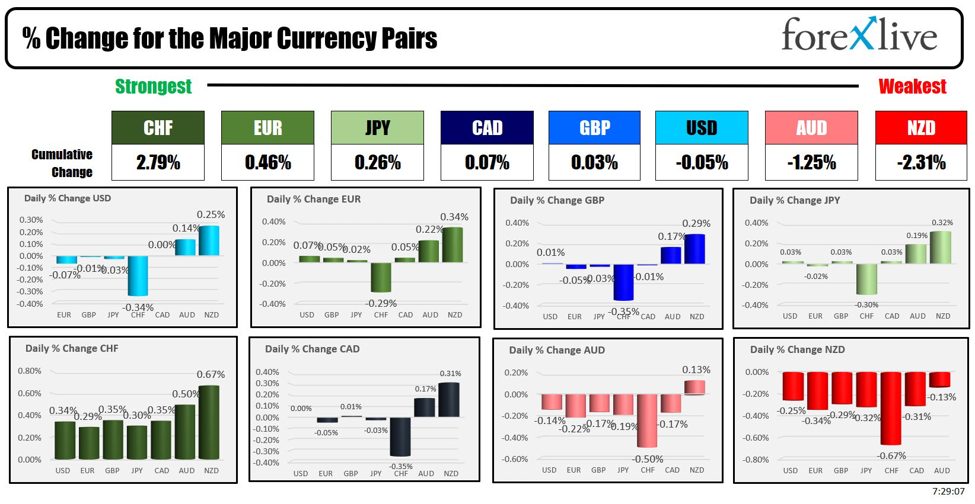

The strongest to the weakest of the major currencies

The CHF is the strongest (flight to safety) and the NZD is the weakest (risk off)as the North American session begins. The USD is mixed with the greenback losing -0.34% vs the CHF and gaining +0.25% vs the NZD. Other than that, the major currencies are within 0.14% of the closing levels from yesterday to start the trading day with the EUR, GBP, JPY and CAD trading near unchanged in the US morning snapshot.

The modest moves come despite Israel’s limited retaliatory strike against Iran following Iran’s significant drone and missile attack on its territory last weekend. The Israel response targeted the Isfahan area in central Iran, where nuclear facilities and an air base are located. Despite reports of explosions and the activation of air-defense systems across Iranian provinces, Iranian state media downplayed the incident, indicating no substantial damage or disruptions at nuclear sites. Reports are that the U.S. was informed of the attack just before its launch, but was not involved. This action by Israel seemed aimed at avoiding a larger conflict escalation and Iran’s reaction has so far been limited, which has investors hoping the conflict tension is over.

US stocks have moved lower in overnight trading on the back of the Israel strike, but has rebounded from the lowest levels. The Dow futures implied a decline of over 300 points but is now down about -60 points now. The S&P is on pace for its 3rd weekly decline. The Nasdaq index is on pace for its 4th straight weekly decline and given the premarket decline, on pace to the worst week since March 2023.

After the close yesterday, Netflix beat earnings and revenues expectations, and also showed strong new customer numbers, but the stock is still down over around -5.5% in pre-market trading as investors worry about the future. The company announced they would stop reporting membership numbers starting Q1 2025 and projected revenues lower than analysts expectation for the current quarter – both are not sitting well with investors.

The major earnings today, are not impressing investors:

American Express Co AXP

- EPS: 3.33 reported vs. 2.95 expected – BEAT

- Revenue: 15.8 billion reported vs. 15.79 billion expected – BEAT

- Shares are trading down -1.15% in premarket trading

Procter & Gamble Co PG

- Core EPS: 1.52 reported vs. 1.41 expected – BEAT

- Revenue: 20.2 billion reported vs. 20.41 billion expected – MISSED

- Shares are trading down -4.14% in premarket trading

Schlumberger SLB

- EPS: 0.75 reported vs. 0.75 expected – MET

- Revenue: 8.71 billion reported vs. 8.69 billion expected – BEAT

- Shares are trading down -1.45% premarket training

Next week is a key release week with Tesla,Visa, Boeing, Meta, IBM, Ford, Chipotle, Intel, Microsoft, Alphabet, Exonn Mobile and Chevron all scheduled to report.

