New Zealand Dollar weakens broadly in Asian session today, reflecting market caution ahead the RBNZ decision later this week, on concerns of less hawkish than expected outcome. The selloff in Kiwi is also dragging down Australian Dollar some what, while Yen and Dollar found some room to recover from last week’s losses. At the same time, European majors are currently mixed. Nevertheless, all major currency pairs and crosses are maintaining their positions within Friday’s range, with New Zealand Dollar being the sole exception.

The day’s trading might remain subdued due to a nearly empty economic calendar. However, scheduled appearances by central bankers, including BoE Deputy Governor Sarah Breeden and Chief Economist Huw Pill, ECB President Christine Lagarde, and Kansas City Fed President Jeffrey Schmid, could inject some volatility into the markets. As the week progresses, the focus will shift to inflation data from US, Eurozone, Japan, and Australia, alongside other key economic indicators such as US durable goods orders, consumer confidence, and ISM manufacturing, as well as Swiss GDP, Canadian GDP, and Chinese PMIs.

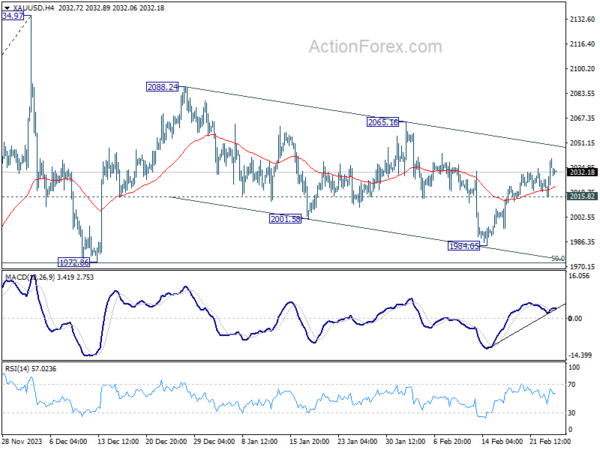

Technically, Gold edges lower today but holds above 2015.82 support. At this point, it’s unsure yet if the corrective fall from 2088.24 has completed with three waves down to 1984.05. Break of 2015.82 support will extend the pattern with another falling leg towards 1984.05 and possibly below. However, sustained break the the near term channel resistance will argue that rebound from 1972.86 is ready to resume through 2088.24. As always, the next movements in Gold will be instrumental in assessing the Dollar’s direction, given their inverse relationship.

In Asia, at the time of writing, Nikkei is up 0.29%. Hong Kong HSI is down -0.31%. China Shanghai SSE is down -0.25%. Singapore Strait Times is down -0.92%. Japan 10-year JGB yield is down -0.0255 at 0.696, back below 0.7% handle.

Ethereum leads crypto charge with upside breakout

Ethereum staged an upside breakout over the weekend, and edged above 3100 mark. For the moment, it’s outperforming Bitcoin is stuck in range after breaching 53000 briefly earlier in the month. There is prospect for Ethereum to continue to outshine Bitcoin in the near term, in anticipation of a new wave of spot crypto ETF on the world’s second-largest digital asset.

The approval of the first spot Bitcoin ETFs by US regulators in January has already marked a significant milestone. These ETFs have attracted over USD 5B in net inflows since their inception on January 11. There is growing speculation that Ether ETFs could receive regulatory approval as soon as the second quarter, possibly in May.

Technically, Ethereum is in upside acceleration mode as seen in D MACD, and the break of channel resistance. Next target is 100% projection of 1519 to 2715 from 2164 at 3360. Considering overbought condition as seen in D RSI, upside might be limited there on first attempt and bring consolidations first. But in any case, outlook will stay bullish as long as 2715 resistance turned support holds. Meanwhile, decisive break of 3360 will pave the way to 161.8% projection at 4099 next, which is above 4k psychological level.

As for Bitcoin, outlook will stay bullish as long as 55 D EMA (now at 46376 holds). Decisive break of 61.8% projection of 24896 to 49020 from 38496 at 53404 will pave the way to 100% projection at 62620.

NZD retreats broadly as caution prevails ahead of RBNZ

New Zealand Dollar weakens broadly in Asian session, as market participants are likely adjusting their positions in anticipation of the upcoming RBNZ rate decision. This cautious approach stems from a blend of profit-taking and hedging against surprises that might deviate from some market expectations. Despite a robust rally earlier in the month, spurred by rate hike speculations, the prevailing market consensus leans towards a steady rate with a side of hawkish rhetoric from RBNZ. Investors are currently scaling back, wary of any outcomes that could fall short of the hawkish forecast.

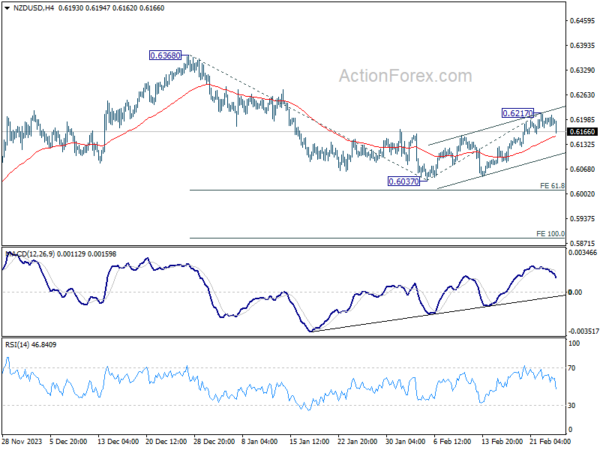

Technically, with today’s decline, immediate focus for NZD/USD is now on 55 4H EMA (now at 0.6153). Sustained break there will argue that the rebound from 0.6037 has completed as a three-wave corrective move to 0.6217. In this case, NZD/USD could be ready to resume the fall from 0.6368 through 0.6037 to 61.8% projection of 0.6368 to 0.6037 from 0.6217 at 0.6012 next.

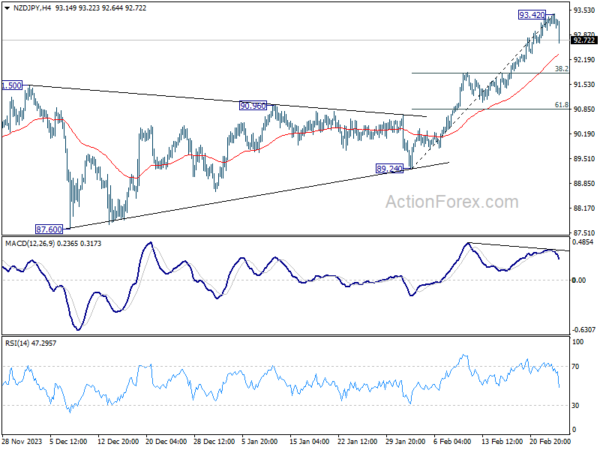

Bearish divergence condition in 4H MACD argues that a short term top was already formed at 93.42 in NZD/JPY. Risk will now stay on the downside as long as 93.42 holds. Deeper fall would be seen to 55 4H EMA (now at 92.31) and below. But for now, considering the overall weakness in Yen, downside should be contained by 38.2% retracement of 89.24 to 93.42 at 91.82 to bring rebound.

RBNZ rate decision and global inflation watch

This coming week places RBNZ squarely in the limelight as it makes its highly anticipated rate decision. While the consensus among financial analysts is for RBNZ to hold official cash rate at 5.50%, the unanimity is not without its dissenters. Notably, ANZ has forecasted a 25bps increase, with expectations of an additional hike in April. This forecast hinges on the perception that RBNZ’s current measures may fall short in adequately addressing inflation, which persisted at 4.7% in the fourth quarter, more than double the target.

RBNZ Governor Adrian Orr’s recent remarks underscored the ongoing struggle against inflation, advocating for more decisive action to ensure inflation expectations are securely anchored around 2% mark. Orr’s cautionary tone, although not convincing all economists of imminent further tightening, reinforces the argument against any expectations for rate cuts within this year.

