M Aug | 0.10% | -0.10% | 1.00% | 1.10% |

| 12:30 | USD | Retail Sales ex Autos M/M Aug | 0.10% | 0.20% | 0.40% | |

| 13:15 | USD | Industrial Production M/M Aug | 0.80% | 0.20% | -0.60% | -0.90% |

| 13:15 | USD | Capacity Utilization Aug | 78.00% | 77.90% | 77.80% | 77.40% |

| 14:00 | USD | Business Inventories Jul | 0.40% | 0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 42 | 39 |