Japanese Yen’s decline intensified today and it’s on the verge of breaking to new historical low against the greenback. Japan’s stock markets are on holiday today, but the strong rally in Nikkei yesterday, which surged 40k psychological mark again, was significant. The robust risk-on sentiment within Japan and its weakening currency are clearly reinforcing each other.

BoJ’s rate hike yesterday, while historic in setting the stage for a new monetary era, does not herald the beginning of a tightening cycle, not yet. The yield gap between Japan and other major economies is set to remain significant, even with anticipated policy loosening by Fed, ECB and other major central banks this year. The escalating Yen selloff raises questions about reactions from Japanese officials, including the likelihood of verbal or direct market interventions to stabilize the currency.

Meanwhile, Dollar maintains its position as the strongest currency of the week, with all eyes now on Fed’s upcoming rate decision and economic projections. The key query is whether Fed will project three rate cuts for this year or lower the forecast to two. Sterling stands as the second strongest, awaiting the release of UK’s CPI data, with Euro not far behind in third place.

Conversely, Kiwi trails as the week’s second weakest currency after Yen, influenced by bets on an earlier rate cut by RBNZ following economic warnings from the Finance Minister last week. Swiss Franc, though currently the third weakest, faces downside risks, especially if SNB signals a rate cut in the second quarter or even surprises markets with a cut at its upcoming meeting.

Technically, NZD/USD’s breach of 0.6037 indicates that fall from 0.6368 is resuming. Next target is 61.8% projection of 0.6368 to 0.6037 from 0.6125 at 0.6010. Firm break there could prompt downside acceleration to 100% projection at 0.5884 next. In any case, outlook will stay bearish as long as 55 D EMA (now at 0.6124 holds).

In Asia, at the time of writing, Hong Kong HSI is up 0.15%. China Shanghai SSE is up 0.45%. Singapore Strait Times is up 0.25%. Japan is on holiday. Overnight, DOW rose 0.83%. S&P 500 rose 0.56%. NASDAQ rose 0.39%. 10-year yield fell -0.043 to 4.297.

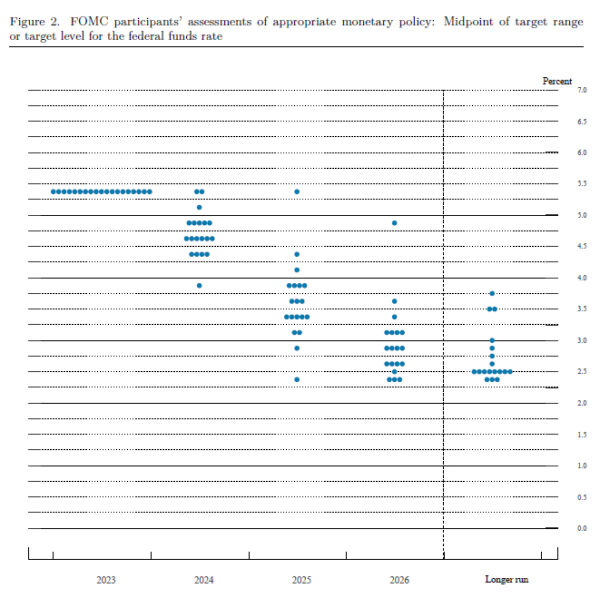

Fed’s dot plot: Three or just two rate cuts this year?

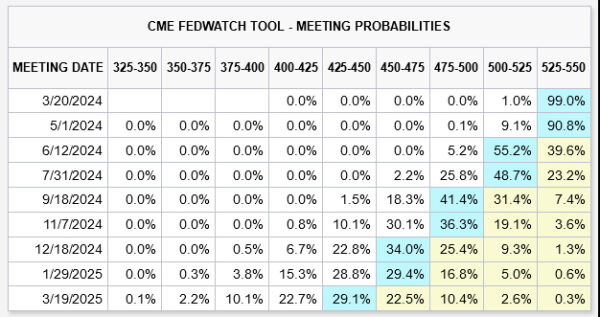

Fed is widely expected to hold interest rates steady at the current range of 5.25-5.50% today. The focal point of today’s announcement, however, lies beyond the immediate rate decision; all eyes are on Fed’s updated economic projections and dot plot for insights into the path of monetary easing this year.

The crux of the matter hinges on whether Fed’s new projections will continue to forecast three rate cuts within the year, and thus making June the likely month to commence.

Alternatively, amidst recent data revealing the stubborn persistence of inflation, Fed might adjust its outlook to envision just two cuts for the year, which would likely postpone the initial reduction to the third quarter.

The December dot plot presented a 8-11 split among Fed members, with 8 anticipating the federal funds rate to exceed 4.75% by year-end, while 11 predicted it would fall below this mark. A subtle but pivotal shift of just two dots would sway the balance to 10-9, leaning towards the scenario of only two rate cuts.

Market expectations, as reflected in Fed fund futures, currently assign slightly over 60% probability to a June rate cut. By December’s end, there’s a 64% likelihood of the federal funds rate adjusting down to 4.50-4.75%.

10-year yield retreated mildly overnight to close at 4.297, but there is no clear sign of topping yet. A hawkish FOMC result today, signalling fewer rate cut this year, could give TNX another push through 4.354 resistance, and thus pulling Dollar higher along. Yet, strong resistance is expected between 4.391 and 4.534 (50% and 61.8% retracement of 4.997 to 3.785) to limit upside, to complete the corrective rebound from 3.785.

