Dollar retreated mildly following comments from two FOMC members, including a known hawkish figure, reiterating expectations for three interest rate cuts within the year. Despite this, the retreat remains subdued as there is no guarantee yet for a June cut. Fed’s approach continues to be heavily influenced by incoming data. The greenback’s next move will hinge on today’s ISM Services data, as well as Friday’s Non-Farm Payrolls.

Euro is trading as the day’s stronger currency, with anticipation building ahead of Eurozone CPI flash release. Market expectations suggest a slight moderation in both headline and core CPI to 2.5% and 3.0%, respectively, for March. Unless faced with significant downside surprises,ECB is poised to begin its interest rate cuts in June rather than April.

In terms of weekly performance, Australian Dollar leads as the strongest currency, followed by Dollar and New Zealand Dollar. Swiss Franc finds itself as the weakest, with Sterling and Canadian Dollar also underperforming. Euro and Yen are situated mid-pack.

Technically, Gold’s record run continues today overbought conditions. 100% projection of 1614.60 to 2062.95 from 1810.26 at 2258.61 is considered clear. Gold should now be on march towards 161.8% projection at 2535.69, or simply put 2500 handle. In any case, near term outlook will stay bullish as long as 2156.88 support holds.

In Asia, at the time of writing, Nikkei is down -0.66%. Hong Kong HSI is down -0.90%. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.66%. Japan 10-year JGB yield is up 0.0153 at 0.768. Overnight, DOW fell -1.00%. S&P 500 fell -0.72%. NASDAQ fell -0.95%. 10-year yield rose 0.036 to 4.365.

Fed’s Mester views three rate cuts as appropriate, yet decision tightly contested

Cleveland Fed President Loretta Mester said overnight that three rate cuts might be appropriate this year, though she mentioned, “it’s a close call” on the possibility of fewer reductions being needed.

Addressing the upcoming meeting scheduled for April 30-May 1, Mester expressed that it is unlikely there will be sufficient information available to make a decision on reducing rates by then. However, she left the door open for a rate cut in June, stating, “We have to be data dependent so I don’t want to rule that out.”

Mester highlighted the importance of upcoming data to gauge whether the disinflation process is merely experiencing a “temporary detour” or if there are signs that efforts to bring inflation back down to the 2% target are faltering.

She cautioned against premature or overly rapid rate reductions, warning that such actions could jeopardize the progress made on inflation control. “Moving rates down too soon or too quickly without sufficient evidence to give us confidence that inflation is on a sustainable and timely path back to 2% would risk undoing the progress we have made on inflation,” Mester remarked.

Fed’s Daly: Three rate cuts very reasonable, but not guaranteed

San Francisco Fed President Mary Daly offered described three rate cuts this year as a “very reasonable baseline.” However, she was careful to clarify that such a projection should not be interpreted as a commitment, stating, “not a promise.”

Daly highlighted the current state of economic growth as a factor tempering the immediacy for policy adjustments, noting, “Growth is going strong, so there’s really no urgency to adjust the rate.”

Furthermore, Daly voiced concerns over the risks associated with prematurely lowering interest rates. She warned of the “real risk” that too early a cut could entrench the “toxic tax” of persistently high inflation.

Japan’s PMI services finalized at 54.1, marked increase in cost burdens

Japan’s PMI Services was finalized at 54.1 in March, a notable improvement from February’s 52.9 and marking the most significant growth for the past seven months. PMI Composite also rose to 51.7 from the previous month’s 50.6.

Usamah Bhatti, economist at S&P Global Market Intelligence, noted that near-term outlook for the service sector appears “robust”, as outstanding business, a key indicator of future work, continues to rise at “near-record rates”. Confidence regarding the 12-month future also remains strong among service providers.

However, the sector is not without its challenges, particularly on the price front. Businesses signaled “another marked increase in cost burdens,” underlining ongoing inflationary pressures. These pressures are mirrored in the broader Japanese private sector, where cost inflation has hit a “five-month high”.

