Euro weakens broadly today amid signals from ECB officials that a rate cut cycle could commence in June, or even earlier in April. This bearish sentiment towards the common currency heightens the significance of upcoming Eurozone economic data releases, with GDP figures tomorrow and CPI data on Thursday poised to play crucial roles in shaping market expectations. Particularly, any negative surprises in growth data could intensify market bets on ECB’s loosening of policy to counteract what is likely an ongoing recession in Eurozone.

Concurrently, Euro’s selloff is exerting some downward pressure on both Sterling and Swiss Franc. Meanwhile, Dollar also faces weakness, partly due to a sharp drop in US 10-year yield. Despite this, the greenback remains within ranges, with its directional breakout hinging on Fed’s upcoming rate decision and the barrage of significant economic data due this week.

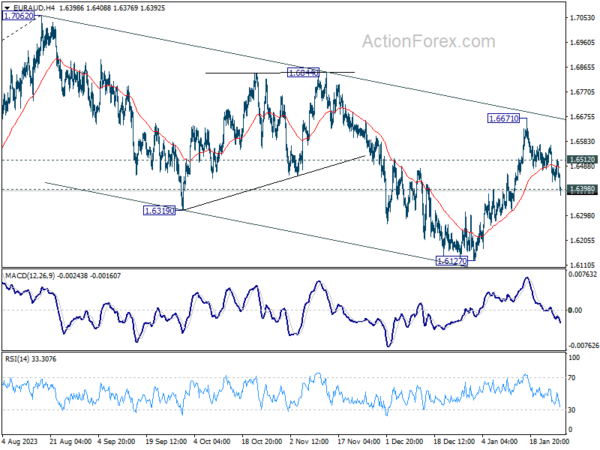

Technically, EUR/AUD’s decline today argues that rebound from 1.6127 might have already completed at 1.6671, ahead of falling channel resistance. Deeper fall is now in favor as long as 1.6512 minor resistance holds. Current decline is part of the corrective pattern from 1.7062 high, and would target 1.6127 support again next.

In Europe, at the time of writing, FTSE is up 0.08%. DAX is down -0.55%. CAC is down -0.12%. UK 10-year yield is down -0.0385 at -4.105. Germany 10-year yield is down -0.054 at 2.251. Earlier in Asia, Nikkei rose 0.77%. Hong Kong HSI rose 0.78%. China Shanghai SSE fell -0.92%. Singapore Strait Times fell -0.61%. Japan 10-year JGB yield rose 0.0054 to 0.725.

ECB’s de Guindos: No fixed calendar for rate cuts

ECB Vice President Luis de Guindos expressed a cautiously optimistic view on the trajectory of inflation in Eurozone. But he also emphasized that the central bank is data-dependent regarding cutting interest rates, rather than time-dependent.

“There has been good news regarding the evolution of inflation, and that — sooner or later — will end up being reflected in the monetary policy,” he told Spain’s RNE radio.

However, he was clear about ECB’s stance being firmly grounded in data-driven decision-making. Guindos emphasized the absence of a fixed timetable for policy changes, stating, “We are going to be dependent on the data, we don’t have any kind of calendar, it will depend on the evolution of inflation.”

ECB’s Centeno endorses early, gradual interest rate cuts

ECB Governing Council member Mario Centeno advocates to start cutting interest rates “sooner and more gradually”, as there are a lot of evidence that inflation is falling sustainably towards 2% target. He also argued that ECB doesn’t need to wait for May wage data before acting.

“We can react later and more strongly, or sooner and more gradually. I am completely in favour of gradualism scenarios, because we have to give economic agents time to adapt to our decisions,” he said in a Reuters interview.

This perspective underscores his preference for a steady, sustainable reduction in interest rates, proposing 25 basis-point steps as “a good metric”.

Centeno’s stance also diverges from some ECB policymakers who propose waiting for Q1 wage data in May, to assess the potential second round effects on inflation. He argues that ECB’s decisions should not be exclusively hinged on wage data. “Data-dependent is not wage-data dependent…we don’t need to wait for May wage data to get an idea about the inflation trajectory,” Centeno remarked.

