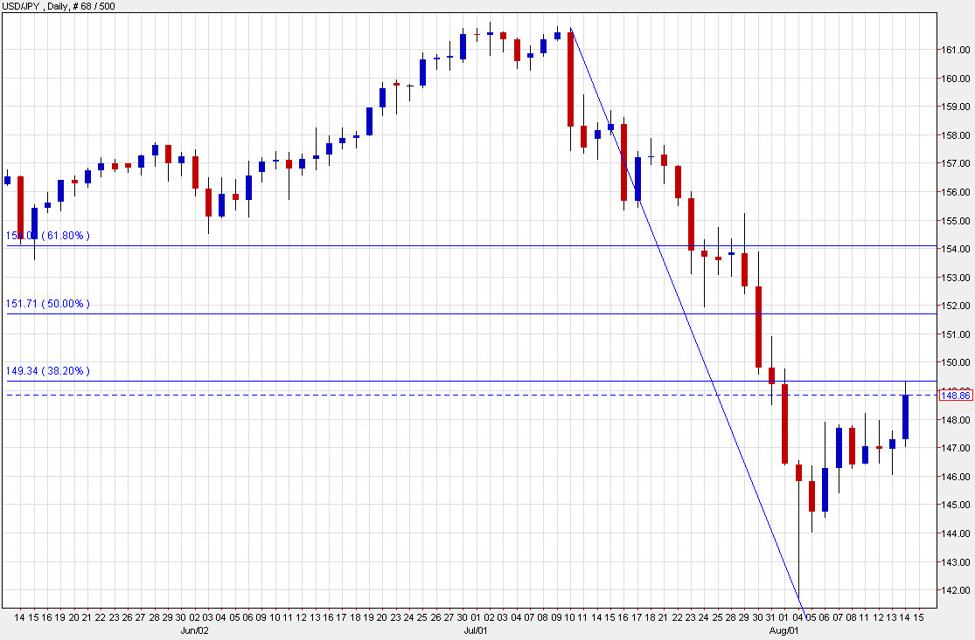

USD/JPY daily

USD/JPY soared after stronger US retail sales but stalled right at a key level.

It rose to 149.32, just two pips shy of the 38.2% retracement of the swan dive from 161.80 to 141.67. It’s stalled there and backed off to 148.96.

The Fibonnaci level is a classic barrier in a bounce from a quick dive and it’s not a surprise to see the market take a breather here. If the 38.2% level can break, it should be clear sailing to 151.71 and eventually to 154.09.

Fundamentally, I would like to see more help from the bond market to confirm it. US 2-year yields were stubbornly lower this week even as stocks mounted an impressive comeback. That’s changed today with a 15 bps rise to 4.09%. If that can continue to extend, it bodes well for carry trades like USD/JPY.

US 2 year yields, daily