Today’s Asian session sees an unusual quietness across the region, with major markets closed for holidays, leading to limited movement among major currency pairs and crosses. New Zealand Dollar is having a slight downtick following RBNZ Governor Adrian Orr’s appearance before a parliamentary committee, where he left market participants parsing for clues on future rate adjustments. Despite Orr’s non-committal stance, the minimal market response suggests that expectations for further rate hikes remain intact, albeit with an air of caution.

The day’s economic calendar remains sparse, shifting the market’s attention to forthcoming comments from notable central bank figures. Neverthless, speeches by ECB Chief Economist Philip Lane and Executive Board member Piero Cipollone, Fed Governor Michelle Bowman and Minneapolis Fed President Neel Kashkari, as well as BoE Governor Andrew Bailey could introduce some volatility into the markets.

However, the real anticipation builds towards Tuesday, setting the stage for a slew of pivotal data releases. US CPI report stands out as a particularly significant indicator, poised to shed light on the ongoing inflation narrative. Additionally, a barrage of important data from the UK, Eurozone, Japan, and Australia are keenly awaited too.

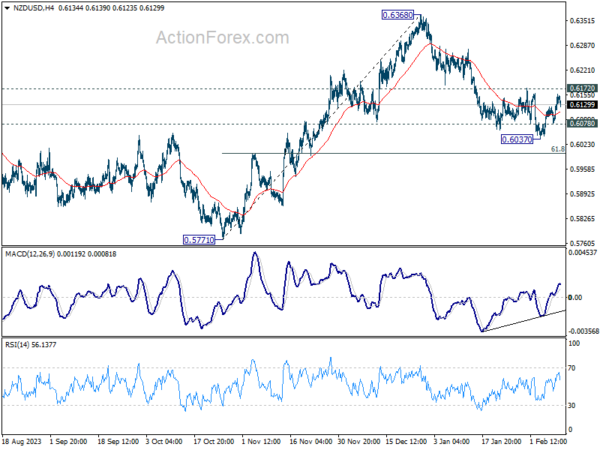

Technically, NZD/USD’s recovery from 0.6037 is still seen as a correction to fall from 0.6368 only. Break of 0.6078 minor support will bring retest of 0.6037. Firm break there should resume the decline through 61.8% retracement of 0.5771 to 0.6368 at 0.5999. Nevertheless, strong break of 0.6172 will argue that the decline has completed and bring further rebound.

Happy Lunar New Year to those who’re celebrating the year of Dragon!

ECB’s Panetta argues for early and gradual rate cuts, dismisses core inflation fears

ECB Council member Fabio Panetta articulated a sense of urgency for ECB to loosen its approach, suggesting that “the time for a reversal of the monetary policy stance is fast approaching.”

Panetta advocates for a nuanced evaluation of the timing and methodology of interest rate adjustments, contrasting the implications of initiating “quickly and gradually” against opting for “later and more aggressive” measures. He warns that the latter could “increase volatility in financial markets and economic activity”.

The backdrop to Panetta’s remarks is a macroeconomic conditions characterized by significant disinflationary progress at an “advanced stage”, with progress toward 2% target “continues to be rapid.

He emphasizes the absence of any “upward de-anchoring of inflation expectations,” pointing instead to emerging downside risks. This observation effectively counters concerns over enduring high core inflation, which Panetta now deems “groundless.”

The crux of Panetta’s argument lies in the potential consequences of delayed policy adaptation. “If monetary policy were to take too long to accompany the ongoing disinflation, downside risks to inflation could emerge that would conflict with the symmetrical nature of the objective set by the ECB’s Governing Council,” he said.

ECB’s de Cos highlights March projections as key to rate cut decisions

In a newspaper interview published on Sunday, ECB Governing Council member Pablo Hernandez de Cos spotlighted the upcoming economic projections in March as a crucial factor in determining the timing for interest rate cuts.

De Cos outlined two primary considerations that the March projections will address: the confidence level in achieving ECB’s 2% medium-term inflation target and the determination of an interest rate path that aligns with reaching this symmetric target.

Reflecting on past challenges, de Cos acknowledged the ECB’s initial underestimation of the inflationary surge post-pandemic and following Russia’s invasion of Ukraine. However, he noted a marked improvement in the accuracy of staff projections, highlighting recent instances where inflation figures came in slightly below expectations.

De Cos’s remarks suggest a positive outlook on Eurozone’s disinflation process, describing it as “well advanced” and likely “to continue in the coming quarters.”

RBNZ’s Orr stands firm on restrictive policy to combat persistent inflation

RBNZ Governor Adrian Orr, in a parliamentary committee appearance today, articulated a firm stance on maintaining restrictive monetary policy to tackle the country’s higher-than-desired inflation rate.

Currently sitting at 4.7%, New Zealand’s inflation remains “too high” and overshoots RBNZ’s target band of 1% to 3%

“That’s why we’ve retained a restrictive monetary policy stance with the official cash rate at 5.5%, and we’ll be back at the end of this month again with our updated views on the wisdom of that stance.”

Deputy Governor Christian Hawkesby provided additional insights, noting the resilience of New Zealand’s financial system and the capacity of consumers to absorb higher interest rates.

“The vast majority of households have continued to manage the debt and service their mortgages, although some are struggling and falling behind,” Hawkesby added.

US inflation slowdown and UK’s major data release set the stage for market moves

The coming week spotlights a slew of crucial economic indicators poised to offer a clearer view of inflationary pressures, consumer health, and the broader economic trajectory across several major economies. With particular attention on US CPI and the batch of data from the UK.

In the US, forthcoming CPI data for January is the focal point, with expectations pointing towards moderation in headline inflation from 3.4% to 2.9%, and a slight dip in core CPI from 3.9% to 3.8%. Beyond inflation, retail sales, University of Michigan consumer sentiment index and inflation expectations, will be under scrutiny.

These figures come at a crucial juncture, as Fed evaluates the persistence of inflationary pressures against a backdrop of enduring consumer strength. With the fed fund futures currently indicating a 60% probability of a Fed rate cut in May, any upside surprises in inflation or consumer spending trends could prompt reassessments of the timing for policy easing, pushing expectations further into the year.

The UK also faces a week brimming with critical data, including December and Q4 GDP, complemented by January’s CPI, retail sales, and employment figures. These releases arrive at a time of notable divergence within BoE’s MPC. Hawks within the committee, like Catherine Mann and Jonathan Haskel, have voiced concerns over the stubbornness of inflation, suggesting that the UK’s disinflationary path lags far behind its international counterparts. Conversely, dovish voices, represented by Swati Dhingra, warn of the economic fallout from overly restrictive monetary policy. This week’s data will likely intensify the debate, offering ammunition to both sides of the policy divide.

The week also features pivotal releases beyond the US and UK, including Swiss CPI, German ZEW economic sentiment, Japan’s GDP, and Australian employment figures. These indicators will shed light on the inflation scenario in Switzerland, economic sentiment in Germany, growth momentum in Japan, and the labor market situation in Australia.

Here are some highlights for the week:

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; Japan PPI, machine tool orders; UK employment; Swiss CPI; Germany ZEW economic sentiment; US CPI.

- Wednesday: UK CPI, PPI; Eurozone GDP revision, industrial production.

- Thursday: Japan GDP; Australia employment, UK GDP, industrial and manufacturing production, goods trade balance; Swiss PPI, SECO consumer climate; Eurozone trade balance; Canada housing starts, manufacturing sales; US retail slaes, Empire State manufacturing index, Philly Fed manufacturing index, jobless claims, import prices, industrial production, NABH housing index.

- Friday: New Zealand BusinessNZ manufacturing; Japan tertiary industry index; UK retail sales; Canada wholesale sales; US PPI, building permits and housing starts, U of Michigan consumer sentiment.

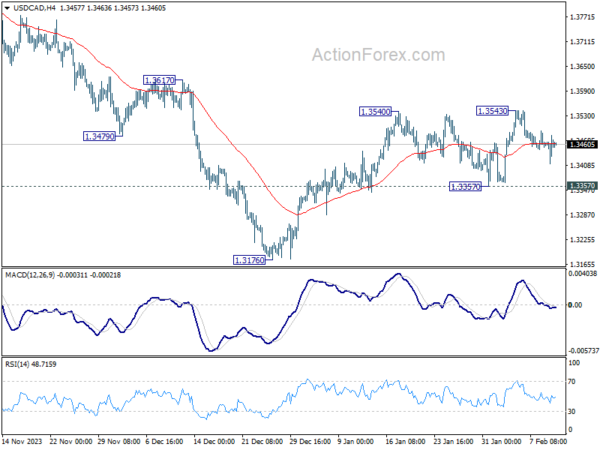

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3419; (P) 1.3451; (R1) 1.3488; More…

Intraday bias in USD/CAD remains neutral at this point and more consolidations could be seen. Further rise is mildly in favor as long as 1.3357 support holds. On the upside, decisive break of 1.3540/3 will resume the rise from 1.3176. That will also revive that case that whole fall from 1.3897 has completed, and target this resistance. Nevertheless, firm break of 1.3357 support will argue that rebound from 1.3176 has completed, and target this low for resuming the decline from 1.3897.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 10:00 | EUR | EU Economic Forecasts |