Sterling climbed broadly today after data showed that UK disinflation progress was slower than anticipated, with services inflation remaining persistently high. This development dashed hopes for an imminent rate cut by BoE, causing the odds of a rate cut in June to plummet from around 50% to below 20%. Despite this, the notable declines in both headline and core CPI keep the possibility of a rate cut at the BoE’s August meeting alive.

While the Pound is performing well, it has been outpaced by New Zealand Dollar and US Dollar. Kiwi surged earlier following hawkish RBNZ statement and forecast. The central bank left OCR unchanged but signaled an increased likelihood of another rate hike this year and delayed the projected timing of the first rate cut to the latter half of 2025.

Dollar is gaining strength amid mild risk aversion and recovery in treasury yields. The focus now shifts to minutes from FOMC meeting. Traders will be looking for hints about the timing of the first rate cut by Fed, although it is unlikely they will find any new information. The minutes are expected to reinforce Fed’s stance that rates will remain elevated for an extended period, with the next move likely being a cut, but timing contingent on further economic data.

On the flip side, Swiss Franc is the worst performer of the day, driven by expectations that the yield gap between Switzerland and other major economies will persist. Euro follows as the second worst, with ECB still on track for a rate cut in June, the Japanese Yen ranks third worst. Canadian Dollar and Australian Dollar are positioned in the middle of the performance spectrum.

Technically, Bitcoin is quickly approaching 73812 record high as near term rally extends. Decisive break there will confirm up trend resumption for 61.8% projection of 24896 to 73812 from 65780 at 86717 next. On the downside, break of 65780 support will delay the bullish case and bring more consolidations first.

In Europe, at the time of writing, FTSE is down -0.69%. DAX is down -0.32%. CAC is down -0.69%. UK 10-year yield is up 0.1178 at 4.245. Germany 10-year yield is up 0.048 at 2.552. Earlier in Asia, Nikkei fell -0.85%. Hong Kong HSI fell -0.13%. China Shanghai SSE rose 0.02%. Singapore Strait Times fell -0.19%. Japan 10-year JGB yield rose 0.0160 to 1.001.

Bundesbank sees German economy gradually gaining momentum in Q2

In its monthly report, Bundesbank indicated that Germany’s economic output is “likely to increase slightly again” in Q2. The general trend suggests that the economy is gradually “picking up speed,” with positive impulses expected from private consumption and a “further recovery” in the service sector.

The Bundesbank also noted that energy-intensive sectors in industry could “recover moderately.” However, it highlighted that a broad-based increase in new orders is still lacking, which is necessary for a thorough recovery. The improved business expectations in the manufacturing sector are anticipated to significantly boost production only in the second half of the year.

Additionally, Bundesbank expects inflation to rise again in May and fluctuate at a slightly higher level in the coming months. This is primarily due to base effects, such as the introduction of the “Germany Ticket” in local passenger transport last May, which will influence year-on-year comparisons.

UK CPI down to 2.3% in Apr, core CPI falls to 3.9%, both above expectations

UK CPI slowed sharply from 3.2% yoy to 2.3% yoy in April, but above expectation of 2.1% yoy. Core CPI (excluding energy, food, alcohol and tobacco) slowed from 4.2% yoy to 3.9% yoy, above expectation of 3.6% yoy.

CPI goods annual rate turned negative from 0.8% yoy to -0.8% yoy. But CPI services annual rate eased just slightly from 6.0% yoy to 5.9% yoy.

RBNZ holds steady at 5.50% but signals potential hike later in 2024

RBNZ kept Official Cash Rate unchanged at 5.50%, as widely anticipated. However, RBNZ surprised markets by raising its projected rate path, suggesting the possibility of another rate hike later this year. Additionally, the timeline for rate cuts has been pushed further into the latter half of 2025. According to key forecast variables, the OCR is expected to rise from the current 5.5% to 5.7% in Q4 2024 before declining to 5.4% in Q3 2025.

Minutes of the meeting highlighted that members agreed on the “significant upside risk” posed by persistent non-tradable inflation. They noted that the influence of recent inflation outcomes on future inflation expectations is critical for price setting, wage expectations, and the stance of monetary policy. Moreover, slower output growth than currently assumed could reduce the pace at which spending can grow without increasing inflationary pressures.

