As we move into US session, safe-haven currencies like Yen, Swiss Franc, and Dollar are showing modest gains, driven by weaker stock futures and treasury yields. However, momentum behind these currencies remains unconvincing, with trading sluggish across the board. Most major pairs and crosses are confined within the ranges established yesterday, reflecting a cautious market tone ahead of the weekend. With no significant events scheduled for the rest of the day, traders appear to be holding off on making any major bets until next week.

Canadian Dollar softened slightly following weaker-than-expected job data, which showed a contraction in July. However, like other currencies, the movement has been minimal. Australian Dollar experienced a brief uptick earlier, bolstered partly by stronger-than-expected inflation data from China, but it has since lost momentum. Meanwhile, Euro and Sterling are experiencing a typical summer lull, with little movement.

In Europe, at the time of writing, FTSE is up 0.19%. DAX is down -0.15%. CAC is up 0.06%. UK 10-year yield is down -0.0422 at 3.939. Germany 10-year yield is down -0.0388 at 2.233. Earlier in Asia, Nikkei rose 0.56%. Hong Kong HSI rose 1.17%. China Shanghai SSE fell -0.27%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield rose 0.0251 to 0.858.

Fed’s Collins: Gradual rate cuts expected as inflation moderates

Boston Fed President Susan Collins indicated in an interview with the Providence Journal that if current economic data trends continue as expected, it may soon be appropriate to start adjusting monetary policy by “easing how restrictive the policy is”.

She emphasized her expectation for “continued gradual reduction” in inflation toward the 2% target, all while maintaining a healthy labor market.

Collins also noted that she anticipates interest rates to be lower in the coming years, although she refrained from providing specific details on the timing and pace of rate cuts.

She highlighted the importance of incoming data before Fed’s September meeting, stating, “We’ll have more data before our September meeting, and I don’t want to get out ahead of that.”

In her assessment, Collins remains confident in the economy’s current growth pace, which she believes should help sustain a strong labor market.

Canada’s jobs down -2.8k in Jul, unemployment rate unchanged at 6.4%

Canada’s employment fell -2.8k in July, much worse than expectation of 26.9k growth. The 62k rise in full-time work was offset by -62k decline in part-time work. Employment rate fell -0.2% to 60.9%.

Unemployment rate was unchanged at 6.4%, below expectation of 6.5%. Labor participation rate fell -0.3% to 65.0%.

Average hourly wages among employees increased 5.2% yoy, slowed from 5.4% yoy.

China’s CPI rises to 0.5% in Jul, driven by surging food prices

China’s CPI rose by 0.5% yoy in July, up from June’s 0.2% yoy surpassing expectations of 0.4% yoy and marking the highest increase since February. This uptick was driven in part by a significant 20.4% yoy surge in pork prices, the highest since December 2022. Core CPI, which excludes food and energy prices, saw a slower rise of 0.4% yoy, down from 0.6% yoy in June.

On a month-over-month basis, CPI rebounded with a 0.5% increase, reversing the -0.2% decline seen in June and exceeding expectation of 0.3% rise. The rise in food prices, driven by high temperatures and heavy rainfall in some regions, contributed significantly to this monthly growth, according to NBS statistician Dong Lijuan.

Meanwhile, China’s PPI as unchanged at -0.8% yoy, slightly better than the expected -0.9%.

GBP/USD Mid-Day Outlook

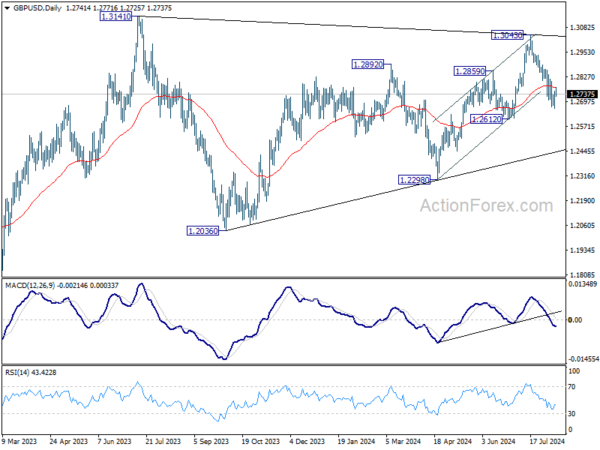

Daily Pivots: (S1) 1.2693; (P) 1.2722; (R1) 1.2780; More…

GBP/USD dips mildly after hitting 55 4H EMA but stays in range above 1.2664. Intraday bias remains neutral for the moment. Another fall is in favor as long as 1.2839 resistance holds. Below 1.2664 will target 1.2612 support. Decisive break there should confirm that rise from 1.2298 has completed, and target this support next. However, break of 1.2839 resistance will argue that the pull back from 1.3043 has completed and turn bias back to the upside.

In the bigger picture, current development suggests that corrective pattern from 1.3141 is extending with fall from 1.3043 as another leg. Break of 1.2612 support would strengthen this case. But still, downside should be contained by 1.2036/2298 support zone even in case of deep decline. Rise from 1.0351 (2022 low) remains in favor to resume at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | CNY | CPI Y/Y Jul | 0.50% | 0.40% | 0.20% | |

| 01:30 | CNY | PPI Y/Y Jul | -0.80% | -0.90% | -0.80% | |

| 06:00 | EUR | Germany CPI M/M Jul F | 0.30% | 0.30% | 0.30% | |

| 06:00 | EUR | Germany CPI Y/Y Jul F | 2.30% | 2.30% | 2.30% | |

| 07:00 | CHF | SECO Consumer Climate Q3 | -32 | -36 | -37 | |

| 12:30 | CAD | Net Change in Employment Jul | -2.8K | 26.9K | -1.4K | |

| 12:30 | CAD | Unemployment Rate Jul | 6.40% | 6.50% | 6.40% |