Dollar faced significant selloff overnight as market participants ramped up bets on a September rate cut by Fed. This shift in sentiment propelled S&P 500 and NASDAQ to record highs too. However, the greenback managed to stabilize in Asian session as the forex markets quieted down in observance of US July 4 holiday. As noted below, despite the current drop, it’s premature to call for near-term bearish reversal in Dollar Index. The direction of Dollar will largely hinge on the upcoming non-farm payroll data due tomorrow.

For the week at this point, Sterling stands as the best performer, with market participants eagerly awaiting the results of UK general elections to adjust their positions. Euro follows as the second-best performer, with attention also focused on the second round of the French parliamentary elections this weekend. Aussie is currently in third place. Conversely, Yen and Swiss Franc are the worst performers for the week, with Dollar trailing as the third worst. Kiwi and Loonie are positioned in the middle.

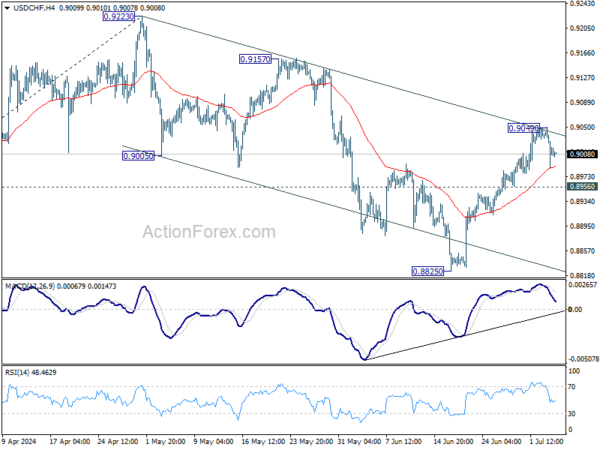

Attention today will be on USD/CHF as Switzerland releases its CPI data, which could influence SNB’s decision on whether to cut interest rates gain. The first attempt for USD/CHF to break through near term falling channel ended as a failure. Yet, while deeper retreat cannot be ruled out, further rise will remain in favor as long as 0.8956 support holds. Sustained break of the channel resistance will argue that whole fall from 0.9223 has completed as a three-wave corrective move and bring stronger rally to 0.9157 resistance next.

In Asia, at the time of writing, Nikkei is up 0.82%. Hong Kong HSI is down -0.06%. China Shanghai SSE is down -0.59%. Singapore Strait Times is up 0.55%. Japan 10-year JGB yield is down -0.0174 at 1.085. Overnight, DOW fell -0.06%. S&P 500 rose 0.51%. NASDAQ rose 0.88%. 10-year yield fell sharply by -0.081 to 4.355.

Dollar index dives to key near term support and Fed cut bets surge

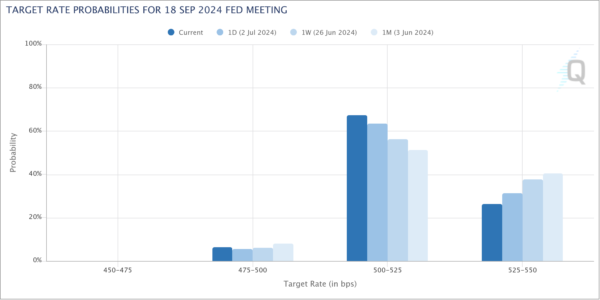

Bets on a rate cut by Fed at the September meeting surged overnight, driven by unexpectedly poor ISM services data. This shift in sentiment also propelled S&P 500 and NASDAQ to new record highs while driving down the 10-year yield and weakening Dollar.

Fed fund futures now indicate nearly 74% chance of a rate cut in September, up significantly from around 62% a week ago.

The change in expectations has led to steep decline in Dollar Index, although it is still too early to call for near-term bearish reversal. DXY found some support at 105.12, as well as 55 D EMA (now at 105.12), and managed to recover, closing at 105.40. A strong bounce from the current level, followed by break of 106.13, could resume the overall rise from 100.61 through 106.51.

However, firm break below 105.12 and 55 D EMA would suggest that the pattern from 106.51 is extending, with the fall from 106.13 as the third leg. Even if the pattern from 106.51 is corrective, deeper decline to 103.99 support and below could be likely.

The upcoming release of the non-farm payroll report tomorrow, along with the US market reopening after the July 4 holiday, will likely provide further clarity on Dollar’s next move.

FOMC minutes: Not appropriate to lower interest rates yet

Minutes from June FOMC meeting highlight continued concerns about the slow progress in reducing inflation this year. Participants emphasized that it would not be appropriate to lower interest rates until there is “greater confidence” that inflation is moving sustainably toward 2% target.

Participants discussed risk-management considerations, noting that with “labor market tightness having eased” and “inflation having declined” over the past year, the risks to achieving employment and inflation goals “had moved toward better balance”. They believe the current monetary policy is “well-positioned” to address existing risks and uncertainties.

The “vast majority” of participants observed that economic activity appears to be gradually cooling, and most viewed the current policy stance as “restrictive”. However, “some participants” noted uncertainty about the “degree of restrictiveness”. They suggested that the continued strength of the economy and other factors might indicate that the longer-run equilibrium interest rate is higher than previously assessed, which would mean that the stance of monetary policy and overall financial conditions might be “less restrictive than they might appear”. A “couple” of participants noted that the longer-run equilibrium interest rate is a better guide for long-term federal funds rate movements than for assessing current policy restrictiveness.

“Several participants” observed that if inflation remains elevated or increases, the target range for the federal funds rate “might need to be raised”. On the other hand, “some members” specifically emphasized that with labor market normalizing, any further weakening in demand could now lead to a larger increase in unemployment compared to the recent past.

Looking ahead

Germany factory orders, Swiss CPI, UK PMI construction will be released in European session today. ECB will publish latest monetary policy meeting accounts. The North American calendar is empty.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6669; (P) 0.6701; (R1) 0.6739; More...

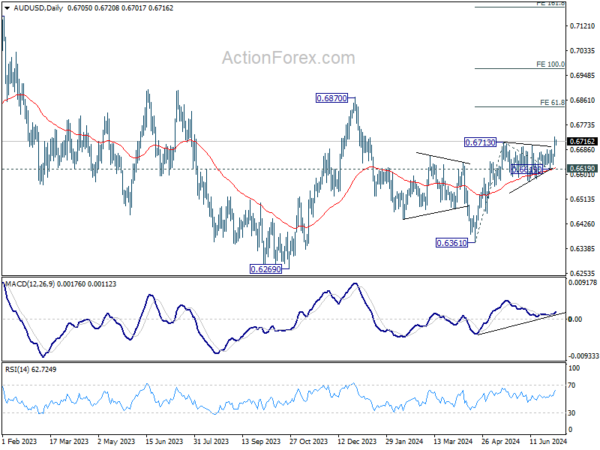

Intraday bias in AUD/USD remains on the upside for the moment. Rise from 0.6361 has just resumed and should target 61.8% projection of 0.6361 to 0.6713 from 0.6619 at 0.6837 next. For now, near term outlook will stay bullish as long as 0.6619 support holds, in case of retreat.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 5.77B | 6.30B | 6.55B | 6.03B |

| 06:00 | EUR | Germany Factory Orders M/M May | 0.90% | -0.20% | ||

| 06:30 | CHF | CPI M/M Jun | 0.10% | 0.30% | ||

| 06:30 | CHF | CPI Y/Y Jun | 1.40% | 1.40% | ||

| 08:30 | GBP | Construction PMI Jun | 54 | 54.7 | ||

| 11:30 | EUR | ECB Meeting Accounts |