“Monetary policy may need to tighten and/or remain restrictive for longer if wage and price setters do not align with weaker productivity growth rates,” the minutes stated.

Japan’s exports rise 8.3% yoy in Apr, imports up 8.3% yoy

In April, Japan’s exports increased by 8.3% yoy to JPY 8981B, falling short of expected 11.1% growth. Nonetheless, this marks the fifth consecutive month of export growth and sets a record for April. Key contributors to this growth included hybrid cars, semiconductor-making equipment, and chips.

Imports also rose by 8.3% yoy to JPY 9443B, slightly below expected 9.0% increase, and set a record for the month. The weak Ten continues to inflate import costs for resource-scarce Japan, with crude oil prices jumping 17.7% yoy, compared to a 2.6% yoy increase in Dollar terms. This resulted in a trade balance deficit of JPY -463B.

On a seasonally adjusted basis, exports rose 0.9% mom to JPY 8843B, while imports decreased by -0.5% mom to JPY 9403B, leading to a trade balance deficit of JPY -561B.

GBP/USD Mid-Day Outlook

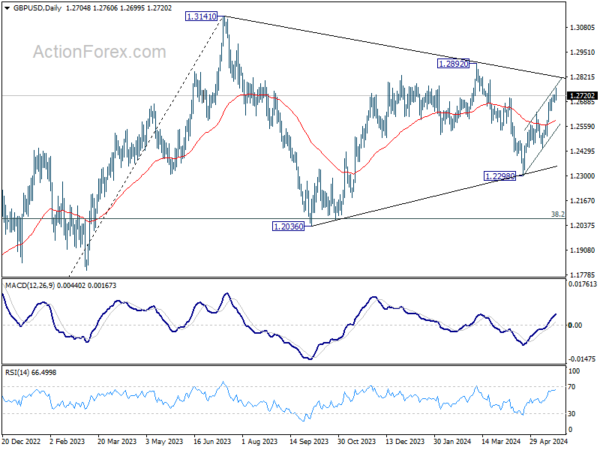

Daily Pivots: (S1) 1.2689; (P) 1.2708; (R1) 1.2729; More…

Intraday bias in GBP/USD remains on the upside for 100% projection of 1.2298 to 1.2633 from 1.2445 at 1.2780. Firm break there will target 1.2892 resistance next. However, break of 1.2685 will minor support will turn bias back to the downside, for retreat to 55 4H EMA (now at 1.2644).

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2298 support will extend the corrective pattern instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Apr | -0.56T | -0.73T | -0.70T | -0.68T |

| 23:50 | JPY | Machinery Orders M/M Mar | 2.90% | -1.80% | 7.70% | |

| 02:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 06:00 | GBP | CPI M/M Apr | 0.30% | 0.20% | 0.60% | |

| 06:00 | GBP | CPI Y/Y Apr | 2.30% | 2.10% | 3.20% | |

| 06:00 | GBP | Core CPI Y/Y Apr | 3.90% | 3.60% | 4.20% | |

| 06:00 | GBP | RPI M/M Apr | 0.50% | 0.50% | 0.50% | |

| 06:00 | GBP | RPI Y/Y Apr | 3.30% | 3.30% | 4.30% | |

| 06:00 | GBP | PPI Input M/M Apr | 0.60% | 0.40% | -0.10% | -0.20% |

| 06:00 | GBP | PPI Input Y/Y Apr | -1.60% | -1.20% | -2.50% | |

| 06:00 | GBP | PPI Output M/M Apr | 0.20% | 0.40% | 0.20% | |

| 06:00 | GBP | PPI Output Y/Y Apr | 1.10% | 1.20% | 0.60% | 0.70% |

| 06:00 | GBP | PPI Core Output M/M Apr | 0.00% | 0.30% | ||

| 06:00 | GBP | PPI Core Output Y/Y Apr | 0.20% | 0.10% | 0.20% | |

| 06:00 | GBP | Public Sector Net Borrowing(GBP) Apr | 18.5B | 11.0B | ||

| 14:00 | USD | Existing Home Sales Apr | 4.18M | 4.19M | ||

| 14:30 | USD | Crude Oil Inventories | -2.4M | -2.5M | ||

| 18:00 | USD | FOMC Minutes |