S&P 500 had visible trouble extending Monday‘s gain far, and no rally into key earnings served as warning. The relief rally following very weak opex Friday, seems to have run its course – and downside risks are reappearning again, meaningfully. GOOG earnings were welcome on the financial side, but then fatigue over AI expenses contribution to the bottom line set in – and in TSLA case, the disappointment over financials was enough. TXN would be the first to recover from the less than deserved decline – and so will NVDA following the opening bell.

But in spite of the Russell 2000 upswing and yields with the dollar moving down from here soon, the S&P 500 bear flag approximating pattern on the daily, reinforces the warning of what‘s ahead should today‘s session turn out weak. Fnancials, discretionaries and general market breadth speak clearly when merely yesterday‘s session is taken into account.

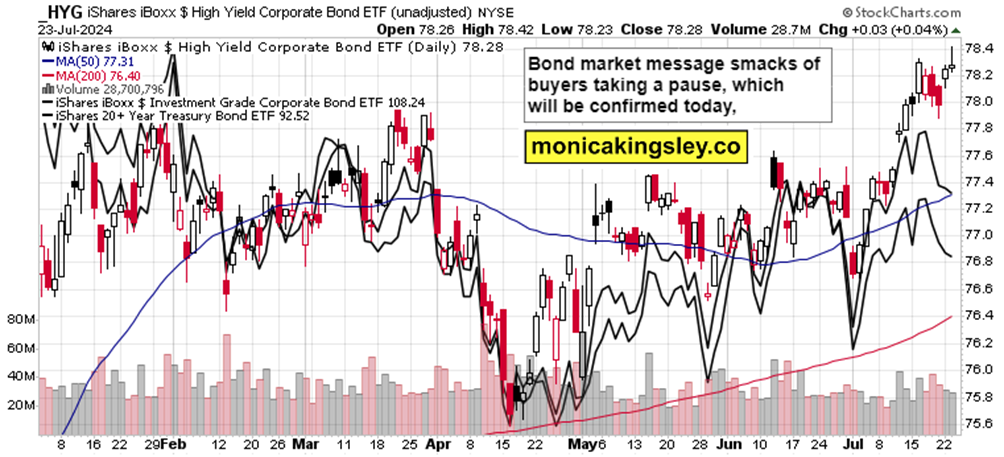

Here‘s how I summed it up in our channel – together with the bond market chart.