Dollar is showing renewed strength in Asian session, particularly against commodity currencies. Market reactions to the televised debate between US President Joe Biden and former President Donald Trump have been muted, with traders shifting their focus to upcoming inflation data.

Both headline and core PCE inflation are expected to dip to 2.6% in May. For Fed to consider lowering interest rates, disinflation needs to show consistent progress for several more months. Currently, Fed fund futures indicate around a 65% chance of a 25bps rate cut in September.

Yen continues to weaken despite stronger-than-expected Tokyo CPI core readings. BoJ has explicitly indicated a possible rate hike in July. But even if it materializes, it is likely to be more symbolic than impactful. Recent global inflation surprises suggest that the interest rate gap between Japan and other major economies will remain wide for the foreseeable future.

Meanwhile, Japan has appointed a new top currency diplomat, Atsushi Mimura, to replace Masato Kanda starting July 31. It remains to be seen if Mimura will implement significant changes to Japan’s strategy regarding Yen’s prolonged depreciation.

In the broader currency markets, Dollar is currently the top performer for the week, followed by Euro and Sterling. New Zealand Dollar is the weakest, trailed by Yen and Swiss Franc. Australian and Canadian Dollars are positioned in the middle.

Technically, USD/CAD’s break of 1.3717 resistance suggests that fall from 1.3790 has completed at 1.3626 already. The whole corrective pattern from 1.3845 might be finished with three waves to 1.3626 too. Further rise is now in favor to 1.3790 resistance first. Decisive break there will raise the chance of larger up trend resumption through 1.3845. The next significant moves will probably be influenced by today’s US PCE inflation data and Canada’s GDP release.

In Asia, at the time of writing, Nikkei is up 0.71%. Hong Kong HSI is up 0.56%. China Shanghai SSE is up 0.98%. Singapore Strait Times is down -0.24%. Japan 10-year JGB yield is down -0.0025 at 1.071. Overnight, DOW rose 0.09%. S&P 500 rose 0.09%. NASDAQ rose 0.30%. 10-year yield fell -0.028 to 4.288.

Tokyo CPI surpasses expectations, Japan’s industrial output rebounds

Japan’s Tokyo CPI core (excluding food) rose to 2.1% yoy in June, beating expectations of 2.0% yoy and up from May’s 1.9% yoy. CPI core-core (excluding food and energy) increased from 1.7% yoy to 1.8% yoy. Headline CPI also ticked up from 2.2% to 2.3% year-on-year. Monthly figures showed Tokyo’s CPI core rose by 0.4% mom, core-core by 0.3% mom, and headline CPI by 0.3% mom.

In addition, Japan’s industrial production saw a significant boost in May, rising 2.8% mom, surpassing the forecasted 2.0%. Of the 15 industrial sectors covered, 13 reported higher output while only two experienced declines.

A Ministry of Economy, Trade and Industry official noted, “The private sector’s sentiment toward output is improving as auto production started to pick up.” Despite this, the ministry maintained its previous assessment that industrial production “showed weakness while fluctuating indecisively.” According to a poll of manufacturers, output is expected to decrease by -4.8% in June but increase by 3.6% in July.

Fed’s Bowman cites multiple risks to inflation, rules out rate cuts for now

In a speech overnight, Fed Governor Michelle Bowman reiterated that Fed is “still not yet at the point where it is appropriate to lower the policy rate.” She emphasized that several upside risks to inflation persist, making it premature to consider rate cuts.

Bowman highlighted several concerns impacting inflation. She noted that further improvements on the supply side are unlikely, and geopolitical developments could disrupt global supply chains, adding to inflationary pressures. Additionally, loosening in financial conditions might increase demand, potentially stalling disinflation progress. Furthermore, increased immigration and continued labor market tightness could lead to persistently high core services inflation.

Bowman stressed that monetary policy is “not on a preset course.” She remains willing to raise interest rates if incoming data suggest that progress on inflation has stalled or reversed.

Looking ahead

Germany import price index and unemployment, France consumer spending, UK Q1 GDP final, and Swiss KOF economic barometer will be released in European session.

Later in the day, Canada will publish GDP. US will release personal income and spending, PCE price index, Chicago PMI.

EUR/JPY Daily Outlook

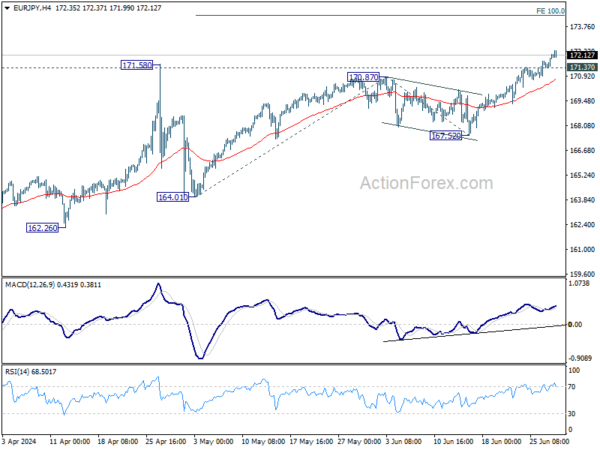

Daily Pivots: (S1) 171.60; (P) 171.89; (R1) 172.38; More…

Intraday bias in EUR/JPY remains on the upside as up trend continues. Next target is 100% projection of 164.01 to 170.87 from 167.52 at 174.38. On the downside, below 171.37 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, strong support from 55 D EMA indicates that the long term up trend is still in progress. Decisive break of 171.58 will confirm resumption and target 100% projection of 139.05 to 164.29 from 153.15 at 178.38. For now outlook will stay bullish as long as 164.01 support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jun | 2.30% | 2.20% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Jun | 2.10% | 2.00% | 1.90% | |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y Jun | 1.80% | 1.70% | ||

| 23:30 | JPY | Unemployment Rate May | 2.60% | 2.60% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M May P | 2.80% | 2.00% | -0.90% | |

| 01:30 | AUD | Private Sector Credit M/M May | 0.40% | 0.40% | 0.50% | |

| 05:00 | JPY | Housing Starts Y/Y May | -6.00% | 13.90% | ||

| 06:00 | EUR | Germany Import Price Index M/M May | 0.20% | 0.70% | ||

| 06:00 | GBP | GDP Q/Q Q1 F | 0.60% | 0.60% | ||

| 06:00 | GBP | Current Account (GBP) Q1 | -17.7B | -21.2B | ||

| 06:45 | EUR | France Consumer Spending M/M May | 0.20% | -0.80% | ||

| 07:00 | CHF | KOF Economic Barometer Jun | 100.5 | 100.3 | ||

| 07:55 | EUR | Germany Unemployment Change Jun | 15K | 25K | ||

| 07:55 | EUR | Germany Unemployment Rate Jun | 5.90% | 5.90% | ||

| 12:30 | CAD | GDP M/M Apr | 0.30% | 0.00% | ||

| 12:30 | USD | Personal Income M/M May | 0.40% | 0.30% | ||

| 12:30 | USD | Personal Spending M/M May | 0.30% | 0.20% | ||

| 12:30 | USD | PCE Price Index M/M May | 0.00% | 0.30% | ||

| 12:30 | USD | PCE Price Index Y/Y May | 2.60% | 2.70% | ||

| 12:30 | USD | Core PCE Price Index M/M May | 0.10% | 0.20% | ||

| 12:30 | USD | Core PCE Price Index Y/Y May | 2.60% | 2.80% | ||

| 13:45 | USD | Chicago PMI Jun | 40 | 35.4 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jun F | 65.6 | 65.6 |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)