Bhatti added that inflationary pressures, alongside BoJ’s recent shift away from negative interest rates, “will likely remain a downside risk to the Japanese private sector economy in the coming months.”

China’s Caixin PMI services edges up to 52.7, matches expectations

China’s Caixin PMI Services edged up slightly from 52.5 to 52.7 in March, matched expectations. PMI Composite, which tracks both manufacturing and service sectors, also increased from 52.5 to 52.7, indicating the most pronounced expansion of overall business activity since May 2023.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted the favorable economic performance in the early months of the year and the manufacturing sector’s five-month run in expansionary territory. He stated, “This indicates a generally stable and positive economic recovery”.

Despite these optimistic signs, the economist pointed out several challenges facing the Chinese economy. Wang Zhe identified persistent downward economic pressures, subdued employment levels, low prices, and insufficient effective demand as critical issues that have yet to be fully addressed.

Looking ahead

Eurozone CPI flash is the main feature in European session. US ADP employment and ISM services will take center stage in US session.

EUR/USD Daily Outlook

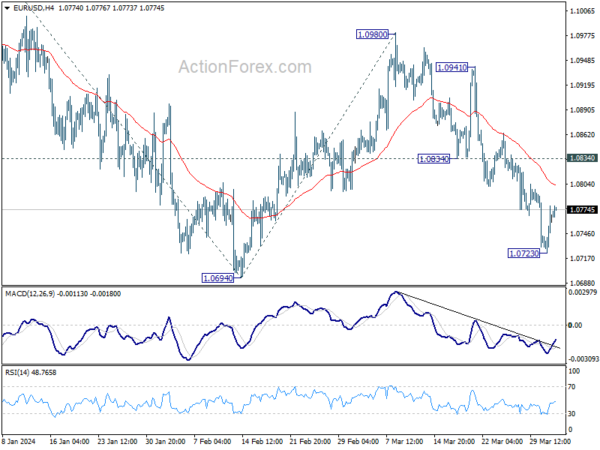

Daily Pivots: (S1) 1.0736; (P) 1.0758; (R1) 1.0790; More…

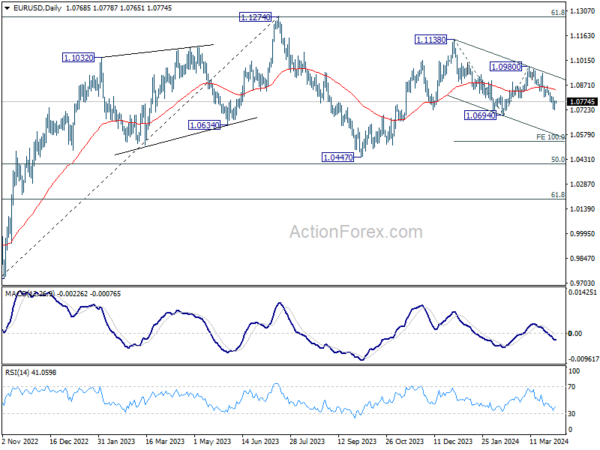

Intraday bias in EUR/USD is turned neutral with current recovery and some consolidation would be seen first. But risk will stay on the downside as long as 1.0834 support turned resistance holds, in case of recovery. Below 1.0723 will bring retest of 1.0694 support first. Decisive break there will resume the whole decline from 1.1138 and target 100% projection of 1.1138 to 1.0694 from 1.0980 at 1.0536.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Services PMI Mar F | 54.1 | 54.9 | 54.9 | |

| 01:45 | CNY | Caixin Services PMI Mar | 52.7 | 52.7 | 52.5 | |

| 08:00 | EUR | Italy Unemployment Feb | 7.20% | 7.20% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Mar P | 2.50% | 2.60% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar P | 3.00% | 3.10% | ||

| 12:15 | USD | ADP Employment Change Mar | 150K | 140K | ||

| 13:45 | USD | Services PMI Mar F | 51.7 | 51.7 | ||

| 14:00 | USD | ISM Services PMI Mar | 52.8 | 52.6 | ||

| 14:30 | USD | Crude Oil Inventories | -0.3M | 3.2M |