Yen softened slightly in Asian session today, influenced by a robust rebound in strong rebound in Nikkei. Meanwhile, New Zealand Dollar received a modest boost, buoyed by an upturn in the country’s services data. This was mirrored by the Australian Dollar, which, along with the Kiwi, found support in the latest batch of Chinese economic indicators. These revealed an encouraging improvement in China’s industrial sector as the year commenced, painting a brighter outlook for the region. However, movements across these currencies, as well as the broader forex markets, remain subdued at the moment.

The atmosphere of caution among traders is palpable, as the financial markets gear up for a week laden with five major central bank meetings and a slew of critical global economic data covering inflation, activity, sentiment, retail sales, and employment. BoJ is set to start this central bank bonanza on Tuesday, with RBA following suit. FOMC will then take center stage on Wednesday, with SNB and BoE concluding the week’s meetings on Thursday. Each of these gatherings carries some surprise elements that could significantly impact the markets.

Technically, Gold should have formed a short term top at 2194.84, and more consolidation should be seen in the near term. There is prospect of deeper pull back, in particular if Dollar strengthens after FOMC. But downside should be contained by 2088.24 resistance turned support to bring up trend resumption.

The impending global monetary easing this year and next, coupled with escalating geopolitical risks, presents a favorable backdrop for Gold. The precious metal should target cluster projection level around 2260 before topping (100% projection of 1810.26 to 2088.24 from 1984.05 at 2262.03 and 100% projection of 1614.60 to 2062.95 from 1810.26 at 2259.15).

In Asia, at the time of writing, Nikkei is up 2.37%. Hong Kong HSI is up 0.11%. China Shanghai SSE is up 0.52%. Singapore Strait Times is flat. Japan 10-year JGB yield is down -0.026 at 0.767.

NZ BNZ services rises to 53.0, signs of early and strong growth emerge

New Zealand’s BusinessNZ Performance of Services Index climbed from 52.2 to 53.0 in February, marking its highest point since March 2023.

A closer examination of the index’s components reveals a generally positive picture. Activity and sales maintained steady pace, inching slightly up from 53.0 to 53.1. Employment saw modest increase, moving closer to the expansionary threshold by rising from 48.3 to 49.1. Notably, new orders and business surged significantly from 52.4 to 56.0, the highest level recorded since December 2022.

The feedback from businesses highlighted persistent concerns, with the proportion of negative comments standing at 57.3% in February, a slight improvement from December’s 58.7% but an increase from January’s 53.0%. Businesses continue to identify the cost of living as the primary factor influencing activity, alongside the difficulties posed by the overall economic conditions.

BNZ’s Head of Research Stephen Toplis said that “when we combine the PMI and PSI together to get an indicator of activity, there is a strong suggestion of growth returning later this year. The turnaround occurs a little stronger and earlier than we are forecasting but, whatever the case, it is a heartening sign”.

China’s industrial production expand 7% yoy, retail sales up 5.5% yoy

China’s industrial production grew 7.0% yoy in the January-February period , above expectation of 5.3% yoy. During the same period, retail sales rose 5.5% yoy, below expectation 5.6% yoy.

Fixed asset investment rose 4.2% yoy, above expectation of 3.2% yoy. Investment into real estate fell by -9% yoy. Investment in infrastructure rose by 6.3% yoy while that in manufacturing increased by 9.4% yoy.

“The economy kept rebounding and improving in January and February with various policies taking effect. But we also need to see that the external environment is increasingly complex, grim and uncertain, and the problem of insufficient domestic demand still remains. The foundation for the economy’s rebound needs to be further solidified,” NBS said.

Five central bank decisions and economic data galore

The upcoming week promises to be a whirlwind for financial markets worldwide, one of the most anticipated periods in the financial calendar for the year, packed with five major central bank meetings and a deluge of significant economic data releases globally.

Central bank marathon: Key things to watch

BoJ kicks off this central bank marathon on Tuesday, with market participants keenly awaiting its decision on whether to exit its negative interest rate policy. This follows encouraging results from recent wage negotiations in Japan. Yet, the central bank could also opt for a delay to act in April. On the same day, RBA is expected to hold its interest rate steady at 4.35%, and focus is on whether the central bank would finally drop hawkish bias.

The spotlight then shifts to FOMC meeting on Wednesday. While interest rates are anticipated to remain at 5.25-5.50%, all eyes will be on Fed’s new economic projections. The key question is whether the updated dot plot will still signal three rate hikes for the year, especially in light of recent data that underscore the persistent nature of inflation, or less.

Thursday sees decisions from both SNB and BoE. Expectations for SNB lean towards holding rates at 1.75%, though there’s a notable minority predicting a rate cut — the first among major central banks. Additionally, SNB’s commentary on Franc’s strength, a growing concern for the Swiss economy, will be closely scrutinized.

