The stronger-than-anticipated core inflation data initially sent shockwaves through US equities overnight, sparking a deep sell-off. However, tech stocks led a remarkable recovery, with all major indexes finishing in green. Notably, S&P 500 posted a remarkable reversal, ending the day up more than 1% after having fallen over -1% intraday—a feat not seen since 2022.

The chances of a 50bps rate cut by Fed next week have now diminished significantly in the wake of recent robust non-farm payroll data and yesterday’s core CPI release. Fed fund futures currently reflect just a 15% chance of such a cut, effectively taking it off the table. That said, market participants are still betting on cumulative rate cuts of 100bps by year’s end, with over 80% probability attached to that scenario. Next week’s release of Fed’s economic projections, alongside the updated dot plot, will be crucial in shaping further market expectations regarding the pace and scale of future rate reductions.

Meanwhile, attention is now turning to ECB’s upcoming decision today, where a 25bps rate cut is widely anticipated. Euro has remained under pressure this week, losing ground against most major currencies except for British pound and Swiss franc. While ECB President Christine Lagarde is expected to maintain a cautious, data-dependent stance on future policy moves, any dovish signals in the updated economic projections could lead to further market bets on a faster easing cycle, pushing the Euro lower.

Looking at overall currency performance this week so far, Aussie is currently the strongest, buoyed by the stock market rebound. Dollar follows closely, with Loonie in third place. On the other end, Swiss Franc is the worst performer, followed by Sterling and Euro. Yen and Kiwi are positioned in the middle of the pack.

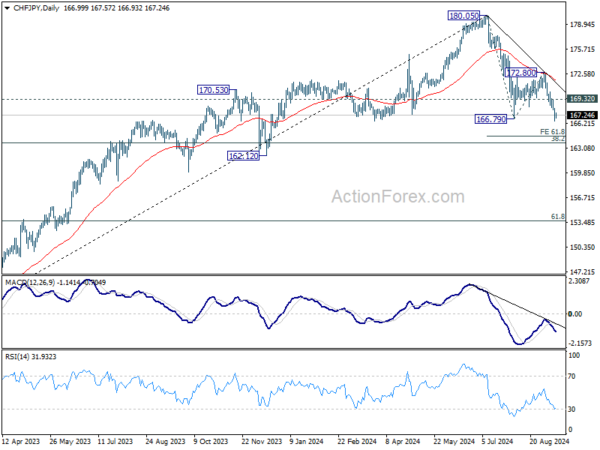

Technically, CHF/JPY’s breach of 166.79 support yesterday indicates that rebound from there has completed at 172.80, after rejection by 55 D EMA. Decline from 180.05 might be resuming for 61.8% projection 180.05 to 166.79 from 172.80 at 164.60. Nevertheless, break of 169.32 minor resistance will delay the bearish case and bring more sideway trading first.

In Asia, at the time of writing, Nikkei is up 2.90%. Hong Kong HSI is up 1.02%. China Shanghai SSE is down -0.05%. Singapore Strait Times is up 0.34%. Japan 10-year JGB yield is up 0.0198 at 0.873. Overnight, DOW rose 0.31% S&P 500 rose 1.07%. NASDAQ rose 2.17%. 10-year yield rose 0.007 to 3.653.

ECB to cut rates again, Lagarde to maintain data-dependent stance

ECB is widely expected to implement a 25bps rate cut today, marking the second adjustment in its current policy easing cycle. This cut would bring the deposit rate down to 3.50% and the main refinancing rate to 4.00%. However, the market’s attention is not solely on today’s decision but rather on the ECB’s forward guidance.

One critical question is whether ECB will hint at another rate cut in October, or if it will maintain a more cautious pace by cutting once per quarter, with December being the next move when fresh economic projections are released. T

These issues are unlikely to be directly addressed in today’s press conference, as ECB President Christine Lagarde will likely reiterate the data-dependent, meeting-by-meeting approach. Nonetheless, ECB’s updated economic forecasts, particularly concerning growth, could offer insight into the bank’s level of concern over the current economic slowdown.

