Australian Dollar leads other commodity currencies lower in Asian session today, reflecting a broader risk-off sentiment in the markets. The market’s risk-off sentiment is further emphasized by the strength of Yen and Swiss Franc, currencies typically favored during periods of uncertainty.

Nikkei has slipped below the 40k mark, while China’s Shanghai SSE is down over -1%. This negative mood should be primarily driven by the unexpected rate cut by China’s central bank, signaling deepening economic troubles in the country.

Some analysts have speculated that market reactions could be influenced by US President Joe Biden’s announcement to withdraw from the presidential race. However, Biden’s exit was largely anticipated and should have already been digested by the markets. The more pressing question now is whether Vice President Kamala Harris will step in to compete against Donald Trump,or if another contender will emerge.

In the currency markets, New Zealand Dollar and Canadian Dollar are trailing the Australian Dollar in losses. On the other hand, Japanese Yen and Swiss Franc are emerging as the strongest performers, reflecting a typical risk-aversion picture. Dollar, Euro, and British Pound are trading in the middle, showing no clear advantage over each other.

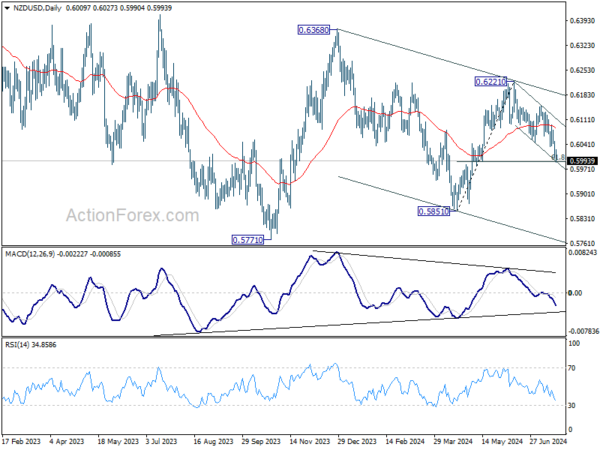

Technically, NZD/USD is now pressing 61.8% retracement of 0.5851 to 0.6221 at 0.5992. Sustained break of 0.5992 will argue that fall from 0.6221 is likely resuming the decline from 0.6368, which is the third leg of the whole down trend from 0.6537 (2023 high). In this bearish case, NZD/USD should tumbles through 0.5851 support to 0.5771 low and possibly below. This will remain the favored case as long as 55 D EMA (now at 0.6086) holds.

In Asia, at the time of writing, Nikkei is down -1.31%. Hong Kong HSI is up 0.79%. China Shanghai SSE is down -1.10%. Singapore Strait Times is down -0.13%. Japan 10-year JGB yield is up 0.0098 at 1.057.

China’s surprise rate cut lifts USD/CNH

In a surprised move, China’s PBoC today announced its first reduction in a key short-term policy rate in nearly a year, following weaker-than-expected economic growth in Q2. The economy expanded at its slowest pace in over a year, prompting the central bank to lower the seven-day reverse repo rate from 1.8% to 1.7%. PBOC emphasized that these rate cuts are part of its strategy to “strengthen counter-cyclical adjustments to better support the real economy.”

Following closely on PBOC’s announcement, Chinese banks adjusted their main benchmark lending rates, marking the first such adjustment since August 2023. The one-year loan prime rate was reduced to 3.35% from 3.45%. The five-year rate, which is crucial for mortgages, dropped to 3.85% from 3.95%.

In response to these developments, USD/CHN extends the recovery from 7.2597 following the news. Technically, current development suggests that pull back from 7.3111 has already completed, and larger rise from 7.0870 is probably ready to resume. Break of 7.3111 will target 100% projection of 7.0870 to 7.2827 from 7.1648 at 7.3605, which is slightly below 7.3745 (2023 high). This will remain the favored case as long as 7.2597 support holds.

New Zealand’s goods exports falls -0.1% yoy, imports down significantly by -13% yoy

In June, New Zealand’s overall goods exports slightly declining by -0.1% yoy, a reduction of NZD 7.4m, totaling NZD 6.2B. Conversely, goods imports experienced a more significant decrease, falling -13% yoy or NZD 821m, resulting in total imports of NZD 5.5B. This led to a trade surplus of NZD 699m, surpassing expectations of NZD 294m.

Examining trade movements by country, exports to major partners showed mixed results. China saw a decrease of NZD 142m in exports, a -9.1% yoy drop, while exports to Australia also fell by NZD 74m or -9.2% yoy. In contrast, exports to the US and the EU increased by NZD 91m (12% yoy) and NZD 129m (34% yoy) respectively. Japan’s exports marginally decreased by NZD 4.1m or -1.1% yoy.

On the import front, China and the EU recorded increases of NZD 11m (0.9% yoy) and NZD 33m (3.3% yoy) respectively. However, imports from Australia, the US, and South Korea saw significant declines, with reductions of NZD 69m (-10% yoy), NZD 49m (-8.4% yoy), and NZD 54m (-14% yoy) respectively.

