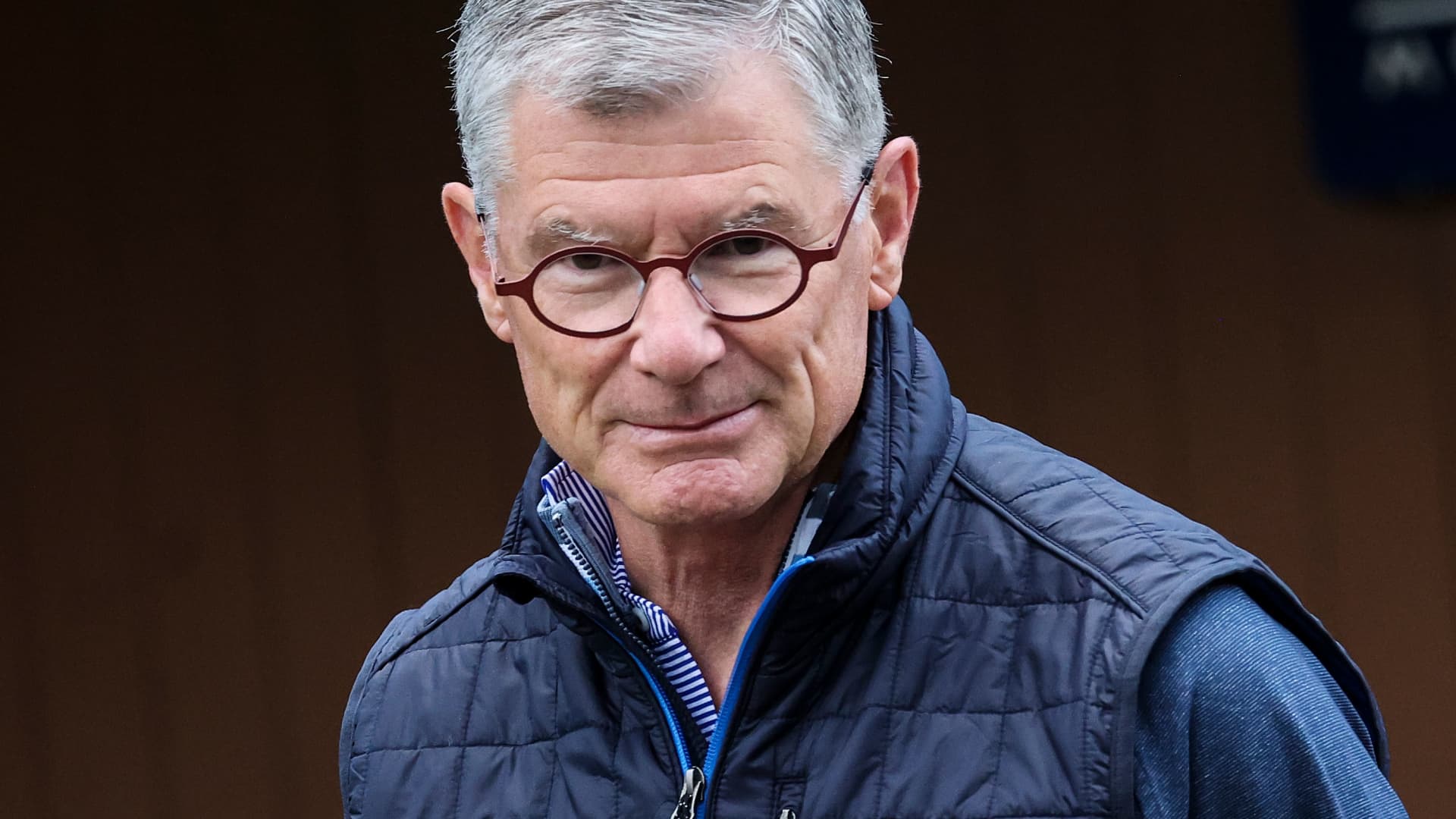

Peloton announced Thursday that CEO Barry McCarthy will be stepping down and the company will lay off 15% of its staff because it “simply had no other way to bring its spending in line with its revenue.”

McCarthy, a former Spotify and Netflix executive, will become a strategic advisor to Peloton through the end of the year while Karen Boone, the company’s chairperson, and director Chris Bruzzo will serve as interim co-CEOs. Jay Hoag, another Peloton director, has been named the new chairperson of the board. Peloton is seeking a permanent CEO.

The company also announced a broad restructuring plan that will see its global headcount cut by 15%, or about 400 employees. It plans to continue to close retail showrooms and make changes to its international sales plan.

The moves are designed to realign Peloton’s cost structure with the current size of its business, it said in a news release. It’s expected to reduce annual run-rate expenses by more than $200 million by the end of fiscal 2025.

“This restructuring will position Peloton for sustained, positive free cash flow, while enabling the company to continue to invest in software, hardware and content innovation, improvements to its member support experience, and optimizations to marketing efforts to scale the business,” the company said.

McCarthy took the helm of Peloton in February 2022 from founder John Foley and has spent the last two years restructuring the business and working to get it back to growth.

As soon as he took over, he began implementing mass layoffs to right size Peloton’s cost structure, closing the company’s splashy showrooms and enacting new strategies designed to grow membership. Contrary to Peloton’s founder, McCarthy redirected Peloton’s attention to its app as a means to capture members who may not be able to afford the company’s pricey bikes or treadmills but could be interested in taking its digital classes.

In a letter to staff, McCarthy said the company needed to implement layoffs because it wouldn’t be able to generate sustainable free cash flow with its current cost structure. Peloton hasn’t turned a profit since December 2020 and it can only burn cash for so long when it has more than $1 billion in debt on its balance sheet.

“Achieving positive [free cash flow] makes Peloton a more attractive borrower, which is important as the company turns its attention to the necessary task of successfully refinancing its debt,” McCarthy said in the memo.

“Investing in hardware, software and content innovation is the lifeblood of the business, and the key to reversing the decline in revenues and restoring the company’s growth,” he continued. “I’ve never been more optimistic that Peloton is on the right path to achieve this objective. There have never been more green shoots or more talent in the building than we have today to complete the turnaround successfully.”

In a news release, Boone thanked McCarthy for his contributions.

“Barry joined Peloton during an incredibly challenging time for the business. During his tenure, he laid the foundation for scalable growth by steadily rearchitecting the cost structure of the business to create stability and to reach the important milestone of achieving positive free cash flow,” Boone said.

“With a strong leadership team in place and the Company now on solid footing, the Board has decided that now is an appropriate time to search for the next CEO of Peloton.”

In a joint statement, Boone and Bruzzo said they are looking forward to “working in lockstep” with the company’s leadership to ensure it “doesn’t miss a beat while the CEO search is underway.”

This is breaking news. Please check back for updates.