Yen weakens mildly in Asian session today, contrasting with Nikkei’s continued up trend towards historical high made in 1990. This development comes amidst diminishing impacts of Japanese officials’ verbal interventions aimed at stemming Yen’s decline. Without tangible policy measures to back these statements, the currency’s depreciation has persisted. Meanwhile, Finance Minister Shunichi Suzuki’s tone has softened a little bit, acknowledging the dual effects of its weakening, even though his major concerns are more on the negative side.

In the broader currency markets, Dollar remains the standout performer of the week, despite having a retreat in the US session overnight. Traders have shown hesitation in pushing the greenback through near term support levels against major peers, at least for now. Australian Dollar has risen to become the week’s second strongest currency, followed by Canadian Dollar. New Zealand Dollar trails at the bottom, with Swiss Franc and Yen also facing behind. Euro and Sterling occupy intermediate positions, with British Pound giving up much ground after a series of mixed economic indicators this week.

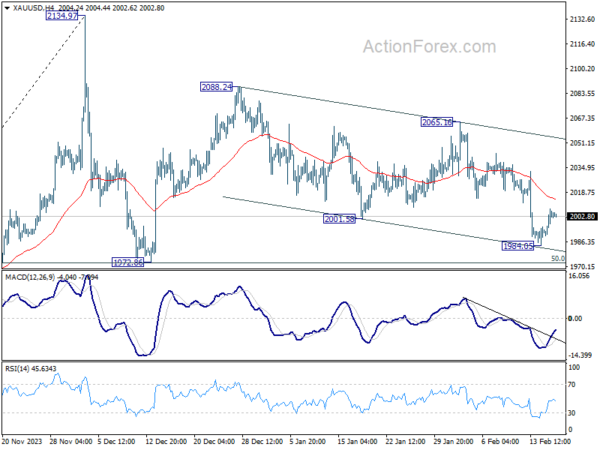

Technically, Gold resumed its near term fall to as low as 1984.05 this week on Dollar’s rally. But it then recovered together with Dollar’s pull back. Near term focus is back on 4H 55 EMA (now at 2014.77). Rejection by this EMA would likely push Gold through 1984.05, and even 1972.86 support to resume whole pattern from 2134.97. However, Sustained break of this EMA will argue that the decline from 2088.24 has completed in a three-wave correction structure. Near term outlook will then be turned bullish for 2088.24 and above.

In Asia, Nikkei closed up 0.86%. Hong Kong HSI is up 2.75%. Singapore Strait Times is up 1.36%. Japan 10-year JGB yield rose 0.0054 to 0.735. Overnight, DOW rose 0.91%. S&P 500 rose 0.58%. NASDAQ rose 0.30% 10-year yield fell -0.027 to 4.240.

Fed’s Bostic: Robust economy allows for unhurried monetary easing without oppressive urgency

Atlanta Fed President Raphael Bostic noted there has been “substantial and gratifying progress” in reducing inflation’s pace, but he warns against premature celebrations.

While inflation is expected to continue to decline, it would be “more slowly than the pace implied by where the markets signal monetary policy should be,” Bostic said in a speech overnight.

With a “strong labor market and macroeconomy,” Bostic highlighted the opportunity to deliberate policy shifts “without oppressive urgency”.

BoE’s Mann focuses on forward-looking indicators after last year’s soft patch

BoE MPC Catherine Mann commented overnight on the -0.3% quarterly contraction in GDP for Q4 2023. She characterized this period as a “soft patch,” adding that the downturn was anticipated and aligned with her expectations.

Rather than dwelling on past performance, Mann is directing her attention to forward-looking indicators, such as business surveys and PMIs, along with BoE’s Decision Maker Panel. “Those are all looking good,” she said.

However, Mann voiced ongoing concerns regarding the persistence of services price inflation in the UK, which she believes is more tenacious than in other advanced economies.

She added that decline in goods price inflation alone would not suffice to sustainably anchor consumer price inflation to the Bank’s 2% target.

ECB’s Scicluna: March could be it for rate cut

In an interview, ECB Governing Council member Edward Scicluna pointed to March economic projections as a crucial factor that could justify a shift in policy, opening the door for rate cuts. “March could be it,” he suggested, “We’ll see how many think that there’s no need to wait for June.”

Acknowledging the “bumpy” path toward achieving ECB’s disinflation objectives, Scicluna emphasized the clear trend of declining inflation. “You should see the writing on the wall and admit objectively that the trend is going down,” he stated.

Despite the possibility of justifying a hold on rate cuts due to various concerns, including geopolitical tensions, Scicluna argued for a more direct approach: “You have to make a judgment; you don’t find these excuses.”

“Let’s face reality — of course, risks are flying all around us,” he said. “But when you get a comprehensive look at things, prices are falling.”

“At a time when demand is falling, I believe you can let off the pedal a bit,” Scicluna said.

RBNZ’s Orr stresses continued effort needed to anchor inflation expectations

In a forum today, RBNZ Governor Adrian Orr indicated that the central bank’s primary challenge lies in firmly anchoring inflation expectations around the 2% target, a goal that remains elusive despite significant progress.

This “tail end” of the inflation fight, as Orr describes, requires meticulous attention to both “capacity pressures” within the economy and the public’s “inflation expectation”s.

“We’ve got more work to do to have inflation expectations truly anchored at that 2% level, he added.

“We observe headline but we are targeting in a large sense core inflation,” Orr stated, emphasizing the importance of these metrics in shaping the central bank’s policy decisions.

NZ BNZ manufacturing rises to 47.3, still someway off to expansion

New Zealand BusinessNZ Performance of Manufacturing Index rose from 43.4 to 47.3 in January, hitting the highest level since June last year. Despite this uptick, it’s important to note that the manufacturing sector remained in contraction for eleven straight months.

BusinessNZ’s Director of Advocacy, Catherine Beard noted that while there are signs of improvement, “the sector is still someway off returning to expansion.”

Looking at some details, production rose from 40.5 to 42.1. Employment rose from 47.0 to 51.3. New orders rose from 44.0 to 47.7. Finished stocks rose from 45.9 to 47.3. Deliveries rose from 43.7 to 49.3.

However, the persistence of negative sentiment among businesses cannot be overlooked. The proportion of negative comments in January rose to 63.2%, up from 61% in December and 58.7% in November, reflecting concerns over seasonal factors such as holiday disruptions and a sustained lack of demand or orders.

Looking ahead

UK retail sales is the main focus in European session. Later in the day, US will release PPI, housing starts and building permits, U of Michigan consumer sentiment. Canada will release wholesale sales.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 161.14; (P) 161.37; (R1) 161.77; More…

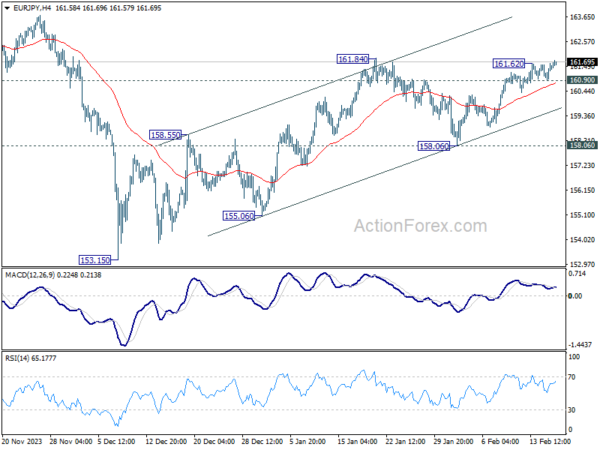

EUR/JPY’s rally resume after brief consolidations and intraday bias is back on the upside. On the upside, firm break of 161.84 will confirm resumption of whole rise from 153.15. Next target is a retest on 164.29 high. On the downside, however, below 160.90 minor support will turn intraday bias neutral first.

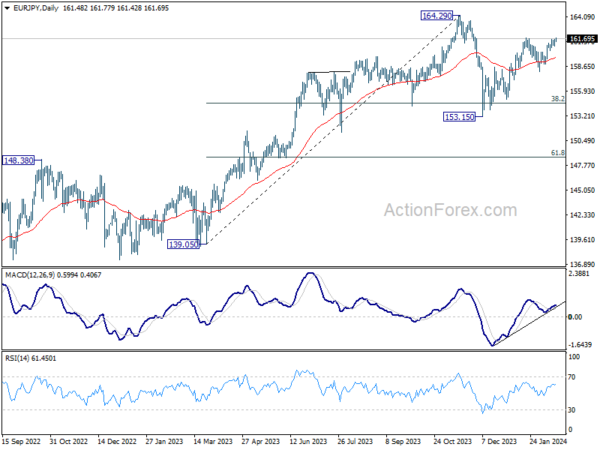

In the bigger picture, price actions from 164.29 medium term top are seen as a correction to rise from 139.05 only. As long as 148.38 resistance turned support holds (2022 high), larger up trend from 114.42 (2020 low) is expected to resume through 164.29 at a later stage. Next target would be 169.96 (2008 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Jan | 47.3 | 43.1 | 43.4 | |

| 04:30 | JPY | Tertiary Industry Index M/M Dec | 0.70% | 0.20% | -0.70% | -1.40% |

| 07:00 | GBP | Retail Sales M/M Jan | 1.50% | -3.20% | ||

| 13:30 | CAD | Wholesale Sales M/M Dec | 0.90% | |||

| 13:30 | USD | Building Permits Jan | 1.52M | 1.49M | ||

| 13:30 | USD | Housing Starts Jan | 1.47M | 1.46M | ||

| 13:30 | USD | PPI M/M Jan | 0.10% | -0.10% | ||

| 13:30 | USD | PPI Y/Y Jan | 0.70% | 1.00% | ||

| 13:30 | USD | PPI Core Y/Y Jan | 1.70% | 1.80% | ||

| 13:30 | USD | PPI Core M/M Jan | 0.10% | 0.00% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Feb P | 80 | 79 |