New Zealand Dollar made significant gains in Asian session today, boosted by unexpectedly strong business confidence data from New Zealand. In retrospect, RBNZ’s unexpected rate cut just two weeks ago now appears to be a timely and strategic move, welcomed by Kiwi traders. By initiating the policy easing cycle earlier than anticipated, RBNZ may have provided the sluggish economy with a crucial boost, which could lead to a shorter and shallower easing cycle than initially feared. If future economic data continues to show resilience, the RBNZ might find itself needing to implement only one more rate cut this year, as originally projected, rather than the two cuts that some market analysts had been predicting.

Despite this strong showing from Kiwi, Swiss Franc remains the top performer of the week at this point, although New Zealand Dollar has overtaken Canadian Dollar for the second spot. On the other end of the spectrum, Euro continues to be the weakest performer, followed by Yen and British Pound. The Dollar and Australian Dollar are holding their positions in the middle of the currency performance chart.

Investor sentiment appears to be cooling after Nvidia’s fiscal second-quarter earnings report, which, despite beating expectations, left investors underwhelmed. The fiscal Q3 forecast, in particular, did not impress, with concerns over gross margins missing market estimates and revenue projections that were just largely in line with expectations. Consequently, NASDAQ futures are trading lower in the Asian session, after the index declined by -1.12% overnight.

Technically, NASDAQ’s retreat from 18171.67 is set to extend lower towards 38.2% retracement of 15708.53 to 18171.68 at 17135.59. Strong rebound from there would keep the rise from 15708.53 intact for another rally to 18671.06 high. However, firm break of 17135.59 will argue that the corrective pattern from 18671.06 has already started the third leg, and deeper fall could be seen to 61.8% retracement at 16590.63 and below. If this bearish scenario unfolds, it could provide a much-needed boost to Dollar, aiding its rebound.

In Asia, at the time of writing, Nikkei is down -0.39%. Hong Kong HSI is down -0.71%. China Shanghai SSE is down -0.43%. Singapore Strait Times is up 0.28%. Japan 10-year JGB yield is up 0.0059 at 0.901. Overnight, DOW fell -0.39%. S&P 500 fell -0.60%. NASDAQ fell -1.12%. 10-year yield rose 0.0008 to 3.841.

NZ ANZ business confidence hits decade high, activity outlook at 7-yr peak

New Zealand’s ANZ Business Confidence surged in August, reaching 50.6, the highest level in a decade, up from 27.1 in July. This sharp increase was accompanied by a notable rise in the own activity outlook, which jumped from 16.3 to a seven-year high of 37.1.

Breaking down the data, investment intentions climbed from -1.4 to 6.9, while employment intentions improved from -3.6 to 11.9. Profit expectations also saw a positive shift, moving from -3.6 to 8.0.

Cost expectations remained elevated, ticking up slightly from 68.2 to 68.3, and pricing intentions rose from 37.6 to 41.0. On a positive note, inflation expectations fell from 3.20% to 2.92%, finally falling within the RBNZ’s target band.

ANZ highlighted that the significant increases in confidence and activity expectations were already evident at the beginning of August. The responses collected after RBNZ’s Official Cash Rate cut did not significantly alter the overall results.

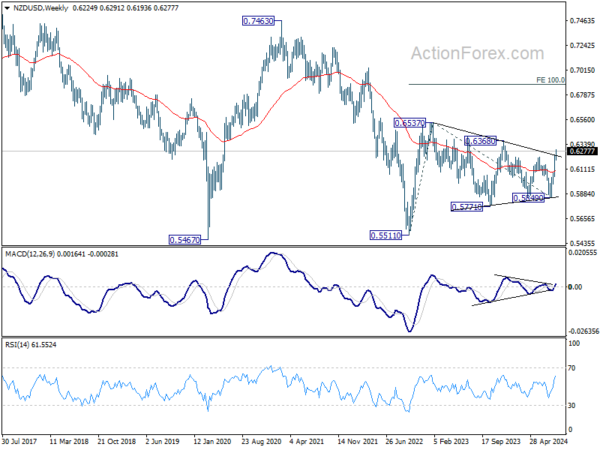

NZD/USD breaks key trend line, sets bullish path towards 0.6537 and beyond

NZD/USD surges notably today in response to strong business confidence data in New Zealand. The solid break of medium term falling trend line strengthens that case that corrective pattern from 0.6537 has completed at 0.5849. Near term outlook will now stay bullish as long as 0.6127 support holds. Next target is 0.6368 resistance.

