Australian Dollar continues to lead the decline among commodity currencies today, with the selloff appearing to accelerate. Despite stabilization in risk sentiment in Europe where major indexes are trading positively, and US futures, particularly NASDAQ, pointing to a stronger open, overall sentiment remains vulnerable. This fragility is largely due to political uncertainty in the US following Joe Biden’s withdrawal from the presidential election race. Additionally, several high-profile earnings reports are set to be released this week, which could further influence market dynamics.

Contributing to Australian Dollar’s woes is the continued decline in Copper prices. Copper just had its worst week since 2022, as the highly anticipated Plenum in China ended with significant disappointment among investors, offering no substantial plan to revive the beleaguered economy. Today’s unexpected rate cut by the People’s Bank of China serves as a stark reminder that economic troubles in the region persist.

Technically, Copper is now pressing 61.8% projection of 5.1650 to 4.3133 from 4.6839 at 4.1575. Decisive break there could trigger downside acceleration to 100% projection at 3.3058 next.

Overall in the currency markets, Yen is currently the strongest for the day, followed by Sterling and Swiss Franc. Dollar and Euro are positioned in the middle. However, Dollar, Euro, Sterling, and Swiss Franc are all trading within last week’s ranges against each other, indicating that their relative positions could easily shift.

In Europe, at the time of writing, FTSE is up 0.91%. DAX is up 1.56%. CAC is up 1.45%. UK 10-year yield is down -0.0074 at 4.121. Germany 10-year yield is down -0.0013 at 2.457. Earlier in Asia, Nikkei fell -1.16%. Hong Kong HSI rose 1.25%. China Shanghai SSE fell -0.61%. Singapore Strait Times fell -0.30%. Japan 10-year JGB yield rose 0.0181 to 1.065.

Bundesbank urges prudence: further rate reductions must be judiciously evaluated

Bundesbank’s latest monthly report indicates that while some factors are bolstering the economy, they are simultaneously complicating efforts to bring inflation down to target.

“The labor markets are still operating at high capacity, wage growth is brisk, and prices are rising strongly, particularly in the service sector,” the report stated.

Bundesbank highlighted that “inflationary risks also predominate on the supply side.” Services inflation is expected to decline only modestly in the coming months, with the overall price index likely to fluctuate around current levels.

Given these conditions, the Bundesbank advised that “possible further interest rate cuts should therefore be carefully considered in light of current data.”

Bundesbank anticipates the economy to “strengthen somewhat” in the Q3. Private consumption is expected to “pick up a little more speed” driven by strongly rising wages, falling inflation, and a robust labor market, which should continue to support consumer spending.

However, the report also cautioned that industrial activity is likely to improve “only hesitantly” due to weak demand, which could result in GDP growth for Q3 falling slightly short of the expectations from June forecast.

ECB’s Kazimir: Two more rate cuts this year not guaranteed

In an op-ed published today, ECB Governing Council member Peter Kazimir addressed market expectations for two additional rate cuts before the end of the year. He stated that while these market bets are “not entirely misplaced,” they should not be considered a “given or a baseline scenario.”

Kazimir highlighted that inflation is “on track” to return to the target but cautioned, “we are clearly not there yet.” He emphasized the persistent risks of inflationary pressures due to various domestic and global factors. “There is still a non-negligible risk of inflationary pressures re-emerging,” he noted.

“There is no need to rush our decisions,” Kazimir added, advising a measured approach. “Enjoy the summer lull and wait for the much-anticipated September ‘health check.’ The upcoming data, combined with fresh forecasts, will set the stage for any necessary decisions.”

China’s surprise rate cut

In a surprised move, China’s PBoC today announced its first reduction in a key short-term policy rate in nearly a year, following weaker-than-expected economic growth in Q2. The economy expanded at its slowest pace in over a year, prompting the central bank to lower the seven-day reverse repo rate from 1.8% to 1.7%. PBOC emphasized that these rate cuts are part of its strategy to “strengthen counter-cyclical adjustments to better support the real economy.”

Following closely on PBOC’s announcement, Chinese banks adjusted their main benchmark lending rates, marking the first such adjustment since August 2023. The one-year loan prime rate was reduced to 3.35% from 3.45%. The five-year rate, which is crucial for mortgages, dropped to 3.85% from 3.95%.

