UPCOMING EVENTS:

- Tuesday: Japan

PPI, UK Labour Market report, US NFIB Small Business Optimism Index, US

CPI. - Wednesday: UK GDP,

UK Industrial Production, Eurozone Industrial Production. - Thursday: US

PPI, US Retail Sales, US Jobless Claims, New Zealand Manufacturing PMI. - Friday: US

Industrial Production, US University of Michigan Consumer Sentiment

Survey, PBoC MLF.

Tuesday

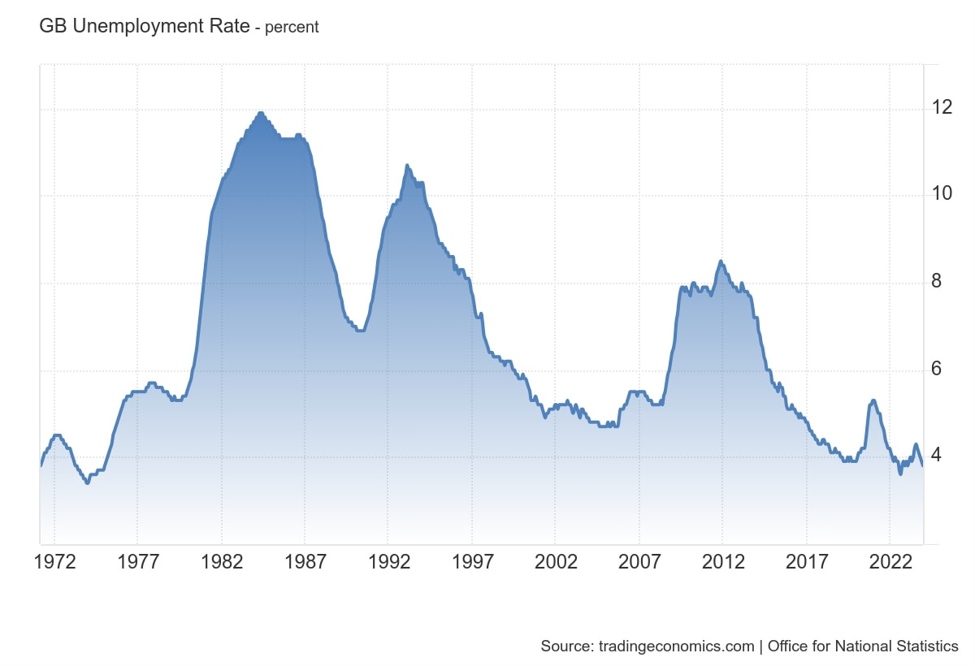

The UK Unemployment Rate is expected to

remain unchanged at 3.8% vs. 3.8% prior.

The Average Earnings Ex-Bonus is expected to tick lower to 5.7% vs. 5.8% prior,

while the Average Earnings including Bonus is seen at 6.2% vs. 6.2% prior. Weak

figures, especially on the wage growth part, should bring expectations for rate

cuts forward, while strong data might not change much for now. The markets

expect the BoE to deliver the first rate cut in August.

UK Unemployment Rate

The US CPI Y/Y is expected at 3.1% vs.

3.1% prior,

while the M/M measure is seen at 0.4% vs. 0.3% prior. The Core CPI Y/Y is

expected at 3.7% vs. 3.9% prior, while the M/M figure is seen at 0.3% vs. 0.4%

prior. This report comes after a series of weak US data, especially on the

labour market side, so (in my opinion) this particular release is likely to be

faded in case of a hawkish reaction to a beat. Conversely, if the data misses,

we should see the market price back in a May rate cut.

US Core CPI YoY

Thursday

The US PPI Y/Y is expected at 1.2% vs.

0.9% prior,

while the M/M measure is seen at 0.3% vs. 0.3% prior. The Core PPI Y/Y is

expected at 2.0% vs. 2.0% prior, while the M/M figure is seen at 0.2% vs. 0.5%

prior. As mentioned for the CPI report, the market might look through a beat in

the data considering the weaker data from the labour market and the ISM PMIs.

US Core PPI YoY

The US Retail Sales M/M is expected at

0.7% vs. -0.8% prior, while the Ex-Autos M/M measure is seen at 0.4% vs. -0.6%

prior. The last

report surprised to the downside across the

board, although some weakness was expected due to negative weather conditions.

Another weak report would add to dovish expectations.

US Retail Sales YoY

The US Jobless Claims continue to be one

of the most important releases every week as it’s a timelier indicator on the

state of the labour market. Initial Claims keep on hovering around cycle lows,

while Continuing Claims remain firm around cycle highs. This week the consensus

sees Initial Claims at 218K vs. 217K prior,

while there’s no consensus for Continuing Claims at the time of writing

although the prior week saw an increase to 1906K vs. 1889K prior.

US Jobless Claims

Friday

The PBoC is expected to keep the MLF rate

unchanged at 2.50%. The central bank recently delivered two bigger than

expected cuts to its RRR

rate and the 5-year LPR

rate. This weekend the Chinese

Inflation data beat expectations across the

board by a big margin with the Headline Y/Y reading jumping to 1.0% and the

Core Y/Y measure to 1.2%. The PBoC might not feel the urgency to cut rates

further at the moment.

PBoC