Australian Dollar declines broadly today, as markets brace for the upcoming RBA rate decision. With the cash rate expected to hold steady at 4.35%, speculation is rife about RBA’s future monetary policy direction. Although the central bank maintains an open stance on rate adjustments, indicating that hikes are still possible, market consensus suggests that further increases are unlikely due to the subdued consumption climate. That’s the base case until second-quarter CPI data presents significant upside surprises, which would make the next meeting in August live. Meanwhile, predictions for a rate cut are being deferred. While some economists anticipate a possible rate cut as early as the fourth quarter, others foresee this moving into the early next year.

In broader currency market movements, New Zealand Dollar also showed weakness, but this trend extended to Yen and Swiss Franc, suggesting that these shifts are not tied to changes in risk sentiment. On a more positive note, Euro is on a recovery path, while Dollar, Canadian Dollar, and British Pound are appearing slightly stronger.

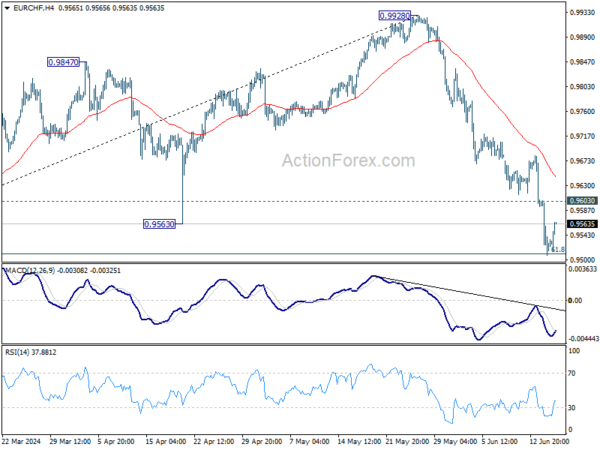

From a technical analysis perspective, several key resistance levels in Euro pairs are being closely watched to determine if Euro’s recovery can sustain and extend. These include 1.0744 minor resistance in EUR/USD, 0.8482 resistance in EUR/GBP, and 0.9603 minor resistance in EUR/CHF. Break of these levels might not necessarily signal a full reversal for Euro. But it would at least indicate that the recent selling climax is over, setting the stage for more stable, consolidative trading in the near term.

In Europe, at the time of writing, FTSE is down -0.16%. DAX is up 0.12%. CAC is up 0.27%. UK 10-year yield is up 0.046 at 4.106. Germany 10-year yield is u 0.069 at 2.432. Earlier in Asia, Nikkei fell -1.83%. Hong Kong HSI fell -0.02%. China Shanghai SSE fell -0.55%. Singapore Strait Times fell -0.81%. Japan 10-year JGB yield fell -0.0064 to 0.932.

ECB’s Lane confidence on inflation, cautions on interpreting data noise

ECB’s Chief Economist Philip Lane expressed “a lot, a fair amount of confidence” today that Eurozone inflation is on track to return to 2% target by the latter half of next year.

In his remarks, Lane highlighted the importance of judiciously interpreting incoming economic data, emphasizing the need to “differentiate the noise and the signal.”

Lane’s confidence stems from anticipated “muted” cost pressures in the coming year. However, he underscored the critical need for a reduction in “domestic services inflation momentum” as a necessary condition for achieving the inflation targets.

SECO slightly upgrades Swiss economic forecasts, but below-average growth persists

The State Secretariat for Economic Affairs said that Swiss economic forecasts remain largely unchanged, with growth expected to stay below average this year. The Expert Group on Business Cycles projects a modest growth rate of 1.2% for the Swiss economy in 2024, slightly up from March forecast of 1.1%.

Challenges such as low capacity utilisation in industrial production and high financing costs are likely to curb investments. However, exports will provide some support, aided by the recent depreciation the Swiss Franc. More significantly, growth will be driven by private consumption, buoyed by rising employment and a stable inflation rate, which is expected to average 1.4% for the current year, a slight decrease from the March forecast of 1.5%.

Looking ahead, GDP growth for 2025, adjusted for sporting events, is projected to reach 1.7%, with inflation at 1.1%. Both were unchanged from prior forecasts.

NZ BNZ services falls to 43, unprecedented contraction

New Zealand’s BusinessNZ Performance of Services Index dropped significantly from 46.6 to 43.0 in May, marking the lowest level of activity for a non-COVID lockdown month since the survey’s inception in 2007.

BusinessNZ Chief Executive Kirk Hope described the May result as “as bad as it can get” for the sector, with contraction levels surpassing those seen during the Global Financial Crisis of 2008/09.

Examining the details, key metrics reveal a stark downturn. Activity/sales fell from 46.0 to 40.9, employment dropped from 47.0 to 46.0, new orders/business decreased from 46.6 to 42.6, stocks/inventories declined from 46.2 to 42.4, and supplier deliveries slid from 47.5 to 46.1.

The proportion of negative comments in May (65.4%) remained similar to April (66.3%), indicating persistent concerns about the economic downturn.

BNZ’s Senior Economist Doug Steel noted, “the speed of decline is as worrisome as its size over the past three months. There is weak and then there is very weak. Overall, this tells of a services sector in reverse, at pace.”

China’s industrial production up 5.6% yoy in May, misses exp 6.0% yoy

China’s industrial production increased by 5.6% yoy in May, falling short of the expected 6.0% yoy and slowing from April’s 6.7% yoy. Despite this overall slowdown, the equipment and high-tech manufacturing sectors showed robust growth, with outputs rising 7.5% yoy and 10% yoy, respectively.

Fixed asset investment grew by 4.0% year-to-date yoy, slightly below the anticipated 4.2%. Within this sector, property development investment notably declined by -10.1%, reflecting ongoing challenges in China’s real estate market.

On a positive note, retail sales rose by 3.7% yoy, surpassing the expected 3.0%. This indicates resurgence in the consumer sector, which could provide a buffer against the broader economic slowdown.

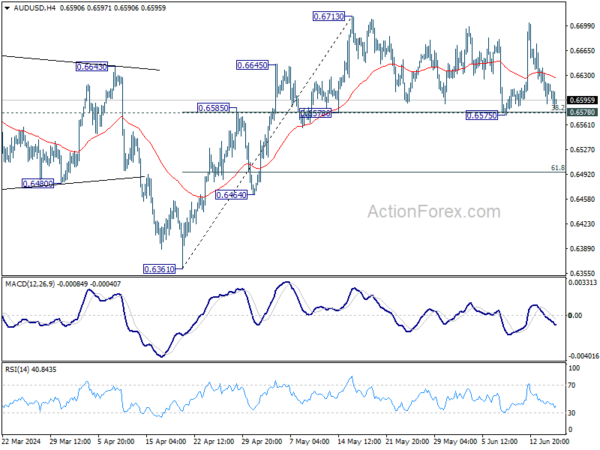

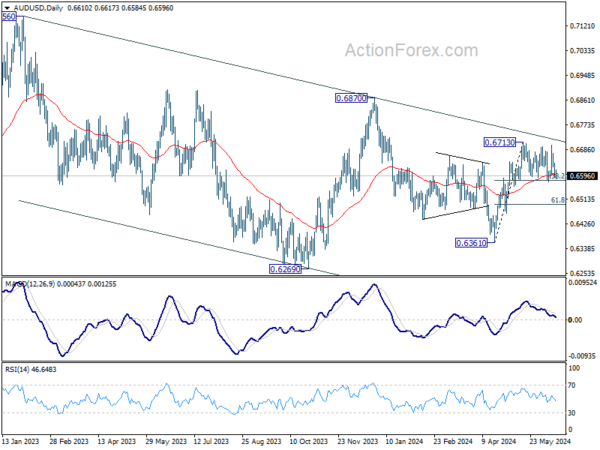

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6590; (P) 0.6617; (R1) 0.6643; More...

No change in AUD/USD’s outlook and intraday bias stays neutral. Further rally is in favor with 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579) intact. On the upside, firm break of 0.6713 will resume whole rise from 0.6361 to 0.6870 resistance next. However, sustained break of 0.6578 will dampen this bullish view, and bring deeper fall to 61.8% retracement at 0.6495.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI May | 43 | 47.1 | 46.6 | |

| 23:01 | GBP | Rightmove House Price Index M/M Jun | 0.00% | 0.80% | ||

| 23:50 | JPY | Machinery Orders M/M Apr | -2.90% | -3.10% | 2.90% | |

| 02:00 | CNY | Industrial Production Y/Y May | 5.60% | 6.00% | 6.70% | |

| 02:00 | CNY | Retail Sales Y/Y May | 3.70% | 3.00% | 2.30% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y May | 4.00% | 4.20% | 4.20% | |

| 07:00 | CHF | SECO Economic Forecasts | ||||

| 12:15 | CAD | Housing Starts Y/Y May | 265K | 241K | 240K | 241K |

| 12:30 | USD | Empire State Manufacturing Index Jun | -6 | -13 | -15.6 |