Japanese Yen rebounds broadly today, likely driven by traders taking profits on short positions after a significant week of sell-off following BoJ’s rate hike. This stabilization comes amidst speculations stirred by Japan’s latest inflation data, raising the prospect of a second hike by BoJ in the second half of the year. Nevertheless, such predictions seem premature at this juncture. Additionally, the decline in benchmark yields from Germany and the UK has provided some support to Yen.

Meanwhile, Dollar is trading as the second strongest currency for the day, albeit with signs of losing momentum as the week draws to a close. This slight pullback could be attributed to profit-taking activities as well. In contrast, Australian Dollar and New Zealand Dollar are facing downward pressure, trading up as the day’s underperformers. Both currencies face additional pressure due to the sharp decline in Chinese Yuan, which hit a four-month low. European majors present a mixed picture, with Sterling notably underperforming compared to its counterparts.

In Europe, at the time of writing, FTSE is up 0.46%. DAX is up 0.07%. CAC is down -044%. UK 10-year yield is down -0.075 at 4.039. Germany 10-year yield is down -0.067 at 2.344. Earlier in Asia, Nikkei rose 0.18%> Hong Kong HSI fell -2.16%. China Shanghai SSE rose 0.26%. Singapore Strait Times fell -0.07%. Japan 10-year JGB yield rose 0.0037 to 0.744.

Canada’s retail sales falls -0.3% mom in Jan, led by motor vehicle and parts dealers

Canada’s retail value fell -0.3% mom to CAD 67.0B in January, smaller than expectation of -0.4% mom decline. Sales were down in three of nine subsectors and were led by decreases at motor vehicle and parts dealers (-2.4% mom)

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were up 0.4% mom.

In volume terms, retail sales increased 0.2% mom.

Advance estimate suggests that sales increased 0.1% mom in February.

ECB’s Nagel: June cut increasingly likely, but no automatism afterwards

In a webcast today, ECB Governing Council member Joachim Nagel indicated that the chance is increasing for a first rate cut “before the summer break” in August. However, he cautioned that afterwards, ECB will maintain a data-dependent approach and policy loosening wouldn’t be on autopilot. “I do not see that there is a kind of automatism,” he remarked. “It is data dependent and it is not a done deal that everything is going smoothly for the rest of the year or maybe for next year. So we have to be vigilant, we have to be cautious.”

The ECB official flagged several “open issues” that warrant cautions, including the volatility in energy prices and the ongoing uncertainties surrounding wage growth and profit margins. “This meeting-to-meeting approach is the best way to address the current situation,” he added.

German Ifo business climate rises to 87.8, glimpses light on the horizon

Germany’s Ifo Business Climate Index rose to 87.8 in March, from the previous 85.7, surpassing anticipated 86.2. This uplift is mirrored in both Current Assessment Index, which advanced from 86.9 to 88.1 against expectations of 86.8. Expectations Index, which climbed from 84.1 to 87.5, outstripping the forecasted 84.7.

A closer look at sector-specific changes reveals significant variances: Manufacturing sector saw a substantial leap from -17.1 to -10.0. Services sector marked a positive turn, moving from -4.0 to 0.3. Meanwhile, the trade sector saw an improvement as its index rose from -30.8 to -22.9. However, the construction sector observed a slight decrease from -35.4 to -33.5,.

Ifo President Clemens Fuest encapsulated the sentiment by stating, “The German economy glimpses light on the horizon,” highlighting a renewed sense of optimism among businesses.

UK retail sales volumes flat in Feb, sales value down -0.1% mom

In February 2024, UK’s retail sales volumes remained unchanged month-over-month, a performance that’s better than expectation of -0.3% mom decline. Meanwhile, sales value slightly dipped by a -0.1% mom.

A broader examination reveals -0.4% decline in sales volumes over the three months leading up to February, compared to the preceding three-month period. Additionally, a year-over-year comparison with the three months to February 2023 shows -1.0% decrease.

