Today’s two-year US Treasury sale was a bit of a gut-check moment for the fixed income market. It was the first test of real-demand at sub-4% yields in this environment. The $69 billion was a big amount to swallow and European fixed income was soft today.

But the demand was there, proven by a 0.6 bps stop through compared to the when-issued market and a yield at 3.874% compared to 4.434% just a month ago. Initially, the market was stagnant but yields have now pressed lower in a sigh of relief.

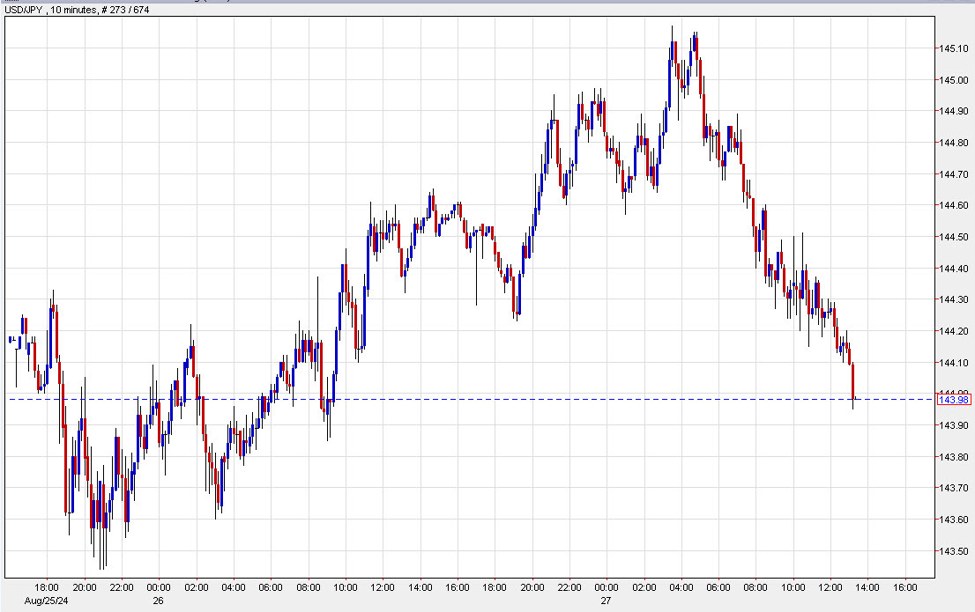

With that, the US dollar is under fresh pressure and USD/JPY in particular is lower, now down 55 pips on the day to 143.95.

USD/JPY 10 mins

The euro has just gotten a fresh bid and run some stops too, up to 1.1181.

This article was originally published by Forexlive.com. Read the original article here.