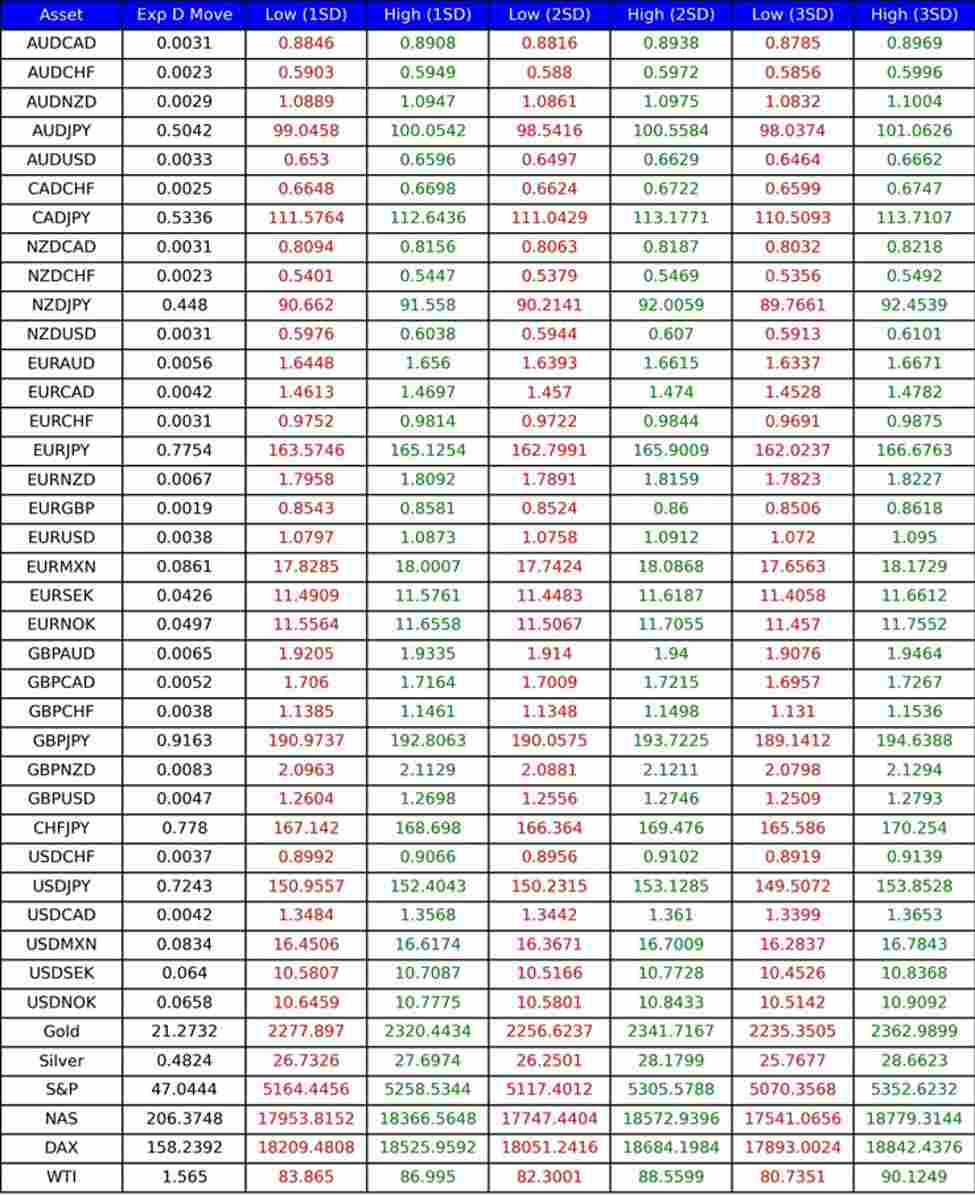

Below is a list of the implied volatility daily ranges for

various assets.

These levels are based on 1-month implied volatility and can

be used as dynamic and market-based levels of support and resistance.

Implied volatility suggests that if prices were normally

distributed, there’s approximately:

- A

68.2% chance that future price movements will stay within 1 standard

deviation of the mean. - A

95.4% chance that they’ll stay within 2 standard deviations. - And

a 99.6% chance that they’ll stay within 3 standard deviations.

But keep in mind that these probabilities are based on the

assumption of a normal distribution, which doesn’t always happen.

However, it gives us a clear indication of what the market

expects in terms of price swings.

Implied volatility is an annualized figure, but we can

convert it to a daily range like the ones we see below.

These levels on their own are quite handy, but when we

combine them with technical analysis tools like pivot points, or fibs, or

psychological levels, you can identify potential entry, take profit, or

stop-loss levels with more increased confidence.

What’s unique about using implied volatility is that it

provides a totally objective and data-dependent price range to complement your

subjective technical analysis

Implied volatility levels for today (4 April 2024)

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading