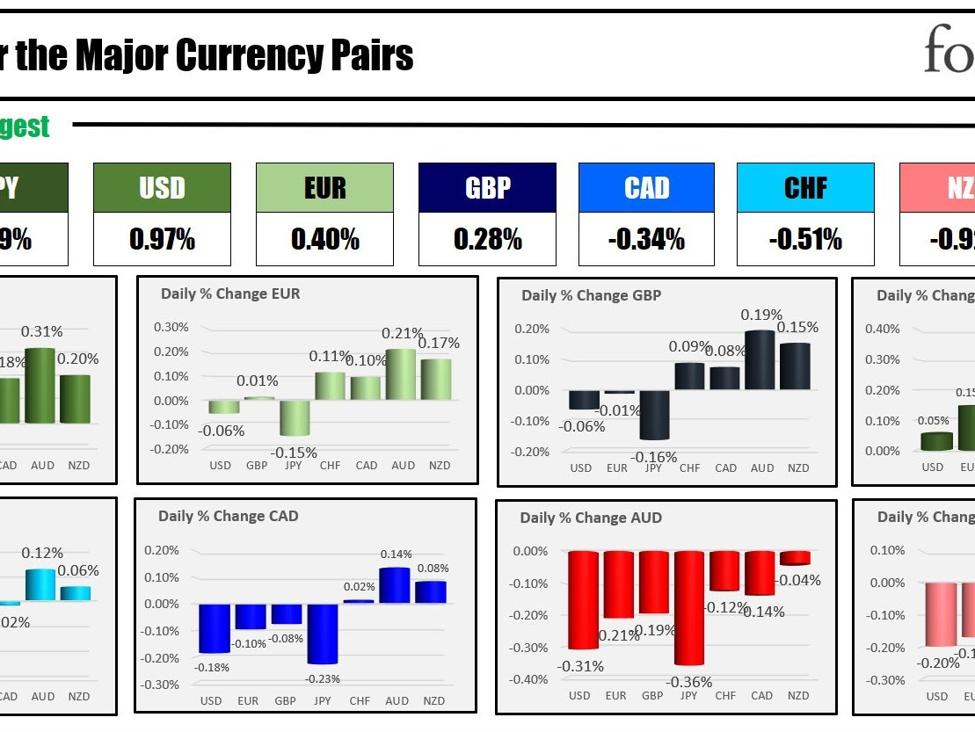

The strongest to the weakest of the major currencies

-

As the North American session begins, the JPY is the strongest and the AUD is the weakest. The USD is mostly higher but with relatively modest gains.

In Europe, PMI services data was released with mixed results. Below are the summary of that data:

- Spanish Services PMI: Actual: 54.7, Forecast: 53.4, Previous: 52.1. BETTER

- Italian Services PMI: Actual: 52.2, Forecast: 52.2, Previous: 51.2. MET expectations

- French Final Services PMI: Actual: 48.4, Forecast: 48.0, Previous: 48.0. BETTER

- German Final Services PMI: Actual: 48.3, Forecast: 48.2, Previous: 48.2. BETTER

- Final Services PMI (Eurozone): Actual: 50.2, Forecast: 50.0, Previous: 50.0. BETTER

- Final Services PMI (UK): Actual: 53.8, Forecast: 54.3, Previous: 54.3. WORSE

-

Overnight, in China, Premier Li Qiang presented the framework for the China economy with an ambitious target for growth of 5%.

-

Growth Target Ambition: China has set an optimistic official growth target of about 5% for the year, despite facing significant economic challenges both domestically and internationally. This target reflects the government’s confidence but is recognized as an uphill task. The target is higher than private economist, the World Banks and IMF estimates which are leaning more toward a 4.5% growth level

-

Government Intervention: To help achieve the ambitious target, the government will conduct an issuance of special treasury bonds worth 1 trillion yuan (about $139 billion) with the proceeds to to stimulate the economy. This rare move, typically reserved for times of crisis, indicates a high level of concern about the current economic conditions especially the turmoil in the property market.

-

Internal Challenges and Policy Decisions: Much of China’s current economic slowdown is attributed to internal challenges and the policy decisions made under Xi Jinping’s leadership. Efforts to address long-term imbalances, push for technological self-sufficiency, and focus on national security and social inequality have prioritized over growth at any cost.