BoE, on the other hand, is expected to maintain interest rates at 5.25%, reiterate that it’s in no hurry to cut interest rates. The outcome of the vote split, given the diverse opinions among BoE members, will be particularly telling. Last time, Jonathan Haskel and Catherine Mann voted for a 25 bps hike while Swati Dhingra voted for a cut, with others voted for a hold.

Beyond these decisions, BoC is slated to release summary of deliberations. ECB will also contribute to the week’s insights by publishing monthly economic bulletin.

Economic data deluge

On the data front, PMIs from Australia, Japan, Eurozone, UK, and US are set to be released, offering a snapshot of business conditions, price pressures and employment situation. CPI figures from Japan, UK, and Canada will be closely watched, as will sentiment indicators from Germany (ZEW and Ifo). Retail sales data from UK and Canada, Australian employment, New Zealand’s GDP, and a suite of data from China, including industrial production, retail sales, and fixed asset investment, will round out a week rich in potential market-moving information.

Here are some highlights for the week:

- Monday: New Zealand BNZ services; Japan machine orders; China industrial production, retail sales, fixed asset investment; Eurozone CPI final, trade balance; Canada IPPI, RMPI; US NAHB housing index.

- Tuesday: BoJ rate decision; RBA rate decision; Swiss Trade balance, SECO economic forecasts; Germany ZEW; Canada CPI; US building permits and housing starts.

- Wednesday: Germany PPI; UK CPI, PPI; Eurozone consumer confidence; BoC summary of deliberations; FOMC rate decisions.

- Thursday: New Zealand GDP; Australia PMIs, employment: Japan trade balance, PMIs; Eurozone PMIs, ECB monthly bulletin; SNB rate decision; UK PMIs, BoE rate decision; Canada new housing price index; US jobless claims, Philly Fed survey, PMIs, existing home sales.

- Friday: New Zealand trade balance; UK Gfk consumer sentiment, retail sales; Germany import price, Ifo Canada retail sales.

AUD/USD Daily Report

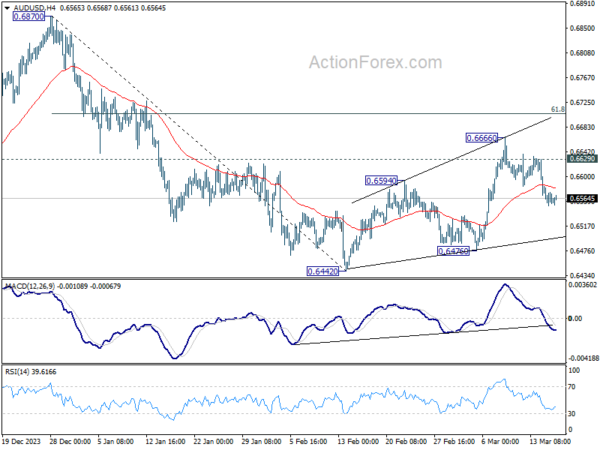

Daily Pivots: (S1) 0.6546; (P) 0.6566; (R1) 0.6579; More…

Intraday bias in AUD/USD stays on the downside as fall from 0.6666 short term top is in progress. Deeper decline would be seen to 0.6476 support first. Break there will argue that decline from 0.6870 is ready to resume through 0.6442 low. On the upside, break of 0.6629 minor resistance will turn bias back to the upside to extend the rebound from 0.6442 instead.

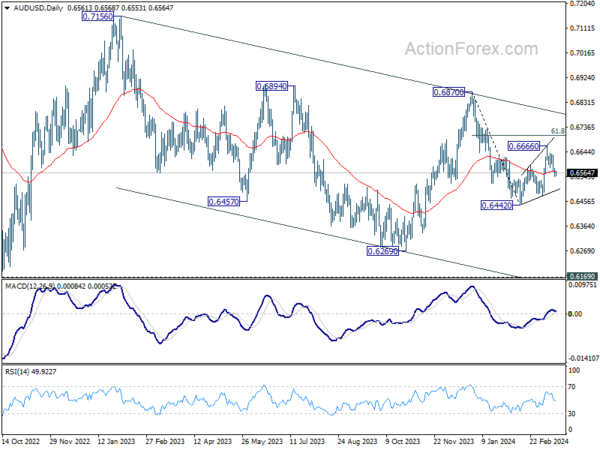

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Feb | 53 | 52.1 | 52.2 | |

| 23:50 | JPY | Machinery Orders M/M Jan | -1.70% | -0.70% | 2.70% | |

| 02:00 | CNY | Industrial Production Y/Y Feb | 7.00% | 5.30% | 6.80% | |

| 02:00 | CNY | Retail Sales Y/Y Feb | 5.50% | 5.60% | 7.40% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Feb | 4.20% | 3.20% | 3.00% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Jan | 14.2B | 13.0B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 2.60% | 2.60% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 3.10% | 3.10% | ||

| 12:30 | CAD | Industrial Product Price M/M Feb | 0.00% | -0.10% | ||

| 12:30 | CAD | Raw Material Price Index Feb | 0.80% | 1.20% | ||

| 14:00 | USD | NAHB Housing Index Mar | 48 | 48 |