Japan CPI core rises to 2.8% in Feb, above BoJ’s target for 23rd month

Japan’s CPI core (ex-fresh food) rises from 2.0% yoy to 2.8% yoy in February, matched expectations. This increase marks the first acceleration in four months and maintains the index above BoJ’s 2% target for the 23rd consecutive month.

The uptick in the core CPI was primarily due to a less pronounced decline in energy prices, reflecting diminishing impact of government subsidies introduced to mitigate energy costs. Specifically, energy prices saw a decrease of -1.7% yoy, a significant moderation from -12.1% yoy drop recorded in January.

The overall headline CPI also showed an uptick, accelerating from 2.2% yoy to 2.8%yoy. However, when examining CPI core-core, which excludes both food and energy, there was a slight slowdown from 3.5% yoy to 3.2% yoy.

New Zealand’s goods exports rises 16% yoy in Feb, imports up 3.3% yoy

In February, New Zealand’s goods exports leaped by 16% yoy to NZD 5.9B. This surge contrasts with a more modest 3.3% yoy increase in goods imports, totaling NZD 6.1B. Consequently, monthly trade deficit narrowed significantly to NZD -218m, far exceeding market expectations of a shortfall of NZD -825m.

Exports to China, New Zealand’s largest trading partner, increased by 10% yoy, contributing an additional NZD 154m. US saw a remarkable 52% yoy jump in exports, adding NZD 305m, while EU and Australia also recorded increases in New Zealand exports by 7.9% yoy and 5.9% yoy, respectively. However, trade with Japan contracted, with exports declining by -10% yoy.

On the import front, China and South Korea marked significant increases of 7.1% yoy and 42% yoy, respectively, indicating robust demand for goods from these economies. Conversely, imports from US and EU saw downturns, declining by 20% yoy and 7% yoy.

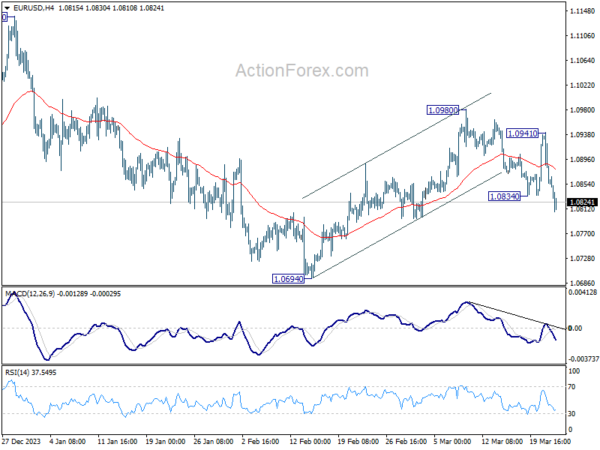

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0830; (P) 1.0886; (R1) 1.0917; More…

Intraday bias in EUR/USD remains on the downside at this point. Current development argues that corrective recovery from 1.0694 has completed at 1.0980 already. Deeper fall is expected to retest 1.0694 next. For now, risk will stay on the downside as long as 1.0941 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (MZD) Feb | -218M | -825M | -976M | -1089M |

| 23:30 | JPY | National CPI Y/Y Feb | 2.80% | 2.20% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Feb | 2.80% | 2.80% | 2.00% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Feb | 3.20% | 3.50% | ||

| 00:01 | GBP | GfK Consumer Confidence Mar | -21 | -20 | -21 | |

| 07:00 | GBP | Retail Sales M/M Feb | 0.00% | -0.30% | 3.40% | 3.60% |

| 09:00 | EUR | Germany IFO Business Climate Mar | 87.8 | 86.2 | 85.5 | 85.7 |

| 09:00 | EUR | Germany IFO Current Assessment Mar | 88.1 | 86.8 | 86.9 | |

| 09:00 | EUR | Germany IFO Expectations Mar | 87.5 | 84.7 | 84.1 | |

| 12:30 | CAD | Retail Sales M/M Jan | -0.30% | -0.40% | 0.90% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Jan | 0.50% | -0.50% | 0.60% |