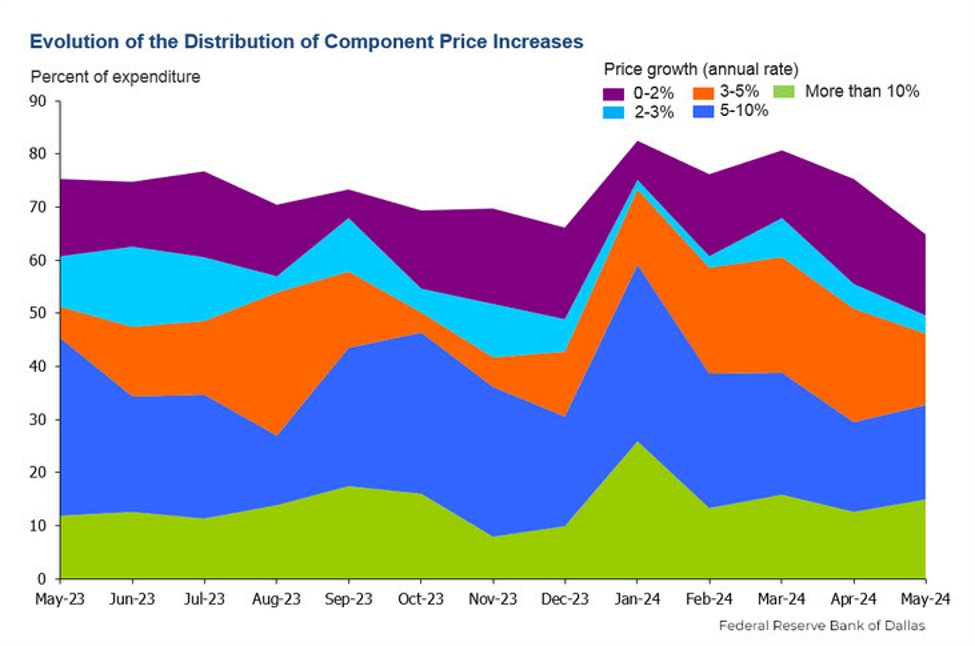

The Dallas and Cleveland PCE remix data illustrates why Fed officials and markets are feeling better about the pricing picture.

- One month annualized trimmed mean 1.4% vs 2.7% prior (lowest this year)

- Six month annualized 3.0% vs 3.1% prior

- 12-month 2.8% vs 2.9% prior

Digging through the numbers, some drivers of inflation:

- Prescription drugs

- Tobacco

- Spectator sports

- Hospitals

- Used trucks

Some drivers of disinflation:

- Computer software and accessories

- Gasoline

- Air transport

- Financial services fees

- Women’s and girls clothing

One thing that wasn’t trimmed out was rent, which was up 4.8% annualized and still remains a problematic part of the inflation picture.

This article was originally published by Forexlive.com. Read the original article here.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)