ECB’s Kazimir: June is the more probable timing for first rate cut

ECB Governing Council member Peter Kazimir indicated in a blog post that June is the “more probable” timing for the first rate cut. But he emphasized that the timing is “secondary” to the decision itself, and he remains open on this issue.

“The next move will be a cut, and it is within our reach,” he asserted, adding, “I am confident that the exact timing, whether in April or June, is secondary to the decision’s impact.”

“The latter seems more probable, but I will not jump to premature conclusions about the timing,” he added.

New Zealand’s goods exports down -8.7% yoy in Dec, imports fall -13% yoy

The New Zealand economy had a significant downturn in international trade during December, with goods exports dropping by -8.7% yoy, amounting to a decrease of NZD 568B, resulting in exports totaling NZD 5.9B. Concurrently, goods imports saw a more pronounced fall of -13%yoy, which translates to a reduction of NZD 896m, culminating in imports of NZD 6.3B. This overall downturn in trade activities led to a monthly trade deficit of NZD 323m, which, while substantial, was less severe than the anticipated deficit of NZD 975m.

A notable aspect of this trade activity is the geographical distribution of these declines. Among New Zealand’s key trading partners, China marked the most significant decrease in exports, with a reduction of NZD 295m, indicating a -16% drop. This was followed by declines in exports to EU (-20% drop, NZD 75m), Japan (-17% drop, NZD 54m), US (-4.6% drop, NZD 38m), and Australia (-0.8% drop, NZD 6m).

On the import side, US led the fall with a dramatic -40% reduction, amounting to NZD 390m less in imports. Other significant decreases in imports were observed from China (-12% drop, NZD 185m), the European Union (-14% drop, NZD 152m), and Australia (-9.8% drop, NZD 79m). However, South Korea bucked this trend with a striking 113% increase in imports to New Zealand, totaling an additional NZD 356m.

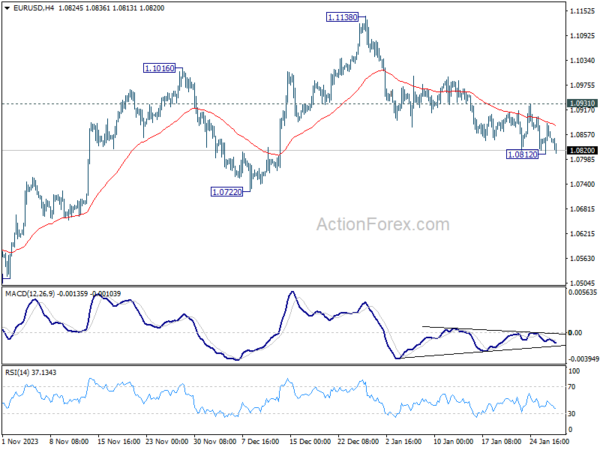

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0816; (P) 1.0851; (R1) 1.0889; More…

EUR/USD is staying above 1.0812 temporary low and intraday bias remains neutral for now. Further decline is mildly in favor as long as 1.0931 resistance holds. On the downside, break of 1.0812 will resume the fall from 1.1138 to 1.0722 support. On the upside, above 1.0931 will turn bias to the upside for stronger rebound towards 1.1138 resistance.

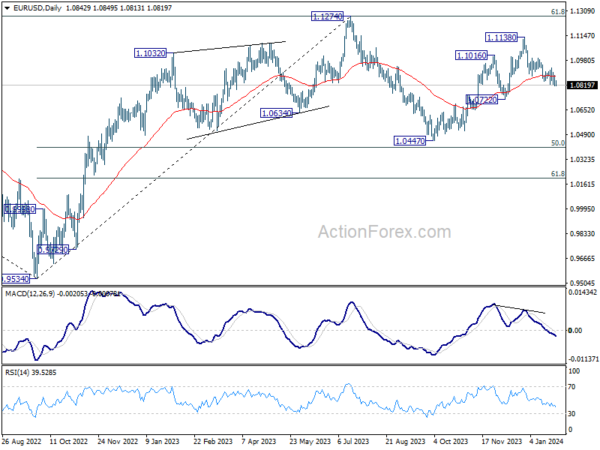

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | -323M | -975M | -1234M | -1250M |