Geopolitical events dominate market movements today amid a sparse economic calendar. Oil prices have surged following an announcement from Libya’s eastern government in Benghazi that oil production and exports would be halted. This move stems from a dispute with the internationally recognized western government in Tripoli over central bank leadership.

Additionally, markets are reacting to news of Israel launching a major airstrike campaign in Lebanon on Sunday. The operation, described by Israel as a preemptive measure against Hezbollah, has escalated tensions, with Hezbollah responding by launching hundreds of missiles at Israel in retaliation for the death of one of its senior commanders in July.

In the currency markets, Yen is currently leading as the strongest performer, although buying momentum remains subdued. Canadian Dollar is gaining strength as well, bolstered by rising oil prices, while Dollar follows, supported by strong durable goods orders data.

Conversely, New Zealand Dollar is the weakest, trailed by Australian Dollar. Euro is also under pressure after Germany’s Ifo institute warned of a deepening economic crisis. Sterling and the Swiss Franc are positioned in the middle of the performance chart.

Technically, WTI’s strong rally today suggests that fall from 80.55 has completed at 72.57, after defending 71.42 support. Further rise is now expected as long as 76.20 support holds, towards 80.55 resistance next. Firm break there will raise the chance that whole consolidation from 87.84 has completed and target 84.72 resistance and above.

In Europe, at the time of writing, FTSE is up 0.48%. DAX is down -0.08%. CAC is up 0.25%. UK 10-year yield is flat at 3.916. Germany 10-year yield is up 0.018 at 2.251. Earlier in Asia, Nikkei fell -0.66%. Hong Kong HSI rose 1.06%. China Shanghai SSE rose 0.04%. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield fell -0.0107 to 0.885.

US durable goods orders jump 9.9% mom in Aug

US durable goods orders surged 9.9% mom to USD 289.6B, well above expectation of 4.0% mom. Ex-transport orders fell -0.2% mom to USD 187.4B, below expectation of 0.0% mom. Ex-defense orders jumped 10.4% mom to USD 271.9B.

Transportation equipment drove the overall growth, up 34.8% mom to USD 102.2B.

German Ifo business climate falls to 86.6, Ifo warns of worsening economic crisis

In August, Germany’s Ifo Business Climate Index dropped from 87.0 to 86.6, slightly surpassing expectations of 86.5 but still signaling growing economic concerns. Current Assessment Index also dipped from 87.1 to 86.5, aligning with forecasts, while Expectations Index marginally beat predictions at 86.8, although still reflecting a decline from 87.0

Sector-wise, manufacturing sector saw a significant decline from -14.2 to -17.8. Services sector turned negative, falling from 0.8 to -1.3. Trade sector showed a minor improvement from -27.9 tox -27.4, while construction remained stagnant at -26.4.

Ifo President Clemens Fuest issued a stark warning, stating, “The German economy is increasingly falling into crisis.”

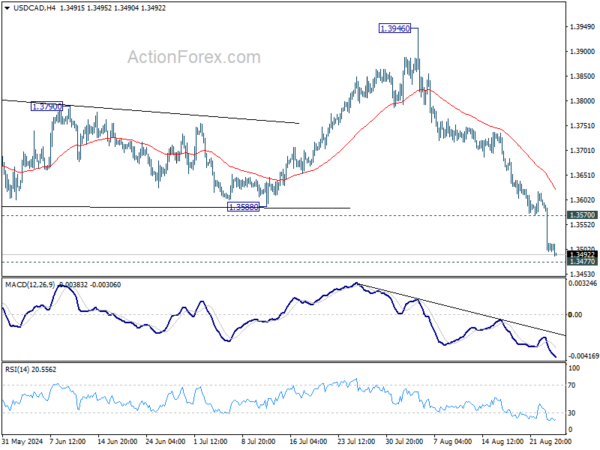

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3465; (P) 1.3542; (R1) 1.3586; More…

USD/CAD’s fall from 1.3946 continues today and intraday bias stays on the downside for 1.3477 support. Firm break there will target 1.3091/3176 support zone. On the upside, above 1.3570 support turned resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

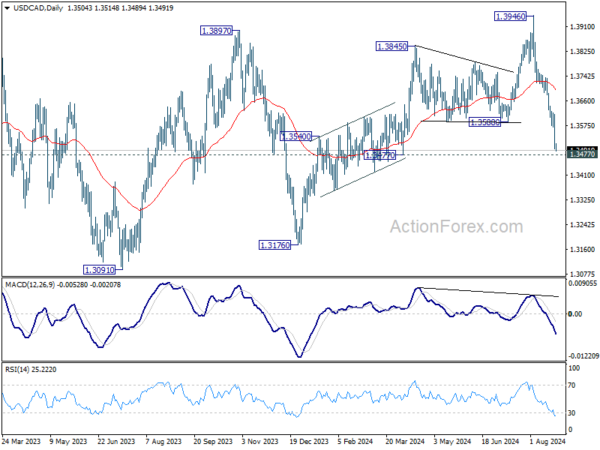

In the bigger picture, current development suggests that corrective pattern from 1.3976 (2022 high) is extending with another falling leg. While deeper decline could be seen, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Aug | 86.6 | 86.5 | 87 | |

| 08:00 | EUR | Germany IFO Current Assessment Aug | 86.5 | 86.5 | 87.1 | |

| 08:00 | EUR | Germany IFO Expectations Aug | 86.8 | 86.5 | 86.9 | 87 |

| 12:30 | USD | Durable Goods Orders Jul | 9.90% | 4.00% | -6.70% | |

| 12:30 | USD | Durable Goods Orders ex Transport Jul | -0.20% | 0.00% | 0.40% |