Japanese Yen is currently the best performer of the week, bolstered by alleged intervention by Japanese authorities overnight. Both Finance Minister Shunichi Suzuki and outgoing top currency official Masato Kanda declined to confirm whether Japan had intervened, with Suzuki reiterating that foreign exchange levels should be market-determined but rapid fluctuations are undesirable. He added that Japan is particularly concerned about one-sided movements.

Yen’s strength was not limited to its rally against Dollar, which was weakened by lower-than-expected US consumer inflation data, reinforcing expectations for a September Fed rate cut. The Japanese currency also surged sharply against both European majors and commodity currencies. The scale and breadth of the Yen’s rally suggest possible intervention. However, as Yen stabilized in the Asian session, it appears the move was not broadly followed by market participants. This stabilization might cap Yen’s strength for now, or at least until BoJ meeting at the end of the month.

Overall in the markets, New Zealand Dollar is the worst performer for the week, pressured by RBNZ’s dovish stance and further weighed down today by data showing sharp deterioration in the manufacturing sector. Swiss Franc and Dollar are tied for the second worst spot. On the other hand, Sterling is the second strongest currency this week, supported by strong UK GDP data, hawkish comments from BoE Chief Economist Huw Pill, and relative political stability in the UK. Australian Dollar and Euro are tied for the third strongest, while Canadian Dollar remains mixed in the middle.

Technically, considering bearish divergence condition in D MACD, as well as the depth of the decline, NZD/JPY should now be corrective the whole rise from 89.93. However, the crosses is now sitting close to a key support level of 55 D EMA (now at 96.14) and 95.52 cluster (38.2% retracement of 89.93 to 99.01 at 95.54). Strong rebound should be seen from this support zone to bring rebound, as set the range for consolidations. Nevertheless, decisive break of 95.52/4 will argue that larger scale correction is already underway.

In Asia, Nikkei fell sharply by -2.45%, possibly affected by Yen’s strong bounce. Hong Kong HSI is up 2.47%. China Shanghai SSE is up 0.21%. Singapore Streait Times is up 0.74%. Japan 10-year JGB yield fell -0.0347 to 1.049. Overnight, DOW rose 0.08%. S&P 500 fell -0.88%. NASDAQ fell -1.95%. 10-year yield fell -0.087 to 4.193.

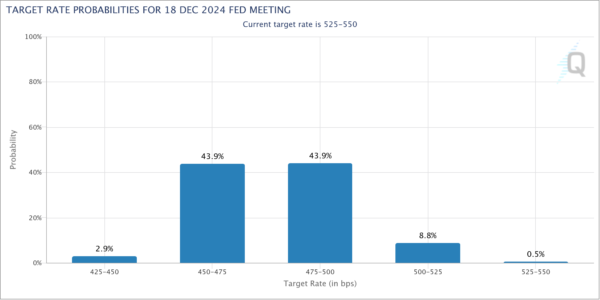

Fed officials optimistic on inflation progress, markets see two rate cuts this year

Several Fed officials welcomed the US June CPI data released yesterday, which showed better-than-expected disinflation progress. This has intensified expectations that Fed would start cutting interest rates in September, with Fed fund futures indicating a 93% chance. More importantly, there is now over 90% probability of two rate cuts by the end of the year, lowering rates to 4.75-5.00%.

Chicago Fed President Austan Goolsbee described the latest inflation data as “excellent,” noting the significant deceleration in shelter inflation as “profoundly encouraging.” He added that “this is what the path to 2% looks like.”

St. Louis Fed President Alberto Musalem also saw the June CPI data as “encouraging further progress toward lower inflation.” He emphasized the need for greater confidence that inflation will converge to 2% before lowering rates. Musalem noted the importance of seeing a moderation in demand and data that shows inflation converging to 2% by mid to late next year, adding, “we’re on a good path.”

