Yen’s selloff resumed after brief recovery yesterday and continued to weaken throughout Asian session. Markets largely ignored comments from former BoJ chief economist Toshitaka Sekine, who suggested the next rate hike could happen as soon as in June. The general understanding is that BoJ will at least wait for Q2 data to confirm if Q1 GDP contraction was merely a temporary setback before making any policy changes. However, downside risk for Yen appears limited, given the likelihood of intervention by Japanese authorities if Yen approaches the critical 160 level against Dollar.

Conversely, Dollar recovering broadly today, supported by hawkish comments from several Fed officials. Overnight, the record run in US stock indexes stalled, with minor decline, while 10-year Treasury yield saw a recovery. Despite encouraging April inflation data, one month of data is insufficient to confirm a sustained disinflation trend. But given recent market reactions, risk would be skewed to the downside for Dollar for the near term.

For the week, Swiss Franc is currently the worst performer, followed by Yen and Dollar. In contrast, New Zealand Dollar leads the pack as the strongest performer, followed by British Pound and Australian Dollar. Euro and Canadian Dollar are positioned in the middle.

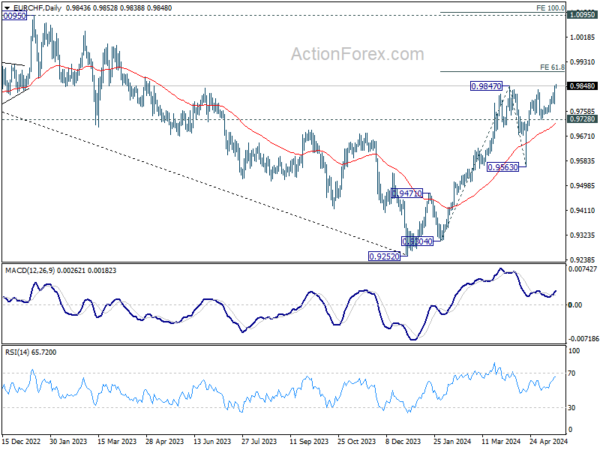

Technically, EUR/CHF’s rally from 0.9252 resumed by breaching 0.9847 resistance. Immediate focus is now on 61.8% projection of 0.9304 to 0.9847 from 0.9563 at 0.9899. Decisive break there could prompt upside acceleration to 100% projection at 1.0106, which is slightly above 1.0095 key structural resistance. In case of retreat, outlook will now remain bullish as long as 0.9728 support holds.

In Asia, at the time of writing, Nikkei is down -0.55%. Hong Kong HSI is up 0.20%. China Shanghai SSE is flat. Singapore Strait Times is down -0.34%. Japan 10-year JGB yield is up 0.0225 at 0.949. Overnight, DOW fell -0.10%. S&P 500 fell -0.21%. NASDAQ fell -0.26%. 10-year yield rose 0.021 to 4.377.

Fed’s Mester, Bostic, and Barkin signal extended restrictive stance

Some Fed officials have emphasized overnight the need for a extended period of restrictive monetary policy as they seek clearer signs of sustainable inflation reduction.

At an event, Cleveland Fed President Loretta Mester stated that incoming economic data suggests it will “take longer” to gain the confidence needed to start lowering interest rates. Mester emphasized that “holding our restrictive stance for longer is prudent” as Fed seeks clarity on the inflation path.

Atlanta Fed President Raphael Bostic, speaking at another event, acknowledged that the April inflation report provided some important insights, particularly noting a slowed rise in shelter costs. However, he cautioned that “one data point is not a trend,” highlighting the importance of watching the May and June data to ensure figures don’t reverse.

In a CNBC interview, Richmond Fed President Thomas Barkin reiterated the need for patience, noting that achieving 2% inflation sustainably “is going to take a little bit more time.” Barkin pointed out that there is still significant movement on the services side of the economy.

ECB’s Schnabel: June rate cut possible, another in July not warranted

In an interview with Nikkei, ECB Executive Board member Isabel Schnabel indicated that a rate cut in June “may be appropriate” based on current data. However, she noted that another cut in July “does not seem warranted.” Schnabel emphasized that the outlook beyond June is “much more uncertain,” pointing out that the “last mile” of disinflation is the “most difficult.”

Schnabel explained that the disinflation process has slowed significantly after most supply-side shocks were reversed, making it a “quite bumpy” global phenomenon. She highlighted that in Eurozone, part of this difficulty is due to base effects and the reversal of fiscal measures.

Importantly, Schnabel underscored that inflation driven by “second-round effects” has become “more persistent.” She advocated for a cautious approach, stressing that “after so many years of very high inflation and with inflation risks still being tilted to the upside, a front-loading of the easing process would come with a risk of easing prematurely.”

Mixed signals in China’s economic data: Industrial production surges, retail sales lag

China’s economic data for April revealed a mixed picture, with industrial production rising by 6.7% yoy, surpassing the expected 4.6%.

However, fixed asset investment for the year to date grew by 4.2% yoy, falling short of the anticipated 4.6%. Notably, real estate investment declined significantly, dropping by -9.8% in the first four months of the year.

Retail sales, a critical indicator of consumer spending, increased by only 2.3% yoy, below the forecast of 3.8%.

According to the National Bureau of Statistics , production and demand saw a stable increase, with employment and prices showing overall improvement. The NBS stated that the economy was generally stable, continuing to rebound and progress well.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 195.66; (P) 196.29; (R1) 197.54; More…

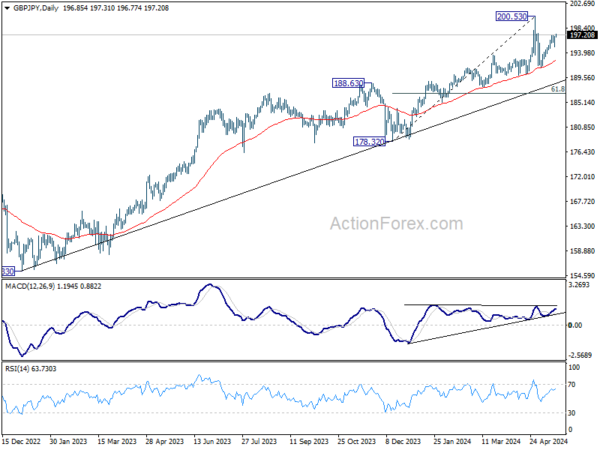

GBP/JPY’s rebound from 191.34 resumed after brief recovery and intraday bias is back on the upside. Rise from 191.34 is seen as the second leg of the corrective pattern from 200.53. Sustained break of 197.07 will pave the way to retest 200.53. On the downside, firm break of 195.02 will argue that the third leg has started, and target 191.34 support and possibly below.

In the bigger picture, a medium term top could be in place at 200.53 after breaching 199.80 long term fibonacci level. As long as 55 W EMA (now at 183.41) holds, fall from there is seen as correcting the rise from 178.32 only. However, sustained break of 55 W EMA will argue that larger scale correction is underway and target 178.32 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q1 | 0.70% | 0.60% | 0.90% | |

| 22:45 | NZD | PPI Output Q/Q Q1 | 0.90% | 0.50% | 0.70% | |

| 02:00 | CNY | Retail Sales Y/Y Apr | 2.30% | 3.80% | 3.10% | |

| 02:00 | CNY | Industrial Production Y/Y Apr | 6.70% | 4.60% | 4.50% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Apr | 4.20% | 4.60% | 4.50% | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr F | 2.70% | 2.70% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr F | 2.40% | 2.40% |