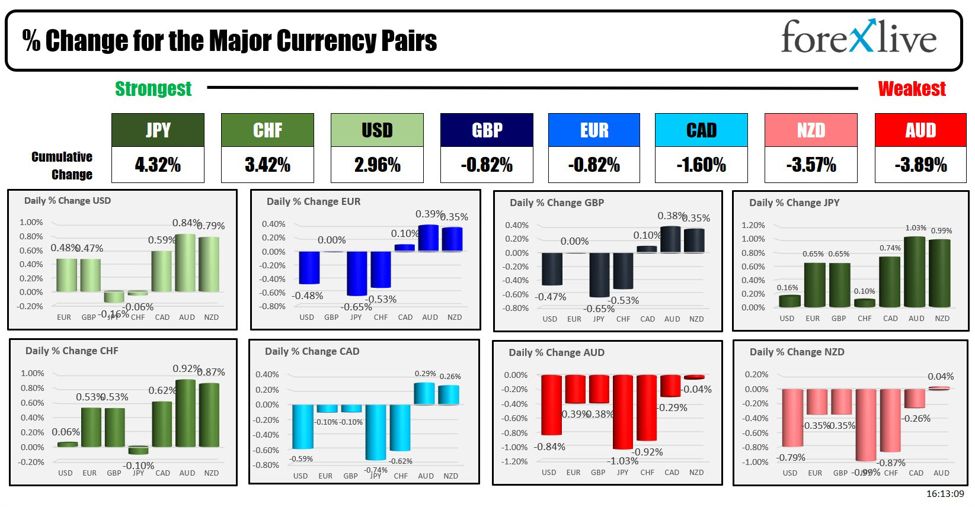

The USD is ending the day mostly higher with gains vs all the major currencies with the exception of the JPY and CHF (-0.16% and -0.06 respectively).

The strongest to the weakest of the major currencies

The greenback rose the most vs the AUD (+0.84%), NZD (+0.79%) and CAD (+0.59%). Solid gains on the day (near 0.50%) were made vs the EUR and the GBP as well.

For the trading week, the USD moved higher vs ALL the major currencies. Below is those gains:

- EUR: +0.72%

- JPY: +1.59%

- GBP: +1.03%

- CHF: +1.46%

- CAD: +0.50%

- AUD: +0.71%

- NZD: +1.52%

The gains in the greenback came despite declines in US yields this week indicative of either an oversold USD, an overbought condition in foreign currencies or simply a head-scratching move. It may also be a fundamental feeling that the US economy is stronger than the others. Fundamentally, the SNB did cut rates by surprise, but the BOJ raised rates for the first time in 17 years.

The RBA and BOE kept rates unchanged this week as did the Fed. The Fed did keep the dot plot at 3 cuts in 2024, BUT it did raise GDP estimates, and lowered the end of year unemployment rate.

- 2-year yield -13.7 basis points

- 5-year yield -14.0 basis points

- 10-year yield -10.6 basis points

- 30-year yield -5.0 basis points

For the trading day, yields moved lower despite the dollar rise.

- 2-year yield 4.595%, -3.6 basis points

- 5-year yield 4.191%, -6.2 basis points

- 10-year yield 4.204%, -6.7 basis points

- 30-year yield 4.381%, -6.1 basis points

US stocks today were mixed with the Dow and the S&P closing lower for the day, but still higher for the week. The Nasdaq closed at a new record high today

- Dow fell -0.77%, but was up 1.97% for the week

- S&P fell -0.14%, but was up 2.29% for the week (largest gains since December)

- Nasdaq rose 0.16%, and was up 2.85% (largest gain since 2nd week in January)

Next week, Friday is a holiday in Australian, New Zealand, and Europe for Good Friday. Core PCE will be released on Friday in the US. Fed’s Powell will also speak on Friday, giving him a chance to comment on the Fed’s favored inflation gauge.

Australia CPI will be released on Wednesday (Tuesday night in the US). Advance US durable goods will be released on Tuesday at 8:30 AM ET.

In other markets at week end:

- Crude oil is trading down $0.20 on the day. For the week, the price fell -$0.21 or -0.17%

- Gold rose $9.97 or 0.45%

- Silver fell -$0.50 or -2.03%

- Bitcoin fell -$4869 or -7.1% on the week.

Thank you for your support this week. Have a great weekend.