In the currency markets, Euro’s reaction to ECB decision will be watched closely, particularly against the British Pound and Swiss Franc.

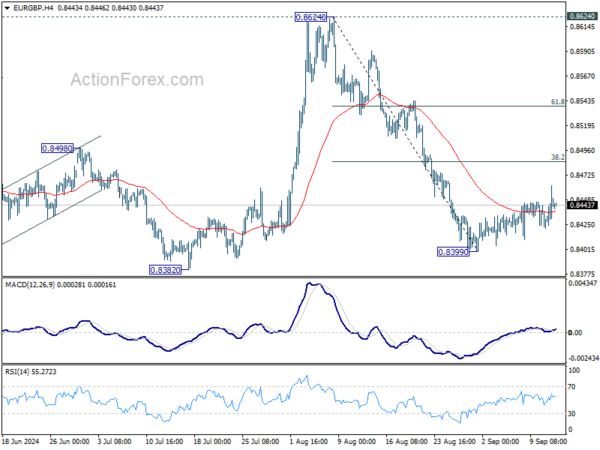

Technically, EUR/GBP’s price actions from 0.8399 short term bottom are still corrective looking. While stronger recovery might be seen, upside should be limited by 38.2% retracement of 0.8624 to 0.8399 at 0.8485. Break of 0.8399 will bring retest of 0.8382 low. Firm break there will resume larger down trend. However, sustained break of 0.8485 will bring stronger rally to 61.8% retracement at 0.8538 and possibly above.

As for EUR/CHF, a temporary low should be formed at 0.9305 with current recovery. But further decline is expected as long as 0.9444 resistance holds. Below 0.9305 will resume the fall from 0.9579 to retest 0.9209 low. Firm break there will resume larger down trend. However, decisive break of 0.9444 will argue that the pullback from 0.9579 has completed as a corrective move. In this case, rise from 0.9209 could be resume to resume through 0.9579 resistance instead.

Japan’s wholesale price growth slows sharply to 2.5% yoy in Aug as Yen rebounds

Japan’s corporate goods price index decelerated to 2.5% yoy in August, falling below market expectations of 2.8% yoy, marking the first slowdown in eight months. The data reflects a cooling in price pressures, which has been reinforced by a significant 7.4% appreciation in Yen during the month.

The stronger Yen drove a steep slowdown in Yen-based import prices, with the annual growth rate dropping sharply from 10.8% yoy in July to just 2.6% yoy in August. This marks a considerable easing in import costs, offering some relief to Japanese businesses relying on foreign goods.

On a month-to-month basis, CGPI fell by -0.2% mom, while import prices measured in yen contracted significantly by -6.1% mom. The sharp fall in import costs suggests that the stronger yen is playing a key role in softening inflationary pressures, especially in the context of global commodity prices.

BoJ’s Tamura advocates for gradual rate increase to 1% neutral mark

BoJ board member Naoki Tamura indicated in a speech today that the likelihood of achieving 2% inflation target sustainably is improving. As a result, the central bank needs to gradually raise interest rates to neutral levels.

Tamura estimated Japan’s neutral interest rate, or the rate that neither stimulates nor slows down economic activity, to be at least around 1%.

He added, “As such, it’s necessary to push up our short-term policy rate at least to around 1% by the latter half of the fiscal year ending March 2026 to sustainably achieve the BoJ’s price goal.”

In light of growing labor shortages and rising wage pressures, Tamura warned that inflation risks were increasing. Companies are responding to tight labor market conditions by raising wages and passing on higher costs through price hikes.

Tamura underscored the need to “raise interest rates at an appropriate timing, and in several stages,” in order to keep inflation under control.

This marked the first time a BoJ policymaker had publicly specified a target level for raising short-term interest rates.