As for today, there are no key economic releases scheduled in Canada or the US. Today is the last day before the quiet period starts for the Fed ahead of their May 1 interest-rate decision.

A Reuters poll released overnight, indicated that while no economists expect the Bank of Japan (BOJ) to raise interest rates before the end of June 2024, there is some anticipation of rate hikes later in the year. Specifically, 21 out of 61 economists predict a rate increase in the third quarter, and 17 out of 55 foresee it in the fourth quarter of 2024. The consensus median forecast places the upper end of the overnight call rate at 0.25% in the fourth quarter, where it is expected to remain until late 2025.

In a more detailed breakdown from a subset of 36 economists, 19% predict a BOJ rate hike in July 2024, but the majority, about 36%, anticipate this will happen in October 2024. Another 31% believe the rate increase will occur in 2025 or later.

Meanwhile, ECBs Simkus said that it is possible the ECB will lower rates three or four times and rate cuts could be back to back. A number of ECB officials indicated that they are focused on June for a rate cut, but add the caveat that it is still being data dependent. They are also chirping that the ECB is not Fed dependent.

A snapshot of the other markets as the North American session begins currently shows.:

- Crude oil is trading down $-0.48 or -0.58% at $81.62. At this time yesterday, the price was at $81.67. The high price overnight reached up to $85.64.

- Gold is trading down -$2.50 or -0.10% at $2376.02. At this time yesterday, the price was higher at $2382.41. It’s high price reached up to $2417.89, before rotating back to the downside.

- Silver is trading down -$0.13 or -0.49% at $28.07. At this time yesterday, the price was at $28.43. It’s high price overnight reached as high as $28.93

- Bitcoin currently trades at $65,051 which is well off the low at $59,629 and after the reports of the strike by Israel. At this time yesterday, the price was trading at $62,800

In the premarket, the US major indices are trading mostly lower:

- Dow Industrial Average futures are implying a fall of -61 points. Yesterday, the index rose 22.07 points or 0.06% at 37775.39

- S&P futures are implying a fall of -7.37 points. Yesterday, the index fell -11.11 points or -0.22% at 5011.11

- Nasdaq futures are implying a fall of -45.23 points. Yesterday, the index fell -81.87 points or -0.52% at 15601.50

The European indices are trading lower ahead of the US open:

- German DAX, -0.65%

- France CAC , -0.17%

- UK FTSE 100, -0.83%

- Spain’s Ibex, -0.55%

- Italy’s FTSE MIB, -0.15% (delayed 10 minutes)

Shares in the Asian Pacific markets were lower after the Israeli attack on Iran

- Japan’s Nikkei 225, -2.66%

- China’s Shanghai Composite Index, -0.29%

- Hong Kong’s Hang Seng index, -0.99%

- Australia S&P/ASX index, -0.98%

Looking at the US debt market, yields are trading lower:

- 2-year yield 4.966%, -2.6 basis points. At this time yesterday, the yield was at 4.931%

- 5-year yield 4.639%, -4.7 basis points. At this time yesterday, the yield was at 4.615%

- 10-year yield 4.589%, -5.7 basis points. At this time yesterday, the yield was at 4.584%

- 30-year yield 4.687%, -5.7 basis points. At this time yesterday, the yield was at 4.699%

Looking at the treasury yield curve spreads moved more inverted:

- The 2-10 year spread is at -37.6 basis points. At this time Friday, the spread was at -35.6 basis points

- The 2-30 year spread is at -27.9 basis points. At this time Friday, the spread was at -24.2 basis points

European benchmark 10-year yields are lower:

European benchmark 10 year yields