New Zealand’s goods exports falls -0.1% yoy, imports down significantly by -13% yoy

In June, New Zealand’s overall goods exports slightly declining by -0.1% yoy, a reduction of NZD 7.4m, totaling NZD 6.2B. Conversely, goods imports experienced a more significant decrease, falling -13% yoy or NZD 821m, resulting in total imports of NZD 5.5B. This led to a trade surplus of NZD 699m, surpassing expectations of NZD 294m.

Examining trade movements by country, exports to major partners showed mixed results. China saw a decrease of NZD 142m in exports, a -9.1% yoy drop, while exports to Australia also fell by NZD 74m or -9.2% yoy. In contrast, exports to the US and the EU increased by NZD 91m (12% yoy) and NZD 129m (34% yoy) respectively. Japan’s exports marginally decreased by NZD 4.1m or -1.1% yoy.

On the import front, China and the EU recorded increases of NZD 11m (0.9% yoy) and NZD 33m (3.3% yoy) respectively. However, imports from Australia, the US, and South Korea saw significant declines, with reductions of NZD 69m (-10% yoy), NZD 49m (-8.4% yoy), and NZD 54m (-14% yoy) respectively.

AUD/USD Mid-Day Report

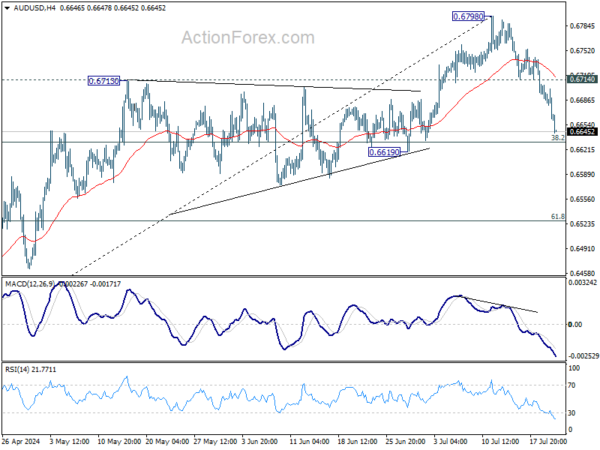

Daily Pivots: (S1) 0.6672; (P) 0.6693; (R1) 0.6707; More...

AUD/USD’s fall from 0.6798 accelerates lower today and intraday bias stays on the downside for 38.2% retracement of 0.6361 to 0.6798 at 0.6631. Strong support could be seen there to bring rebound, and break of 0.6714 resistance will turn bias back to the upside for retesting 0.6798. However, sustained break of 0.6631 will bring deeper fall to 61.8% retracement at 0.6528 instead.

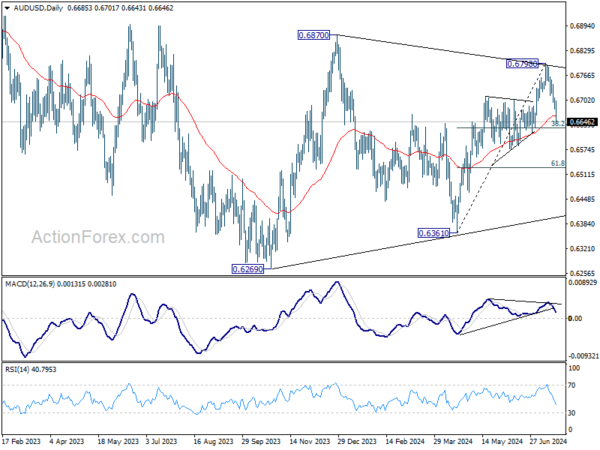

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective patter, which is still extending. Break of 0.66870 resistance will extend the rising leg from 0.6269 towards 0.7156 (2023 high). However, break firm break of 0.6619 support will argue that another falling leg has started back towards lower side of the range between 0.6169/6361.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jun | 699M | 294M | 204M | 54M |

| 01:15 | CNY | 1-Y Loan Prime Rate | 3.35% | 3.45% | 3.45% | |

| 01:15 | CNY | 5-Y Loan Prime Rate | 3.85% | 3.95% | 3.95% |