-

Employment and Modernization Goals: Achieving the 5% growth is seen as essential for meeting other economic objectives, such as creating 12 million jobs and advancing Xi Jinping’s broader modernization goals, indicating the interconnectedness of China’s economic targets with its long-term strategic visions.

-

Blueprint for Growth: The emphasis on “new productive forces,” including homegrown technological innovations in high-end manufacturing, artificial intelligence, and biotech, points to a strategic pivot towards enhancing China’s self-reliance in science and technology amid global competition, particularly with the U.S.

-

Property Market Strategy: The absence of the mantra “Houses are for living in, not for speculating on” from the government work report suggests a potential shift in approach to the property crisis, with the state possibly taking a more active role in the property market to stabilize it.

-

Foreign Investment and Market Access: Despite a fall in foreign direct investment, China pledges to lift market-access restrictions in manufacturing and ease barriers in telecommunications and healthcare, aiming to reassure and attract more foreign investment.

IN geopolitical news (for now at least), Hamas negotiators have decided to extend their stay in Cairo for an additional third day to continue their discussions aimed at securing a ceasefire agreement, according to a statement from a Hamas official relayed by newswire services. The talks are part of ongoing efforts to reach a peaceful resolution amid the broader context of tension in the region. Al-Arabiya sources have also reported that despite previous setbacks, the Cairo talks are moving forward with the objective of finalizing a truce. This development comes after earlier reports from Reuters indicated that ceasefire negotiations between Hamas and mediators had hit an impasse on Tuesday in Egypt, with no significant breakthrough as the deadline of Ramadan looms. These discussions are critical, as they represent a continued effort to navigate the complex dynamics and seek a path towards stability and peace in the region

A snapshot of the markets as the North American session begins currently shows:

- Crude oil is trading at down -$0.60 at $78.14. At this time yesterday, the price was at $79.37.

- Gold is trading up $10.11 or 0.48% at $2124.08. At this time yesterday, the price was at $2082.20. The price high today reached $2127.35. The all-time high price reached in early December reached $2146.77.

- Silver is trading up six cents or 0.25% at $23.93. At this time yesterday, the price was at $23.14

- Bitcoin currently trades at $67,340. At this time yesterday, the price was trading at $65,017. The high price today reach $68,850. That high was just $150 short that $69,000 all-time high level

In the premarket, the US stocks, the major indices are trading lower after major indices fell yesterday

- Dow Industrial Average futures are implying a decline of -106 points. Yesterday the index fell -97.55 points or -0.25% at 38989.84

- S&P futures are implying a decline of -17.7 points. Yesterday the index fell -6.13 points or -0.12% at 5130.94.

- Nasdaq futures are implying a loss of -98 points. Yesterday the index fell -67.43 points or -0.41% at 16207.51.

In the European equity markets, the major indices are trading mostly lower:

- German DAX, -0.12%. Last week the index rose 1.81%.

- France CAC -0.09%. Last week the index fell -0.41%.

- UK FTSE 100, -0.01%. Last week the next fell -0.31%.

- Spain’s Ibex, -0.12%. Last week the index fell -0.65%.

- Italy’s FTSE MIB, +0.34% (delayed by 10 minutes).

Shares in the Asian Pacific markets were mixed/lower:

- Japan’s Nikkei 225, -0.03%

- China’s Shanghai composite index, +0.28%

- Hong Kong’s Hang Seng index, -2.61%

- Australia S&P/ASX, -0.15%

Looking at the US debt market, yields are moving higher:

- 2-year yield 4.578%, -2.9 basis points. At this time yesterday, the yield was at 4.558%.

- 5-year yield 4.178% -3.3 basis points. At this time yesterday, the yield was at 4.183%

- 10-year yield 4.185%, -3.3 basis points. At this time yesterday, the yield was at 4.205%

- 30-year yield 4.324% -3.0 basis points. At this time yesterday, the yield was at 4.357%

- The 2-10 year spread is at -39.5 basis points.At this time yesterday, the spread was at -35.3 basis points

- The 2-30 year spread is at -25.6 basis points.At this time yesterday, the spread was at -19.9 basis points

European benchmark 10-year yields are lower to start the trading week:

European 10 year yields are lower