Dollar remains subdued today, but selling momentum has turned weak. With US markets closed for the holiday, trading activity is expected to be light. Meanwhile, traders are also gearing up for tomorrow’s key US non-farm payroll data, which will be crucial. Further cooling in the job market and wage growth is needed to give Fed policymakers the confidence to start cutting interest rates in September.

Swiss Franc had a brief dip following lower-than-expected inflation data but quickly regained ground. It might be premature to determine if SNB will lower interest rates again in September. Additionally, with the French elections looming this weekend, Swiss Franc traders are likely to remain cautious as risk sentiment could flip dramatically.

For the week, Australian Dollar has overtaken Sterling and Euro as the best performer. Swiss Franc, Yen, and Dollar are continuing their positions at the bottom of the performance chart. Canadian Dollar and New Zealand Dollar hold middle positions.

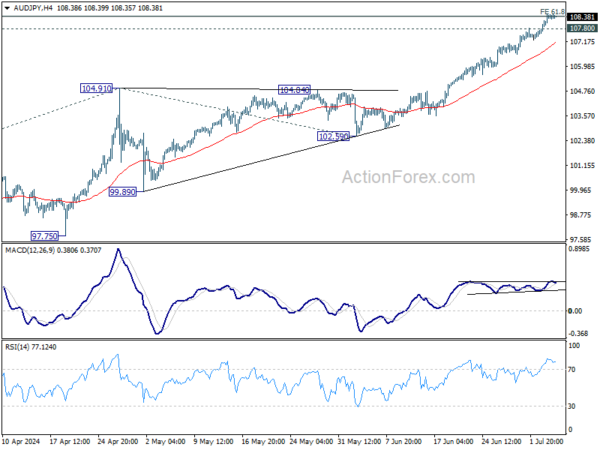

Technically, Yen pairs are showing signs of fatigue, including USD/JPY, EUR/JPY, and GBP/JPY. Yen might be entering a consolidation phase in the near term, awaiting further guidance from as traders look forward to BoJ meeting at the end of the month. A break of 107.80 minor support in AUD/JPY would indicate short-term topping, leading to deeper pullback to 55 4H EMA (now at 107.12) and possibly below.

In Europe, at the time of writing, FTSE is up 1.03%. DAX is up 0.45%. CAC is up 0.87%. UK 10-year yield is up 0.0239 at 4.200. Germany 10-year yield is up 0.010 at 2.577. Earlier in Asia, Nikkei rose 0.82%. Hong Kong HSI rose 0.28%. China Shanghai SSE fell -0.83%. Singapore Strait Times rose 0.71%. Japan 10-year JGB yield fell -0.0195 to 1.083.

ECB divided over rate cut at June meeting

Accounts from ECB’s June meeting reveal that “almost all members” supported the 25bps rate cut. However, there was a significant “dissenting view”, arguing that recent data and ongoing inflationary risks “did not support the case for a rate cut”.

The dissenters pointed to “stickiness” in inflation and highlighted the risk that geopolitical factors could exacerbate inflation this “stickiness”. They also warned that diverging from US interest rate path could “risk adding to inflationary pressures via exchange rate effects”.

Looking ahead, ECB remains committed to ensuring inflation returns sustainably to the 2% medium-term target. Members emphasized maintaining a data-dependent, meeting-by-meeting approach without pre-committing to a specific rate path, allowing for full policy flexibility.

ECB’s Lane Expects wage growth normalization in 2025

ECB Chief Economist Philip Lane, speaking in Italy today, expressed optimism that wage growth will normalize by 2025, based on surveys and forward-looking indicators among companies.

“The reason why we think inflation will come down next year is that this is the last year of high wages,” Lane said. He highlighted that wage increases, which were around five or six percent last year, are now projected to be around three to four percent.

Lane also emphasized ECB’s focus on domestic inflation, explaining, “What we can mostly influence is domestic inflation because the ability of European firms to raise prices depends on monetary conditions.” He acknowledged that while domestic inflation has decreased from its peak a year ago, it remains around 4%, which continues to be a concern.

UK PMI construction falls to 52.2, slowing growth amid election uncertainty

UK PMI Construction fell to 52.2 in June, down from 54.7 in May, and below the expected 54.0. S&P Global highlighted the sharpest rise in employment in ten months, while inflationary pressures remained subdued.

Andrew Harker, Economics Director at S&P Global Market Intelligence, noted that the slowdown, particularly in housing activity, was partly due to “election uncertainty”. He suggested that trends might improve once the election period ends.

Firms remain optimistic about the year-ahead outlook and increased employment significantly. Inflation pressures stayed low, encouraging firms to expand purchasing activity. Stable supply-chain conditions also supported this positive trend..

Swiss CPI slows to 1.3% yoy in Jun, vs exp 1.4% yoy

Swiss CPI rose 0.0% mom in June, below expectation of 0.1% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) fell -0.1% mom. Domestic product prices rose 0.2% mom while imported products prices fell -0.5% mom.

For the 12-month period, CPI rose 1.3% yoy, slowed from prior month’s 1.4% yoy, below expectation of 1.4% yoy. Core CPI slowed from 1.2% yoy to 1.2% yoy. Domestic products prices growth was unchanged at 2.0% yoy. Imported products prices fell -0.8% yoy, down from May’s -0.6% yoy.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 5.77B | 6.30B | 6.55B | 6.03B |

| 05:45 | CHF | Unemployment Rate Jun | 2.30% | 2.30% | ||

| 06:00 | EUR | Germany Factory Orders M/M May | -1.60% | 0.90% | -0.20% | -0.60% |

| 06:30 | CHF | CPI M/M Jun | 0.00% | 0.10% | 0.30% | |

| 06:30 | CHF | CPI Y/Y Jun | 1.30% | 1.40% | 1.40% | |

| 08:30 | GBP | Construction PMI Jun | 52.2 | 54.0 | 54.7 | |

| 11:30 | EUR | ECB Meeting Accounts |