Fundamental

Overview

The USD continues to remain

under pressure amid positive risk sentiment and the imminent rate cuts from the

Fed which should help global growth. These are generally bearish drivers for

the greenback.

In fact, the appreciation

of the AUD has been mostly driven by the US Dollar side of the equation,

although it outperformed the other major currencies due to the hawkish RBA. In

fact, the market pared back more aggressive rate cuts expectations and it’s now

seeing just one cut by the end of the year.

The focus will be on

tomorrow’s Flash PMIs and then Fed Chair Powell speech at the Jackson Hole

Symposium on Friday.

AUDUSD

Technical Analysis – Daily Timeframe

AUDUSD Daily

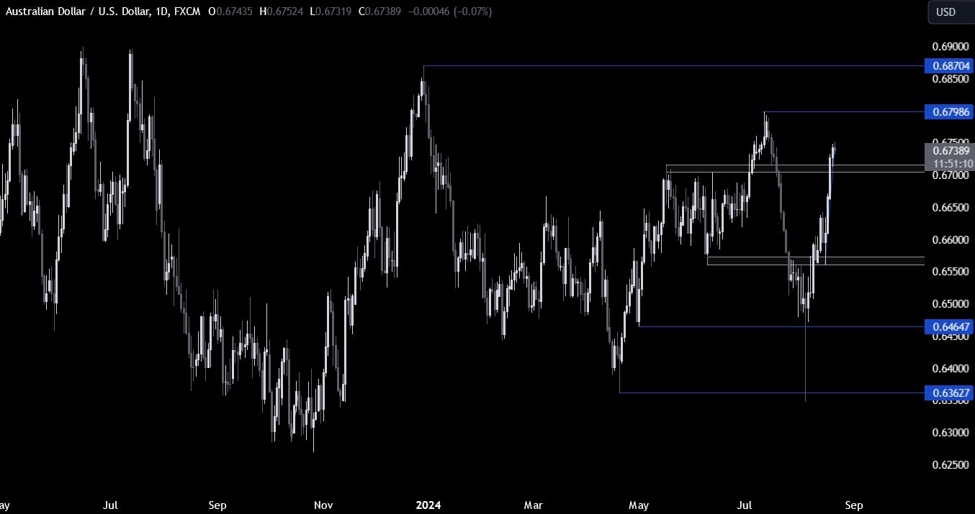

On the daily chart, we can

see that AUDUSD had an incredible rally from the lows set at the beginning of August

as the market erased the growth scare and added to the gains as the risk sentiment

kept on improving. The next target for the buyers should be the high at the

0.68 handle. The sellers, on the other hand, will want to see the price falling

back below the key 0.67 handle to start target new lows.

AUDUSD Technical

Analysis – 4 hour Timeframe

AUDUSD 4 hour

On the 4 hour chart, we can

see that we now have a good support

zone around the 0.67 handle where we can find also the trendline

for confluence.

This is where we can expect the buyers to step in with a defined risk below the

trendline to position for new highs with a better risk to reward setup. The

sellers, on the other hand, will want to see the price breaking lower to pile

in for a drop into the 0.6550 level next.

AUDUSD Technical

Analysis – 1 hour Timeframe

AUDUSD 1 hour

On the 1 hour chart, there’s

not much else we can glean from this timeframe other than waiting for a pullback

into the key support zone where the buyers will look for a bounce, while the

sellers will look for a break. The red lines define the average daily range for today.

Upcoming

Catalysts

Tomorrow we get the Australian PMIs, the US Jobless Claims and US PMIs. On

Friday we conclude the week with Fed Chair Powell speaking at the Jackson Hole

Symposium.