San Francisco Fed President Mary Daly highlighted the broader economic context, saying, “With the information we have received today, which includes data on employment, inflation, GDP growth, and the outlook for the economy, I see it as likely that some policy adjustments will be warranted.” However, she noted that the timing of these adjustments is still uncertain.

New Zealand BNZ manufacturing freefalls to lowest non-lockdown level since 2009

New Zealand BusinessNZ Performance of Manufacturing Index fell sharply from 46.6 to 41.1 in June, well below the long-term average of 52.6 and marking the lowest non-lockdown monthly level since February 2009.

Breaking down the details, production dropped from 44.0 to 35.4, and new orders fell from 43.9 to 38.8. These sub-40 activity levels for production and new orders are the lowest seen outside of COVID lockdowns since November 2008. Employment also declined significantly, from 50.4 to 43.8, its lowest non-COVID monthly result since July 2019. Finished stocks decreased from 52.3 to 47.9, while deliveries remained unchanged at 44.9.

BusinessNZ’s Director of Advocacy, Catherine Beard, expressed significant concern over the “freefall in activity from May to June,” highlighting the severe challenges facing a sector that has been contracting for the past 15 months. The proportion of negative comments surged to 76.3%, up from 63.5% in May and 69% in April, with respondents highlighting an overall economic slowdown and tough recessionary conditions.

Looking ahead

Canadian building permits will be released in European session. But US PPI and U of Michigan consumer sentiment will catch more attention.

EUR/USD Daily Outlook

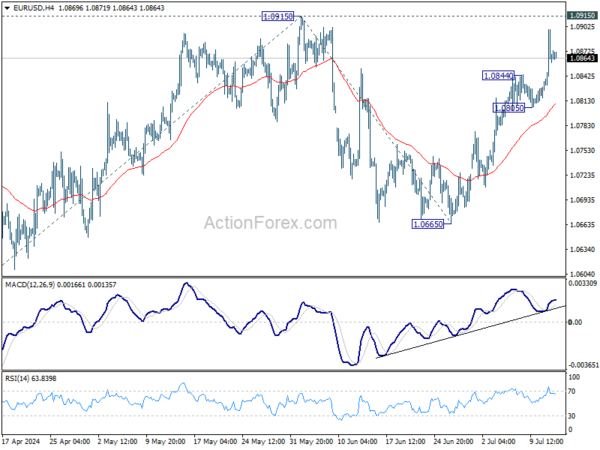

Daily Pivots: (S1) 1.0829; (P) 1.0864; (R1) 1.0904; More….

Intraday bias in EUR/USD remains on the upside for retesting 1.0915 resistance. Decisive break there will resume whole rally from 1.0601 and target 100% projection of 1.0601 to 1.0915 from 1.0665 at 1.0919 next. For now, risk will stay on the upside as long as 1.0805 support holds, in case of retreat.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that could still be in progress. Break of 1.0601 will target 1.0447 support and possibly below. On the upside, firm break of 1.0915 resistance will start another rising leg back to 1.1138 resistance instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Jun | 41.1 | 47.2 | 46.6 | |

| 03:00 | CNY | Trade Balance (USD) Jun | 99.1B | 85.1B | 82.6B | |

| 03:00 | CNY | Trade Balance (CNY) Jun | 704B | 590B | 586B | |

| 04:30 | JPY | Industrial Production M/M May F | 3.60% | 2.80% | 2.80% | |

| 12:30 | CAD | Building Permits M/M May | -5.00% | 20.50% | ||

| 12:30 | USD | PPI M/M Jun | 0.10% | -0.20% | ||

| 12:30 | USD | PPI Y/Y Jun | 2.20% | 2.20% | ||

| 12:30 | USD | PPI Core M/M Jun | 0.20% | 0.00% | ||

| 12:30 | USD | PPI Core Y/Y Jun | 2.50% | 2.30% | ||

| 14:00 | USD | Michigan Consumer Sentiment Jul P | 68.5 | 68.2 |