Markets:

- S&P 500 down 11 points to 5297 after hitting record

- Dow Jones Industrial Average hits 40,000 for the first time

- WTI crude oil up 66-cents to $79.30

- US 10-year yields up 2 bps to 4.38%

- Gold down $8 to $2378

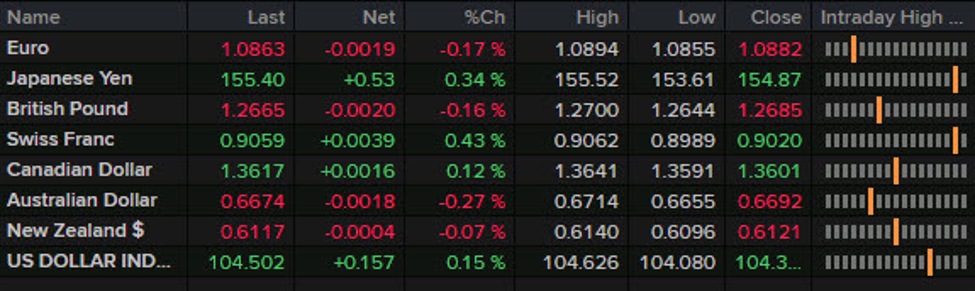

- USD leads, CHF lags

It’s tough to find anything to hang the price action on today. Yesterday there was some real enthusiasm in risk assets following CPI and retail sales and that continued in early equity trading but it sputtered elsewhere. The worries started in bonds and FX as yields rose led by the front end and the USD climbed.

To be sure, the moves were modest but they highlight a market that’s not yet ready to give up on high US inflation. The data was mostly softer but the market may have picked out the import/export prices on the hot side and sensed some pipeline inflation there. Initial jobless claims are also hanging in there at historically good levels.

Or perhaps it was the Fed talk that weighed as officials emphasized a higher-for-longer stance, making some question whether two cuts this year is too much to price in. On that front, the 51 bps of easing that were priced in yesterday faded to 46 bps.

USD/JPY has made a solid recovery from yesterday’s low of 153.60 and is now nearly 200 pips higher, adding 53 more today, or recouping above half of the CPI-inspired loss.

The euro remains interesting on a few fronts and EUR/CHF in particular as that pair looks to break to a one-year high. The EUR/USD chart is also one worth keeping an eye on as it flashes some strength.

But overall today, the mode was back-and-fill after a great run in risk trades. Economic data remains the name of the game.