Dollar rises modestly in early US trading following stronger-than-expected Q2 GDP data. The robust performance overshadowed the mixed durable goods orders data, instilling some optimism in the market. Despite this, overall market reactions remain subdued. US futures point to a flat open, suggesting a degree of stabilization following yesterday’s sharp selloff. Additionally, 10-year yield has recovered slightly from its earlier dip.

Meanwhile, the Japanese Yen, which had seen significant gains recently, is retreating slightly. The buying climax for the Yen might have passed, but it’s too early to determine if risk sentiment has improved. Traders could be switching their positions to the Yen’s safe-haven counterpart, the Swiss Franc, which is currently the strongest currency for the day.

In the broader currency markets, Swiss Franc is leading as the strongest performer, followed by Yen and Euro. Australian Dollar is at the bottom of the chart, followed by New Zealand Dollar. British Pound is currently the third weakest of the day. Dollar and Canadian Dollar are mixed in the middle.

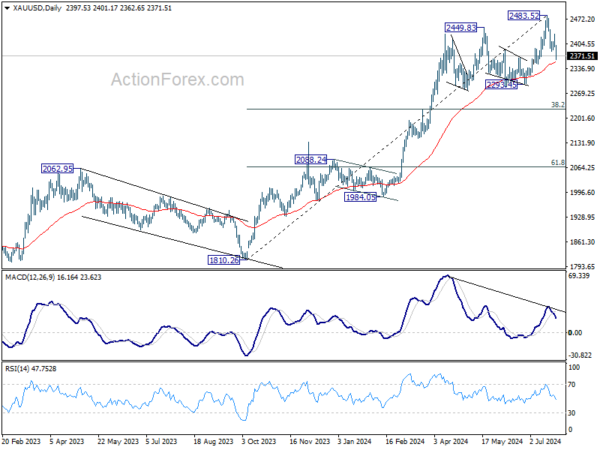

Technically, Gold’s pullback from 2483.52 record high resumed today. Immediate focus is on 55 D EMA (now at 2354.60) Strong support from there would keep near term outlook bullish for another rise through 2483.52 before topping. However, considering bearish divergence condition in D MACD, sustained break of 55 D EMA will argue that a medium term top was already in place. Fall from 2483.52 would then be correcting whole five wave rally from 1810.26. Next target is 38.2% retracement of 1810.26 to 2483.52 at 2226.33.

In Europe, at the time of writing, FTSE is down -0.29%. DAX is down -0.99%. CAC is down -1.81%. UK 10-year yield is down -0.0111 at 4.149. Germany 10-year yield is down -0.013 at 2.433. Earlier in Asia, Nikkei fell -3.28%. Hong Kong HSI fell -1.77%. China Shanghai SSE fell -0.52%. Singapore Strait Times fell -0.88%. Japan 10-year JGB yield fell -0.0029 to 1.075.

US Q2 GDP grows 2.8% annualized, inflation pressures ease

The advance estimate of US GDP growth in Q2 2024 showed a robust 2.8% annualized increase, significantly exceeding the anticipated 2.0% and doubling Q1’s pace of 1.4%.

This stronger-than-expected growth was driven by rises in consumer spending, private inventory investment, and nonresidential fixed investment. Notably, imports also increased, which are subtracted in the GDP calculation.

On the inflation front, GDP price index slowed from 3.1% to 2.3%, falling below the expected 2.6%. PCE price index also eased from 3.4% to 2.6%, and core PCE price index saw a notable decrease from 3.7% to 2.9%.

The sharp uptick in GDP growth, coupled with cooling inflation metrics, presents an optimistic economic outlook. Deceleration in price indexes suggests easing inflationary pressures, which would support rate cut by Fed in the coming months.

US durable goods orders falls -6.6% mom, but ex-transport orders up 0.4% mom

US durable goods orders fell sharply by -6.6% mom to USD 264.5 in June, much worse than expectation of 0.4% mom rise. However, ex-transportation orders rose 0.5% mom to USD 188.7B, above expectation of 0.2% mom. Ex-defense orders fell -7.0% mom to USD 247.6B. Transportation equipment drove the headline contraction and fell -20.5% mom to USD 75.8B.

US initial jobless claims falls to 235k vs exp 238k

US initial jobless claims fell -10k to 235k in the week ending July 20, slightly below expectation of 238k. Four-week moving average of initial claims was relatively unchanged at 236k.

Continuing claims fell -9k to 1851k in the week ending July 13. Four-week moving average of continuing claims rose 5k to 1854k, highest since December 4, 2021.

German Ifo falls to 87, economy stuck in crisis

Germany’s Ifo Business Climate Index fell from 88.6 to 87.0 in July, missing expectations of 89.0. Current Assessment Index also dropped from 88.3 to 87.1, below the anticipated 88.5. Additionally, Expectations Index declined from 88.8 to 86.9, underperforming the forecast of 89.0.