BoC rate cut and US GDP advance headline light economic week

BoC’s rate decision is the major highlight in a relatively light economic week. It’s widely expected that BoC will lower its overnight interest rate by 25bps to 4.50%. Going forward, a recent Reuters survey shows that a slim majority of economists, 16 out of 30, expect BoC to cut rates twice more this year, in October and December, bringing the rate to 4.00%. Ten economists predict just one more cut to 4.25%, while four expect a total of three additional cuts to 3.75%.

The median forecast is for a total of four rate cuts this year, including the previous cut in June, the upcoming one this week, and further cuts in October and December. This aligns with the forecasts from all five major Canadian banks. However, the eventual rate path will depend on how the sticky core inflation and wage growth evolve in Canada.

On the data front, US Q2 GDP advance release is another significant event. Growth is expected to bounce back from the lowest rate since 2022 in Q1. However, any lower-than-expected momentum would solidify market expectations that Fed is on track for two rate cuts this year. Additionally, the US will release durable goods orders and PCE inflation data, with the latter expected to mirror the latest CPI report, indicating further disinflation.

Other notable economic data releases this week include PMIs from major economies, Germany’s Gfk consumer sentiment, and Ifo business climate index. Japan’s Tokyo CPI is also on the docket.

Here are some highlights for the week:

- Monday: New Zealand trade balance; China rate decision.

- Tuesday: Eurozone consumer confidence; US existing home sale.

- Wednesday: Australia PMIs; Japan PMIs; Germany Gfk consumer sentiment; Eurozone PMIs; UK PMIs; Canada new housing price index, BoC rate decision; US goods trade balance, PMIs, new home sales.

- Thursday: Japan corporate service price index; Germany Ifo business climate; Eurozone M3 money supply; US Q2 GDP advance, jobless claims, durable goods, orders.

- Friday: Japan Tokyo CPI; US personal income and spending, PCE inflation.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6250; (P) 1.6270; (R1) 1.6308; More…

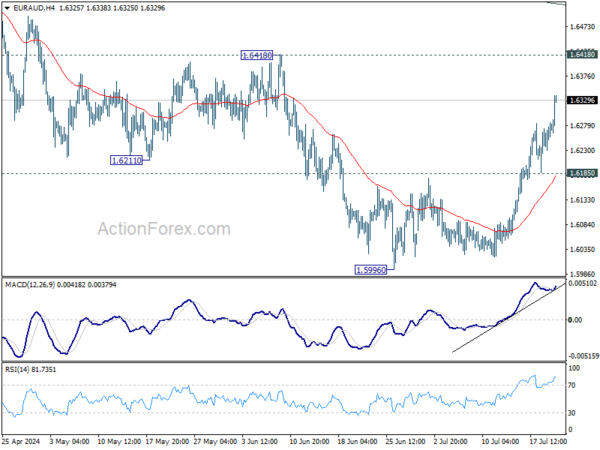

Intraday bias in EUR/AUD is back on the upside as rebound from 1.5996 resumed after brief retreat. Current development suggest that 1.0762 has completed with three waves down to 1.6000 fibonacci support. Further rise should be seen to 1.6418 resistance first. Firm break there will solidify this bullish case and target 1.6742 resistance next. On the downside, though, break of 1.6185 support will dampen this bullish view and bring retest of 1.5996 instead.

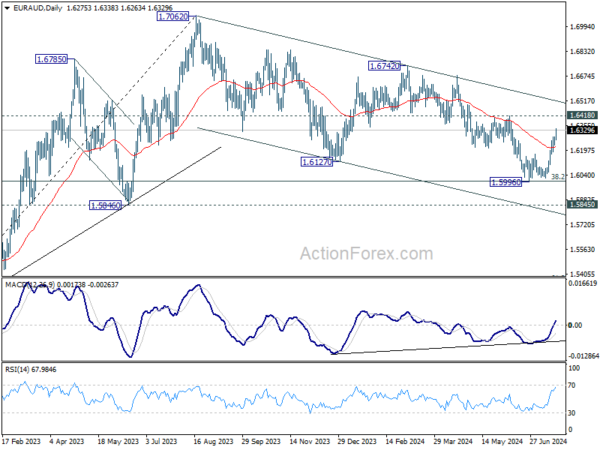

In the bigger picture, fall from 1.7062 medium term top is seen as a correction to the up trend from 1.4281 (2022 low) only. Strong support is still expected between 1.5846 and 38.2% retracement of 1.4281 to 1.7062 at 1.6000 to bring rebound. Break of 1.6148 resistance will argue that the correction has completed, and the up trend is ready to resume through 1.7062.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jun | 699M | 294M | 204M | 54M |

| 01:15 | CNY | 1-Y Loan Prime Rate | 3.35% | 3.45% | 3.45% | |

| 01:15 | CNY | 5-Y Loan Prime Rate | 3.85% | 3.95% | 3.95% |