Dollar weakened broadly after the release of the US Non-Farm Payroll report, though the initial selloff was far from decisive. June’s employment data showcased a robust labor market with near-average job and solid earnings growth , coupled with just a slight uptick in unemployment rate. However, significant downward revisions to April and May’s job growth numbers (-111k) suggest the labor market may not be as robust as initially reported. These mixed signals add some weight to the argument for a Fed rate cut in September, but they are not conclusive enough to cement such expectations.

At the same time, Canadian Dollar faced pressure after weak employment data for June revealed contraction in jobs and a spike in the unemployment rate. Meanwhile, Sterling continues to ride high, maintaining broad firmness as political uncertainties clear up following the UK general elections, with Labour’s landslide victory injected a sense of stability. Yen is attempting a recovery but lacks consistent buying momentum. Euro is mixed as traders look forward to French election runoff on Sunday.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is up 0.82%. CAC is up 0.37%. UK 10-year yield is down -0.039 at 4.164. Germany 10-year yield is down -0.010 at 2.578. Earlier in Asia, Nikkei fell -0.00%. Hong Kong HSI fell -1.27%. China Shanghai SSE fell -0.26%. Japan 10-year JGB yield fell -0.0126 to 1.070.

US NFP rises 206k in Jun, but May and Apr revised sharply lower

US Non-Farm Payroll employment increased by 206k in June, above expectation of 180k. Growth was slightly lower than average monthly gain of 220k over the prior 12 months.

However, prior month’s growth was revised sharply lower from 272k to 218k. April’s figure was also revised sharply lower by -57k to 165k. That is, April and May’s combined downward revision was -111k.

Unemployment rate ticked up from 4.0% to 4.1%, above expectation of holding steady at 4.0%. Unemployment rate also rose slightly from 62.5% to 62.6%.

Average hourly earnings rose 0.3% mom, matched expectations. Annual hourly earnings growth slowed from 4.0% yoy to 3.9% yoy.

Canada’s employment falls -1.4k in Jun, unemployment rate rises further to 6.4%

Canada’s employment contracted -1.4k in June, much worse than expectation of 25.0k growth.

Unemployment rate rose from 6.2% to 6.4%, above expectation of 6.3%. It has now risen 1.3% since April 2023. Employment rate fell -0.2% to 61.1%.

Total hours worked were down -0.4% mom, up 1.1% yoy. Average hourly wages rose 5.4% yoy, up from May’s 5.1% yoy.

Eurozone retail sales rises 0.1% mom in May, EU up 0.1% mom too

Eurozone retail sales volume rose 0.1% mom in May, below expectation of 0.2% mom. Sales volume, increased by 0.7% mom for food, drinks, tobacco, and by 0.4% mom for automotive fuel in specialized stores. Sales volume fell -0.2% mom for non-food products (except automotive fuel).

EU retail sales also rose 0.1% mom. Among Member States for which data are available, the highest monthly increases in the total retail trade volume were recorded in Denmark (+2.3%), Lithuania (+1.8%) and Luxembourg (+1.7%). The largest decreases were observed in Slovakia (-1.0%), Ireland (-0.9%), Bulgaria and Malta (both -0.8%).

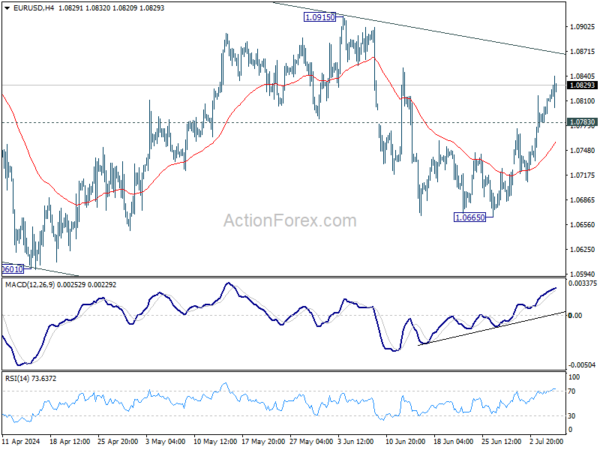

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0791; (P) 1.0804; (R1) 1.0825; More….

Intraday bias in EUR/USD remains on the upside for the moment. Rise from 1.0665 is in progress to 1.0915 resistance first. Firm break there will resume whole rebound from 1.0601. Nevertheless, on the downside, below 1.0775 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still in progress. Break of 1.0601 will target 1.0447 support and possibly below. On the upside, firm break of 1.0915 resistance will start another rising leg back to 1.1138 resistance instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Household Spending Y/Y May | -1.80% | 0.20% | 0.50% | |

| 05:00 | JPY | Leading Economic Index May P | 111.1 | 111.1 | 110.9 | 0.10% |

| 06:00 | EUR | Germany Industrial Production M/M May | -2.50% | 0.20% | -0.10% | |

| 06:45 | EUR | France Trade Balance (EUR) May | -8.0B | -7.2B | -7.6B | |

| 06:45 | EUR | Industrial Output M/M May | -2.10% | -0.20% | 0.50% | 0.60% |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jun | 711B | 718B | ||

| 08:00 | EUR | Italy Retail Sales M/M May | 0.40% | 0.20% | -0.10% | |

| 09:00 | EUR | Eurozone Retail Sales M/M May | 0.10% | 0.20% | -0.50% | |

| 12:30 | USD | Nonfarm Payrolls Jun | 206K | 180K | 272K | 218K |

| 12:30 | USD | Unemployment Rate Jun | 4.10% | 4.00% | 4.00% | |

| 12:30 | USD | Average Hourly Earnings M/M Jun | 0.30% | 0.30% | 0.40% | |

| 12:30 | CAD | Net Change in Employment Jun | -1.4K | 25.0K | 26.7K | |

| 12:30 | CAD | Unemployment Rate Jun | 6.40% | 6.30% | 6.20% | |

| 14:00 | CAD | Ivey PMI Jun | 53 | 52 |