Japanese Yen found modest strength in Asian session today, lifted by stronger than expected consumer inflation data from Japan. At the same time, two-year yield climbed to its highest point since 2011 while Nikkei is steady. The data intensified speculations around BoJ’s move to abandon its negative interest rate policy. Almost all economists are expecting a rate hike in the first half of the year, with April still tagged as the most probable timing. However, the CPI raises the chance of an expedited move in March.

Despite today’s recovery, it’s premature to declare bullish reversal for Yen. BoJ Governor Kazuo Ueda has indicated that, even with the shift away from negative rates, the monetary policy stance will remain accommodative, and any tightening efforts are expected to unfold gradually. Additionally, the prospect of other major central banks, such as Fed, postponing policy easing could maintain a significant yield gap, thereby restraining any potential Yen rally.

In other market developments, Euro is trading as the week’s standout performer for, followed by Swiss Franc and Sterling. New Zealand Dollar finds itself lagging at the bottom, with market participants keenly awaiting RBNZ’s rate decision tomorrow. Australian Dollar, alongside the Dollar, shows weakness, whereas Canadian Dollar and Yen are mixed.

Technically, EUR/USD is now pressing medium term channel resistance after yesterday’s strong rebound. The notable support from 55 D EMA is a near term bullish sign. The overall favored case is that correction from 1.7062 has completed with three waves down to 1.6127. Break of 1.6671 resistance will strengthen this bullish case, and target a retest on 1.7062 high next.

In Asia, at the time of writing, Nikkei is down -0.21%. Hong Kong HSI is down -0.48%. China Shanghai SSE is up 0.55%. Singapore Strait Times is down -0.91%. Japan 10-year JGB yield is up 0.010 at 0.700. Overnight, DOW fell -0.16%. S&P 500 fell -0.38%. NASDAQ fell -0.13%. 10-year yield rose 0.039 to 4.299.

ECB’s Lagarde highlights wage dynamics in inflation outlook

In a speech delivered at the European Parliament overnight, ECB President Christine Lagarde emphasized the significant role of wage pressures. According to Lagarde, wage pressures “remain strong” across the region, anticipated to be an “increasingly important driver of inflation dynamics” in the coming quarters.

This shift towards wage-driven inflation comes as the contribution of profits, previously a significant factor in domestic cost pressures, begins to wane. Importantly, Lagarde pointed out that labor cost increases are being “partly buffered by profits”, preventing a full pass-through to consumer prices.

Lagarde also touched on the risks associated with second-round effects, a concern for economies dealing with inflation. She reassured that ECB’s current restrictive monetary policy, combined with a notable decline in headline inflation and well-anchored longer-term inflation expectations, serves as a “safeguard against a sustained wage-price spiral”.

Looking ahead, Lagarde expects continued deceleration in inflation rates as the effects of previous shocks diminish and tighter financing conditions exert downward pressure.

Fed’s Schmid counsels patience, preemptive policy shifts unnecessary

Kansas City Fed President Jeffrey Schmid emphasized a cautious approach to adjusting Fed’s monetary policy. With inflation persistently above the target, coupled with tight labor markets and strong demand, Schmid argues there is “no need to preemptively adjust the stance of policy.”

His stance highlights a preference for a measured response, suggesting that “the best course of action is to be patient,” a sentiment that underscores the importance of observing the economy’s reaction to the already implemented policy tightening measures. He urged to wait for “convincing evidence that the inflation fight has been won.”

Schmid also addressed the current state of high inflation, indicating that “we are not out of the woods yet.” He pointed out that recent reductions in inflation have primarily resulted from decreases in energy and goods prices, thanks to the rebalancing of oil markets and the healing of supply chains.

Core inflation in Japan eases to 2%, but surpasses expectations

Japan’s CPI core (all items ex food) slowed from 2.3% yoy to 2.0% yoy, above expectation of 1.9% yoy. This marks the third consecutive month of decline, reaching the lowest level in 22 months and aligning precisely with BoJ’s inflation target of 2%.

The headline CPI also saw a decrease, moving from 2.6% to 2.2% yoy. Nevertheless, CPI core-core (ex-food and energy) showed only modest improvement, edging down from 3.7% to 3.5% yoy.

A significant factor contributing to the overall CPI’s decline a -12.1% yoy drop in energy prices, resulting from government interventions to mitigate utility bills through subsidies for oil wholesalers. In contrast, food prices saw 5.9% yoy increase, while accommodation fees surged by 26.9% yoy.

The latest inflation data should fortify the argument for BoJ to terminate its negative interest rate policy soon. However, the decisive factor for the exact timing—be it March or April—hinges on the forthcoming wage negotiations between large enterprises and unions scheduled for March 13.

Looking ahead

Germany Gfk consumer sentiment and Eurozone M3 money supply will be released in European session. Later in the day, US will release durable goods orders, house price index and consumer confidence.

USD/JPY Daily Outlook

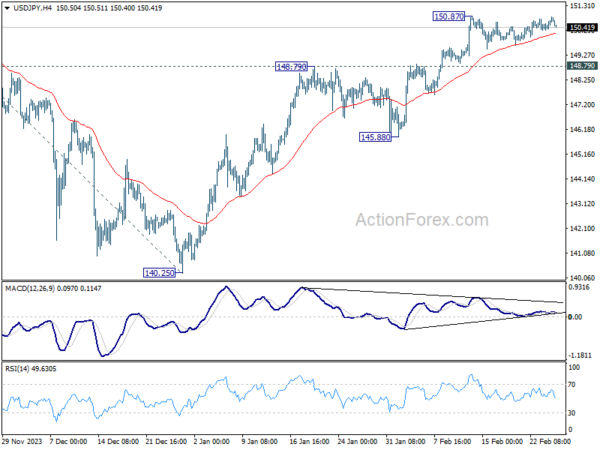

Daily Pivots: (S1) 150.39; (P) 150.61; (R1) 150.94; More…

USD/JPY retreats mildly ahead of 150.87 resistance as consolidation continues. Intraday bias remains neutral and outlook is unchanged. In case of deeper retreat, downside should be contained by 148.79 resistance turned support to bring rebound. On the upside, break of 150.87 will resume 140.25 to 151.89/93 key resistance zone. Decisive break there will confirm larger up trend resumption of 155.50 projection level next.

In the bigger picture, rise from 140.25 is seen as resuming the trend from 127.20 (2023 low). Decisive break of 151.89/.93 resistance zone will confirm this bullish case and target 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. However, break of 148.79 resistance turned support will delay this bullish case, and extend the corrective pattern from 151.89 with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Y/Y Jan | 2.20% | 2.60% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Jan | 2.00% | 1.90% | 2.30% | |

| 23:30 | JPY | National CPI ex Food & Energy Y/Y Jan | 3.50% | 3.70% | ||

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | 2.50% | 2.90% | ||

| 07:00 | EUR | Germany Gfk Consumer Confidence Mar | -29 | -29.7 | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 0.20% | 0.10% | ||

| 13:30 | USD | Durable Goods Orders Jan | -4.40% | 0.00% | ||

| 13:30 | USD | Durable Goods Orders ex Transport Jan | 0.30% | 0.50% | ||

| 14:00 | USD | S&P/CS Composite-20 HPI y/y Dec | 6.00% | 5.40% | ||

| 14:00 | USD | Housing Price Index M/M Dec | 0.10% | 0.30% | ||

| 15:00 | USD | Consumer Confidence Feb | 114.9 | 114.8 |