It is a holiday in the US in observance of Presidents Day. As a result, the US stocks, bond and commodity exchanges were all closed for the day.

The forex market did trade with limited liquidity and up and down price action.

For the USD, the biggest mover was the NZDUSD which rose about 0.44% from the Friday close. That rise happened mostly in the Asian Pacific session. The other currency pairs vs the USD were limited to 0.22% or less.

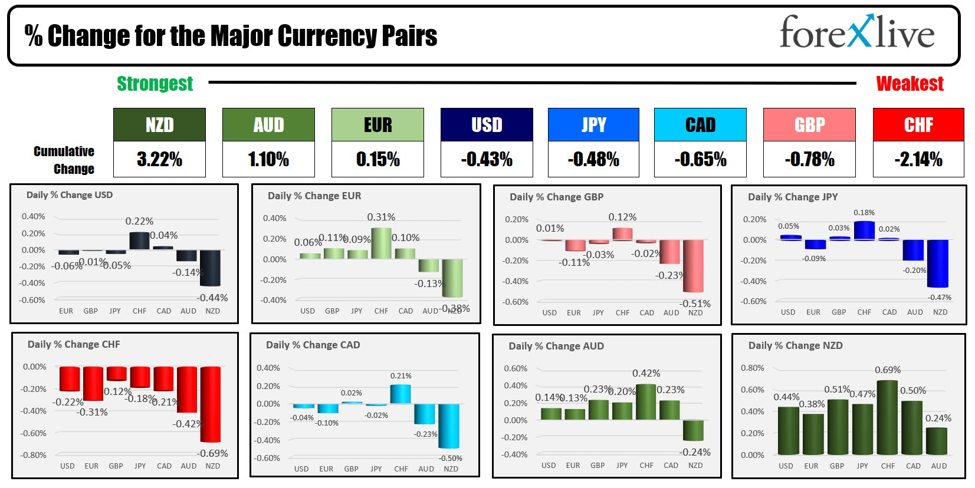

Overall, the NZD is ending the day as the strongest of the major currencies. The CHF is the weakest. The USD is ending the day in the middle of the strongest to the weakest with a tilt to the downside (mainly due to the USDs -0.44% fall vs the NZD).

Below is the ranking of the strongest to the weakest.

The strongest to the weakest of the major currencies

Technically speaking:

- EURUSD: The EURUSD bottomed today near the 200 hour MA at 1.07605, and stalled the rally near the 100 day MA at 1.07905. Those two moving averages have defined the support and resistance into Tuesday’s trading.

- USDJPY: The USDJPY traded the day above the low of a swing area at 149.70 and the high of a swing area at 150.158. The price is trading at 150.13 near the high of the upper level. Move above in the new trading day should be more bullish.

- GBPUSD: The GBPUSD traded higher in the Asian session but stalled ahead of the falling 100 bar MA on the 4-hour chart at 1.26308. That is resistance into Tuesday’s trading. On the downside the 200 day MA at 1.2563 remains a key level that needs to be broken and stay broken if the sellers are to take more control in the new day.

- USDCHF: The USDCHF remained above its 100 day MA at 0.8795 today keeping the buyers in full control. In the new trading day, hold above that level and the upside will have traders targeting the 200 day MA at 0.88449. Get above it, and the buyers are more confident.

- USDCAD: The USDCAD based in the Asian session at the 100 bar MA on the 4-hour chart at 1.3467. Remember that level on any dips lower this week. The subsequent move higher was able to extend above the 200 day MA at 1.3479 and the 200 hour MA at 1.34867. Bullish. Stay above those MAs (with the 200 hour MA as close support), keeps the buyers happy and the sellers scared. The 100 hour MA at 1.3511 is the next upside target in the new trading day.

- AUDUSD: The AUDUSD is trading above and below its 100 day MA at 0.6536. That MA will be the key barometer in the new trading day (above is more bullish/below is more bearish).

- NZDUSD: The NZDUSDs move to the upside took the price to the 200 bar MA on the 4-hour chart and broken 38.2% retracement at 0.61406. That will be the barometer for the new trading day. Buyers are making the play. Can they keep the upside momentum going?

Good fortune with your trading.