Eventually, RBNZ’s upcoming decision should be heavily influenced by the latest economic projections outlined in the quarterly Monetary Policy Statement. The prevailing wisdom suggests the central bank might opt to conserve its policy ammunition, delivering a hawkish narrative without altering rates. However, the door remains ajar for a surprise rate hike.

Beyond the shores of New Zealand, a slew of inflation data from US, Eurozone, Australia and Japan will draw significant market attention. Analysts and investors alike are keen to see if US PCE and core inflation data resonate with recent CPI report’s implications of disinflationary pause. Such an outcome could lend weight to the argument favoring a Fed rate cut in the second half of the year, rather than the first.

ECB finds itself at a crossroads, with market participants eyeing rate cuts potentially starting in April or June. A slight deviation below expectations in the upcoming Eurozone CPI flash might not precipitate an immediate rate cut in March but could bring forward the timing to April. Conversely, unexpected inflationary pressures could push the window for easing to June.

Other notable economic indicators to watch include US durable goods orders, consumer confidence, and ISM manufacturing, along with Swiss GDP, Canadian GDP, and Chinese PMIs.

Here are some highlights for the week:

- Monday: Japan corporate service prices; US new home sales.

- Tuesday: Japan CPI; Germany Gfk consumer sentiment; Eurozone M3 money supply; US durable goods orders, house price index, consumer confidence.

- Wednesday: Australia monthly CPI; RBNZ rate decision; Germany import prices; Swiss Credit Suisse economic expectations; Canada current account; US CPI revision, goods trade balance.

- Thursday: Japan industrial production, retail sales, housing starts; New Zealand ANZ business confidence; Australia retail sales; Germany retail sales, CPI flash, unemployment; Swiss GDP, KOF economic barometer; UK M4 money supply, mortgage approvals; Canada GDP; US jobless claims, personal income and spending, PCE inflation, Chicago PMI, pending home sales.

- Friday: New Zealand building permits; Japan unemployment rate PMI manufacturing final, consumer confidence; China NBS PMIs, Caixin PMI manufacturing; Swiss retail sales PMI manufacturing; Eurozone PMI manufacturing final, CPI flash, unemployment rate; UK PMI manufacturing final; Canada PMI manufacturing; US PMI manufacturing final, ISM manufacturing.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6549; (P) 0.6565; (R1) 0.6580; More…

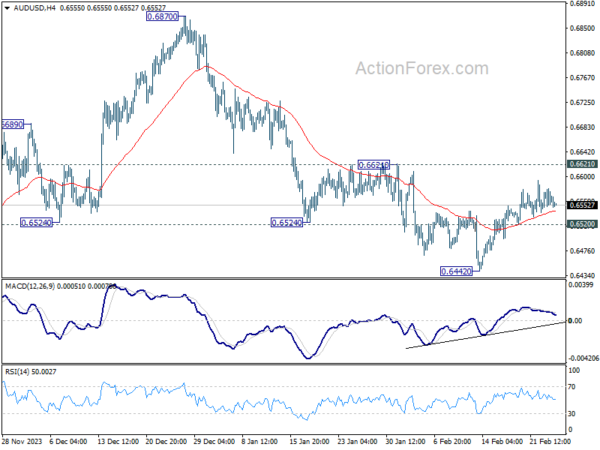

Intraday bias in AUD/USD remains neutral for the moment and outlook is unchanged. Recovery from 0.6442 could extend higher, but outlook will remain bearish as long as 0.6621 resistance holds. On the downside, below 0.6520 minor support will turn bias to the downside for retesting 0.6442. Nevertheless, considering bullish convergence condition in 4H MACD, decisive break of 0.6621 will turn near term outlook bullish for 0.6870 resistance instead.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jan | 2.10% | 2.40% | 2.40% | |

| 15:00 | USD | New Home Sales M/M Jan | 685K | 664K |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading