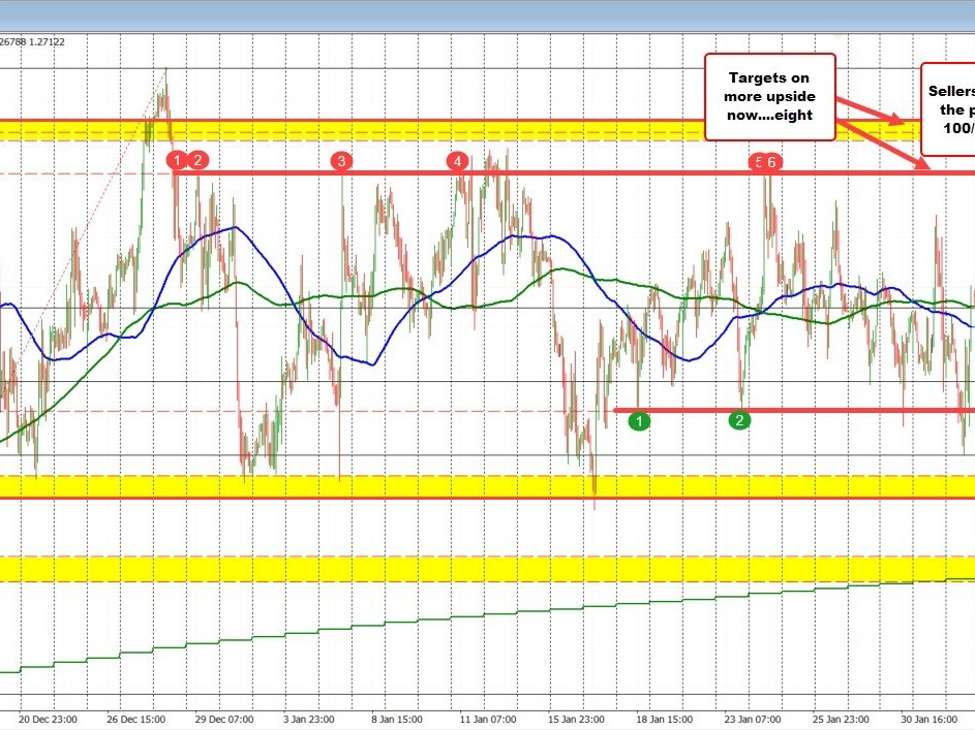

GBPUSD trades back above the 100/200 hour MA

The GBPUSD is following the dollar lower moves seen as yields in the US tumble. the market is discounting the comments from Fed Chair Powell and thinking more in terms of slower growth/higher unemployment. The regional banking concerns are also helping to send funds into treasuries, weakening the US dollar in the process.

Technically, the price of the GBPUSD has moved back above its 100 and 200-hour MAs at 1.2691 and 1.27015. Those MAs disect the range of 1.2600 to 1.2800 that has prevailed since mid-December (see red box on the chart above). Admittedly, the price has been above and below those MAs. over the last 4 or so trading weeks. That is what happens when the price does not trend, but instead waffles between the buyer and sellers.

If the price stays above the MAs, the bias is more in favor of the buyers technically. The price yesterday was near 1.2750. The high from last week was near 1.2775.

Today, the Bank of England decided to keep the base rate unchanged at 5.25%, in a move that was widely anticipated. However, the decision featured an unexpected three-way split, with Haskel and Mann advocating for a 25 basis points (bps) increase, while Dhingra favored a 25bps reduction. The policy statement notably abandoned the previous guidance suggesting that “further tightening” might be necessary. Instead, the MPC emphasized that monetary policy must remain “sufficiently restrictive” for a “sufficiently long” period. The decision

Key points from the decision and remarks include:

- Inflation Expectations: The BoE now anticipates inflation hitting its 2% target by Q2 2024, an adjustment from the earlier forecast of Q4 2025. However, the two-year inflation forecast stands at 2.3%, indicating concerns that current market expectations might be too optimistic to align with the BoE’s inflation goals.

- Rate Cut Speculation: Governor Bailey indicated that while inflation is moving in the right direction, it hasn’t reached a point justifying rate reductions.

- Impact of Prior Tightening: Bailey mentioned that about two-thirds of the impact from previous tightening measures has already taken effect, highlighting the lag in monetary policy impact.

- Future Rate Cuts: The Governor clarified that any future rate cuts would still maintain a restrictive policy stance, underscoring a cautious approach to easing.

The central bank joined the wait-and-see trend from central banks as the economy’s growth and inflation remain in question. Will inflation continue to move lower or will the fall stall as service sector prices remain a concern.

The first cut is anticipated by June and roughly 110bps of easing expected by year-end.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading