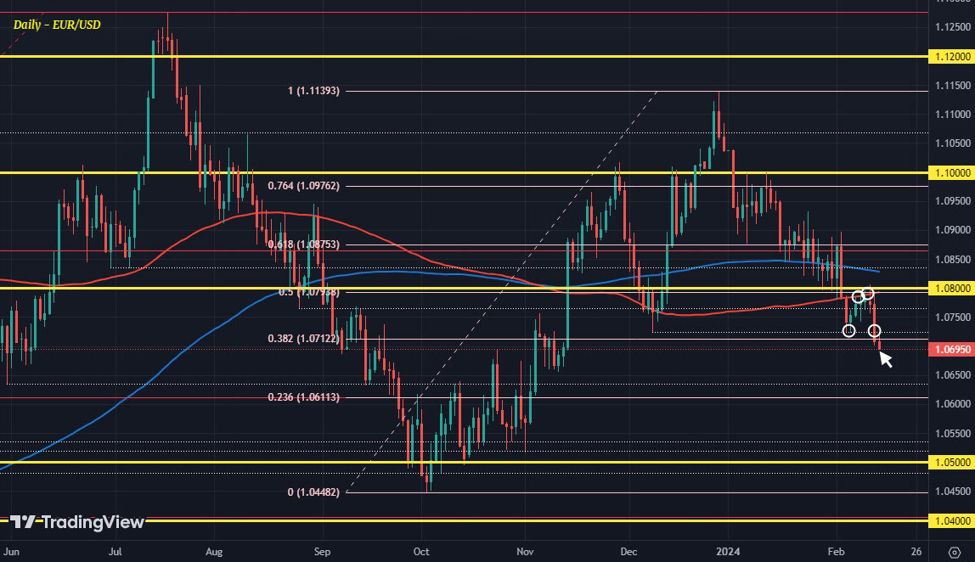

EUR/USD daily chart

There was a bit of a question mark even with the break of the December low of 1.0723 yesterday. Price action still traded more sideways around 1.0700-20 mostly but are we finally seeing a crack to the downside? The pair is down just slightly to fresh lows of 1.0695 as European traders look to stretch the range today.

Looking at broader markets, there are no signs of a strong dollar bid today. Outside of a drop in EUR/USD and GBP/USD, the dollar is keeping a more tentative look elsewhere. This comes with 10-year Treasury yields down 2.5 bps to 4.290% currently.

That being said, the technical consideration above is one that is rather important for EUR/USD. Sellers are looking to solidify more downside momentum but I would argue that it really requires a firm break of 1.0700 at this point. Let’s see if they can manage that into the daily close today.

After that, we’ll have to take in all the risk factors again when we get to the US retail sales data tomorrow.