From a medium term point of view, break of 0.6368 resistance will further solidify the bullish case that rise from 0.5511 (2022 low) is resuming. Further break of 0.6537 resistance would pave the way to 100% projection of 0.5511 to 0.6537 from 0.5849 at 0.6875.

Fed’s Bostic signals readiness for rate cuts, but urges caution before September decision

Atlanta Fed President Raphael Bostic signaled that it “may be time to move” towards lowering interest rates, though he remains cautious about committing to a cut in September.

Speaking at an event overnight, Bostic emphasized the need for more data before making a definitive decision.

“I don’t want us to be in a situation where we cut and then we have to raise rates again,” he noted. “So, if I’m going to err on one side, it’s going to be waiting longer just to make sure that we don’t have that up and down.”

Looking ahead

Eurozone economic sentiment and Germany CPI flash will be released in European session. Later in the day, US will publish Q2 GDP revision, jobless claims, goods trade balance and pending home sales.

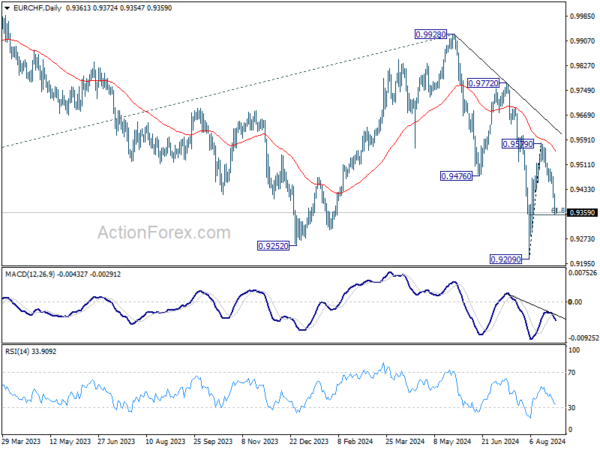

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9339; (P) 0.9379; (R1) 0.9406; More….

EUR/CHF’s fall from 0.9579 is in progress and intraday bias stays on the downside. Sustained break of 61.8% retracement of 0.9209 to 0.9579 at 0.9350 will pave the way to retest 0.9209 low. On the upside, above 0.9418 minor resistance will turn intraday bias neutral first. But rise will stay on the downside as long as 0.9579 resistance holds.

In the bigger picture, medium term corrective pattern from 0.9407 (2022 low) might have completed with three waves to 0.9928. Decisive break of 0.9252 (2023 low) will confirm long term down trend resumption. Next target will be 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. For now, outlook will stay bearish as long as 0.9928 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | ANZ Business Confidence Aug | 50.6 | 27.1 | ||

| 01:30 | AUD | Private Capital Expenditure Q2 | -2.20% | 1.10% | 1.00% | 1.90% |

| 05:00 | JPY | Consumer Confidence Index Aug | 37.1 | 36.7 | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Aug | 95.9 | 95.8 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Aug | -10.6 | -10.5 | ||

| 09:00 | EUR | Eurozone Services Sentiment Aug | 5.1 | 4.8 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Aug F | -13.4 | -13.4 | ||

| 12:00 | EUR | Germany CPI M/M Aug P | 0.00% | 0.30% | ||

| 12:00 | EUR | Germany CPI Y/Y Aug P | 2.10% | 2.30% | ||

| 12:30 | CAD | Current Account (CAD) Q2 | -6.0B | -5.4B | ||

| 12:30 | USD | Initial Jobless Claims (Aug 23) | 234K | 232K | ||

| 12:30 | USD | GDP Annualized Q2 P | 2.80% | 2.80% | ||

| 12:30 | USD | GDP Price Index Q2 P | 2.30% | 2.30% | ||

| 12:30 | USD | Goods Trade Balance (USD) Jul P | -97.1B | -96.6B | ||

| 12:30 | USD | Wholesale Inventories Jul P | 0.20% | 0.20% | ||

| 14:00 | USD | Pending Home Sales M/M Jul | 0.20% | 4.80% | ||

| 14:30 | USD | Natural Gas Storage | 33B | 35B |