Sector-wise, manufacturing index plunged from -9.3 to -14.1, indicating significant dissatisfaction among manufacturers. Services sector saw a decline from 4.2 to 0.7, while the trade sector fell from -23.6 to -27.8. Construction also showed a decrease, moving from -25.2 to -26.0.

Ifo noted that sentiment has “declined considerably,” with companies expressing growing dissatisfaction with the current business situation. The level of skepticism regarding the coming months has increased notably. The German economy, as described by Ifo, is currently “stuck in crisis.”

Japanese government notes export stagnation as global risks mount

Japan’s government maintained its economic assessment but noted a more pessimistic outlook for exports due to weakening demand from China.

According to the Cabinet Office’s Monthly Economic Report, the Japanese economy is recovering at a “moderate pace,” though it has recently “appeared to be pausing.” The assessment of exports was downgraded from “appearing to be pausing for picking up” to “almost flat,” reflecting the impact of slowing Chinese demand.

In the short term, the economy is expected to continue its moderate recovery, supported by an “improving employment and income situation.” However, several risks threaten this outlook. These include the slowdown in global economies, high-interest rates in the US and Europe, and the “lingering stagnation of the real estate market in China.”

The report also highlighted the need to monitor price increases, geopolitical tensions in the Middle East, and fluctuations in financial and capital markets.

USD/JPY Mid-Day Outlook

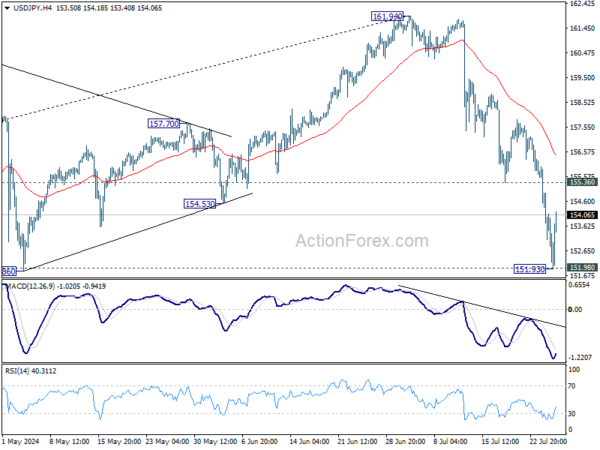

Daily Pivots: (S1) 152.68; (P) 154.33; (R1) 155.56; More…

Intraday bias in USD/JPY is turned neutral first with current recovery, and some consolidations would be seen above 151.93 temporary low. But risk will remain on the downside as long as 155.36 support turned resistance holds. Decisive break of 151.89 resistance turned support will argue that large scale correction is underway to 148.66 fibonacci level. Nevertheless, break of 155.36 will turn bias back to the upside for stronger rebound.

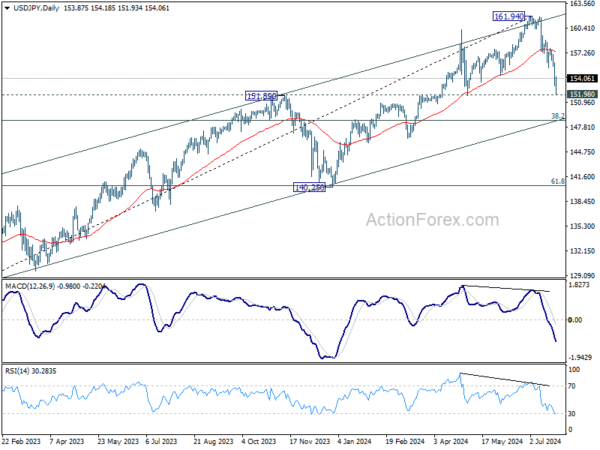

In the bigger picture, considering the depth and momentum of the current decline, 161.94 should be a medium term top already. Fall from there is seen as correcting the whole rise from 127.20 (2023 low) at least. Break of 151.89 will pave the way to 38.2% retracement of 127.20 to 161.94 at 148.66. Risk will now stay on the downside as long as 55 D EMA (now at 157.25) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jun | 3.00% | 2.60% | 2.50% | 2.70% |

| 08:00 | EUR | Germany IFO Business Climate Jul | 87 | 89 | 88.6 | |

| 08:00 | EUR | Germany IFO Current Assessment Jul | 87.1 | 88.5 | 88.3 | |

| 08:00 | EUR | Germany IFO Expectations Jul | 86.9 | 89 | 89 | 88.8 |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 2.20% | 1.90% | 1.60% | 1.50% |

| 12:30 | USD | Initial Jobless Claims (Jul 19) | 235K | 238K | 243K | |

| 12:30 | USD | GDP Annualized Q2 P | 2.80% | 2.00% | 1.40% | |

| 12:30 | USD | GDP Price Index Q2 P | 2.30% | 2.60% | 3.10% | |

| 12:30 | USD | Durable Goods Orders Jun | -6.60% | 0.40% | 0.10% | |

| 12:30 | USD | Durable Goods Orders ex Transport Jun | 0.50% | 0.20% | -0.10% | |

| 14:30 | USD | Natural Gas Storage | 13B | 10B |