Looking ahead

ECB rate decision is the main focus of the day. US will release PPI and jobless claims.

AUD/USD Daily Report

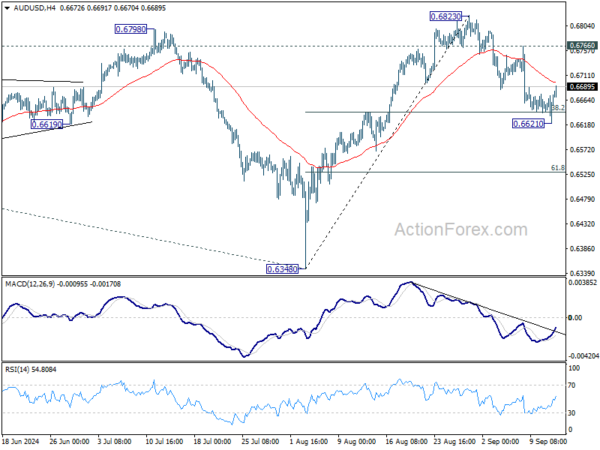

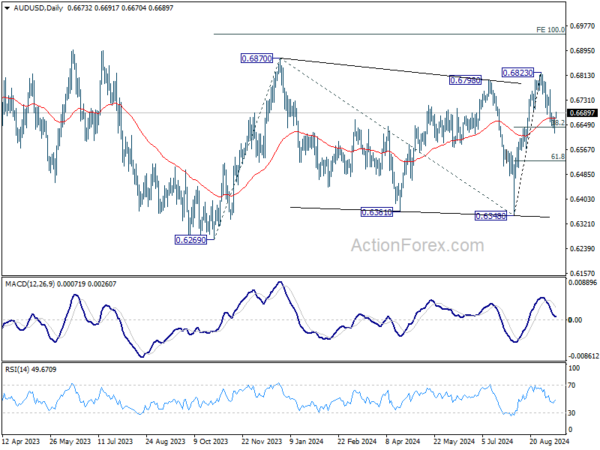

Daily Pivots: (S1) 0.6639; (P) 0.6657; (R1) 0.6693; More...

AUD/USD recovered after dipping to 0.6621 briefly and intraday bias is turned neutral first. Some consolidations would be seen but risk will stay on the downside as long as 0.6766 resistance holds. Break of 0.6621 and sustained trading below 38.2% retracement of 0.6348 to 0.6823 at 0.6642 will target 61.8% retracement at 0.6529. On the upside, though, above 0.6766 resistance will bring retest of 0.6823 instead.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 0.6798/6870 resistance zone will target 0.7156 resistance. In case of another fall, strong support should be seen from 0.6169/6361 to bring rebound.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Aug | 1.00% | -14% | -19% | -18% |

| 23:50 | JPY | BSI Large Manufacturing Index Q3 | 4.5 | -2.5 | -1 | |

| 23:50 | JPY | PPI Y/Y Aug | 2.50% | 2.80% | 3.00% | |

| 01:00 | AUD | Consumer Inflation Expectations Sep | 4.40% | 4.50% | ||

| 12:15 | EUR | ECB Main Refinancing Rate | 4.00% | 4.25% | ||

| 12:15 | EUR | ECB Deposit Rate | 3.50% | 3.75% | ||

| 12:30 | CAD | Building Permits M/M Jul | 6.50% | -13.90% | ||

| 12:30 | USD | PPI M/M Aug | 0.20% | 0.10% | ||

| 12:30 | USD | PPI Y/Y Aug | 1.80% | 2.20% | ||

| 12:30 | USD | PPI Core M/M Aug | 0.20% | 0.00% | ||

| 12:30 | USD | PPI Core Y/Y Aug | 2.50% | 2.40% | ||

| 12:30 | USD | Initial Jobless Claims (Sep 6) | 231K | 227K | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | 49B | 13B |