New Zealand Westpac consumer confidence rises to 93.2 in Q1, yet pessimism lingers

New Zealand Westpac Consumer Confidence rose from 88.9 to 93.2 in Q1, marking its highest level in over two years. Despite this rise, the index continues to hover below the pivotal 100 mark, indicating prevailing sense of pessimism among New Zealanders regarding economic conditions. Present Conditions Index saw significant uplift from 77.1 to 85.1, while Expected Conditions Index advanced modestly from 96.7 to 98.6.

Westpac’s analysis highlights that households are gradually feeling more optimistic about their financial situations, which has subsequently spurred an increase in “spending appetites”. This positive shift in consumer sentiment is observed across all income brackets, with “middle-income households exhibiting” the most marked improvement.

Looking ahead

UK CPI and PPI are the main focuses in European session, while Eurozone consumer confidence will also be featured. Later in the day, BoC will release summary of deliberations before FOMC rate decision and press conference.

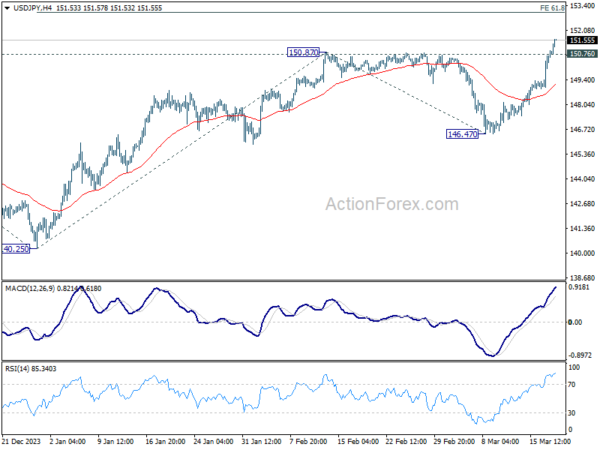

USD/JPY Daily Outlook

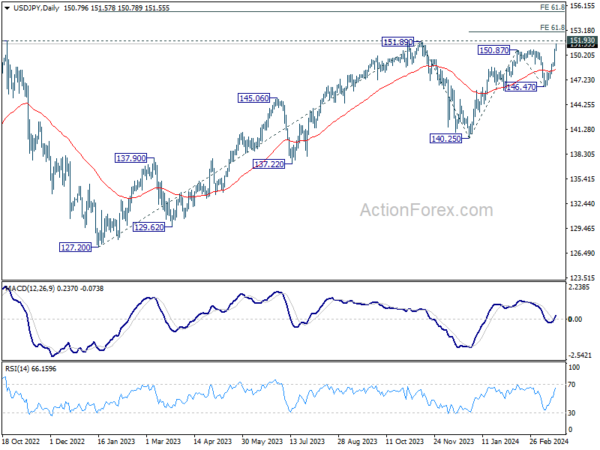

Daily Pivots: (S1) 149.58; (P) 150.27; (R1) 151.55; More…

USD/JPY surges past 150.87 resistance to resume the rally from 140.25. Intraday bias stays on the upside for next key resistance at 151.93. Decisive break there will confirm long term up trend resumption. Next near term target will be 61.8% projection of 140.25 to 150.87 from 146.47 at 153.03. On the downside, below 150.76 minor support will turn intraday bias neutral and bring consolidations first. But outlook will stay bullish as long as 55 4H EMA (now at 149.09) holds.

In the bigger picture, correction from 151.87 (2023) high could have completed at 140.25 already. Rise from 127.20 (2023 low), as part of the long term up trend, is probably ready to resume. Decisive break of 151.93 resistance (2022 high) will confirm this bullish case. Next medium term target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. This will remain the favored case as long as 146.47 support holds, in case of another pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Survey Q1 | 93.2 | 88.9 | ||

| 21:45 | NZD | Current Account (NZD) Q4 | -7.84B | -7.80B | -11.47B | -10.97B |

| 07:00 | EUR | Germany PPI M/M Feb | -0.20% | 0.20% | ||

| 07:00 | EUR | Germany PPI Y/Y Feb | -3.80% | -4.40% | ||

| 07:00 | GBP | CPI M/M Feb | 0.70% | -0.60% | ||

| 07:00 | GBP | CPI Y/Y Feb | 3.50% | 4.00% | ||

| 07:00 | GBP | Core CPI Y/Y Feb | 4.60% | 5.10% | ||

| 07:00 | GBP | RPI M/M Feb | 0.80% | -0.30% | ||

| 07:00 | GBP | RPI Y/Y Feb | 4.50% | 4.90% | ||

| 07:00 | GBP | PPI Input M/M Feb | 0.20% | -0.80% | ||

| 07:00 | GBP | PPI Input Y/Y Feb | -2.70% | -3.30% | ||

| 07:00 | GBP | PPI Output M/M Feb | 0.10% | -0.20% | ||

| 07:00 | GBP | PPI Output Y/Y Feb | -0.10% | -0.60% | ||

| 07:00 | GBP | PPI Core Output Y/Y Feb | -0.40% | |||

| 07:00 | GBP | PPI Core Output M/M Feb | 0.20% | |||

| 09:00 | EUR | Italy Industrial Output M/M Jan | 0.10% | 1.10% | ||

| 14:30 | USD | Crude Oil Inventories | -0.9M | -1.5M | ||

| 15:00 | EUR | Eurozone Consumer Confidence Mar P | -15 | -16 | ||

| 17:30 | CAD | BoC Summary of Deliberations | ||||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |