The ECB cut rates but does not commit to a path of future rate moves:

- ECBs expects growth to pick up to 0.9% in 2024 vs 0.7% prev.

- Inflation forecast 2.5% in 2024 (vs 2.3% prev), 2.2% in 2025 (versus 2.1% prev) and 1.9% in 2026 (vs 1.9% prev).

- Growth forecast 1.4% in 2025 vs 1.5% prev. and 1.6% in 2026 vs 1.6% prev.

October is fully priced for a rate cut.

The EURUSD has traded marginally higher after the rate decision and the lack of pre-commitment from the ECB in their commentary..

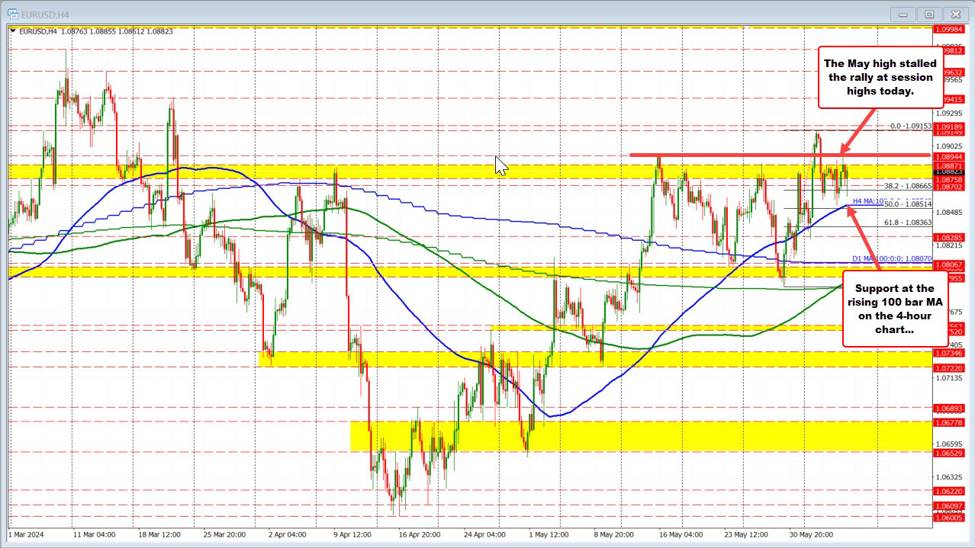

The high-price in the EURUSD today extended to the high-price going back to May 16 at 1.08944 and backed off.

On the downside, the price remains above the rising 100-bar moving average on the 4- hour chart at 1.0854.

Moving above 1.08944 or below 1.0854 would be the break points for traders going forward today. Look for momentum on a break.

This article was originally published by Forexlive.com. Read the original article here.