The past week in the financial markets was a blend of the anticipated and the unforeseen, creating a cloud of indecision among traders. Central bank decisions by ECB, BoC, and BoJ unfolded largely as anticipated. But BoJ’s slightly hawkish communication provided a temporary lift to Yen. Despite ECB President’s cautious stance, traders continued to bet heavily on an imminent ECB rate cut, pressuring Euro.

In US, surprisingly robust economic data sent mixed signals, presenting a conundrum for investors torn between celebrating the economy’s resilience and fretting over potential delays in Fed’s rate cut cycle.

The most unexpected twist from China, with sudden intervention to revive its faltering stock markets. This move, however, did not significantly bolster the Australian and New Zealand Dollars as one might have expected.

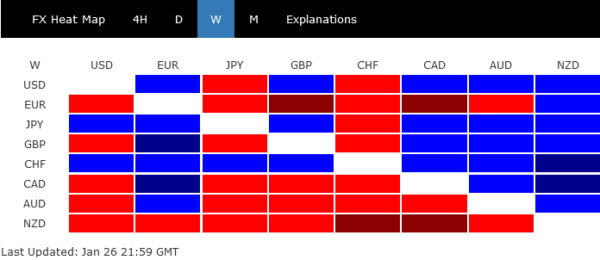

By the week’s end, Swiss Franc emerged as the strongest currency, largely due to renewed bets against Euro in anticipation of ECB rate cuts. Yen followed as the second strongest, with Dollar also showing strength. Conversely, New Zealand Dollar lagged as the weakest, trailed by Euro and Australian Dollar. Canadian Dollar also leaned towards the weaker side, while Sterling was mixed.

Yet, it’s crucial to underscore that the majority of major pairs and crosses concluded the week within the bounds of the previous week’s range, suggesting that the market predominantly remained in a consolidation phase amidst these various developments.

ECB, BoC, BoJ maintained status quo with varied market reactions

Last week, three major central banks – ECB, BoC and BoJ – unanimously decided to keep their monetary policies unchanged, a move that was largely anticipated by market observers. However, the reaction in the forex markets has varied, reflecting different interpretations of each bank’s communication and future policy directions.

ECB’s cautious tone against premature rate cut speculation was met with skepticism by traders, who are increasingly betting on an early rate cut, thereby exerting downward pressure on the Euro. Contrary to ECB, BoJ provided a slightly hawkish surprise, which has contributed to a brief lift in Yen. Canadian Dollar showcased resilience, buoyed by market expectations that the BoC is likely to initiate rate cuts later than ECB.

Despite ECB President Christine Lagarde’s efforts to temper expectations for early interest rate cuts, market traders appear to be unmoved. The likelihood of an ECB rate cut as soon as April is now being priced in at around an 80% chance, indicating a strong market sentiment that diverges significantly from Lagarde’s cautionary stance.

Traders’ aggressive positioning for an April rate cut comes even as some economists continue to advocate for a more conservative forecast, suggesting that June could be a more probable timeline for ECB’s first rate move. However, the anticipation for April meeting is palpable, as it’s increasingly perceived as a “live” session.

This growing anticipation hinges on the possibility of ECB needing to downgrade its inflation projections downwards, if inflation data consistently come in lower than expectations.

BoC has marked a notable shift in its monetary policy approach by dropping its tightening bias, as indicated by Governor Tiff Macklem’s recent remarks. He stated that no further tightening would be necessary, provided their economic forecasts align with expectations.

However, it’s important to note that this doesn’t necessarily signal imminent rate cuts. Opinions among market analysts and economists remains divided regarding the timing of the BoC’s first rate reduction. While June is currently viewed as the most probable month for the initiation of rate cuts, the situation remains fluid.

A critical factor that could accelerate BoC’s decision to lower rates is the performance of growth data. Should this data come in weaker than expected, it might compel the central bank to move ahead with rate cuts earlier than currently anticipated.

BoJ’s meeting was marked by a slight hawkish surprise from Governor Kazuo Ueda, even though he refrained from providing any explicit clues about exit from negative interest rates within the year.

At the post-meeting press conference, Ueda acknowledged the gradually increasing likelihood of Japan achieving a sustainable 2% inflation target, specifically noting the consistent rise in service prices as an indicator of this trend. He also mentioned BoJ need not delay its decision for examining this year’s wage negotiations in full. At the same time, the cautious tone regarding the danger of premature exit was dropped.

Reactions in swap markets was immediate and significant. Probability of a 10 bps rate hike by BoJ in April has surged to over 70%, a substantial increase from 40% chance estimated just last week.

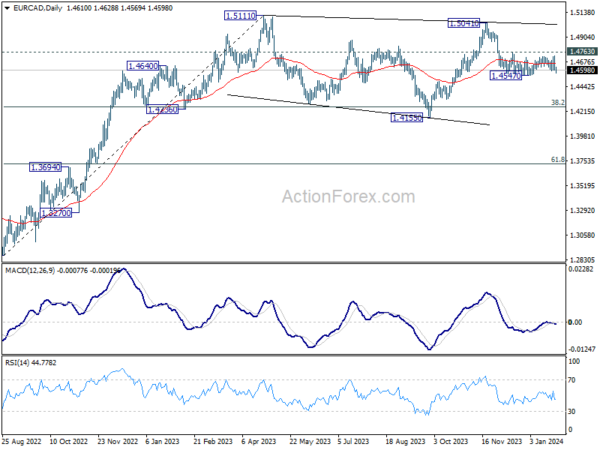

Looking at the performance of their crosses, EUR/CAD dipped mildly to end the week, but stayed above 1.4547 support. With 1.4763 resistance intact, fall from 1.5041 is still in favor to continued. Break of 1.4547 will resume the decline, which is seen as the third leg of the consolidation pattern from 1.5111. Next target will be 38.2% retracement of 1.2867 to 1.5111 at 1.4254.

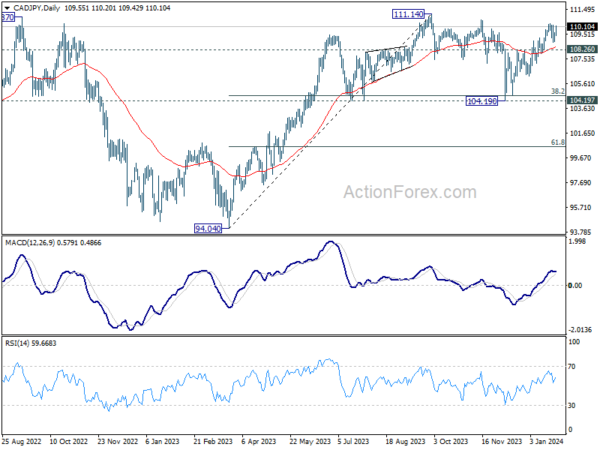

CAD/JPY rebounded strongly after brief dip to 108.87. Rise from 104.19 is still expected to continue to retest 111.14 high. However, it should be noted that the structure of this rise is currently more corrective looking than impulsive. Thus, it could just be the second leg of the consolidation pattern from 111.14. Rejection by 111.14, followed by sustained break of108.26 support, will start the third leg back to 104.19 cluster support (38.2% retracement of 94.04 to 111.14 at 104.60).

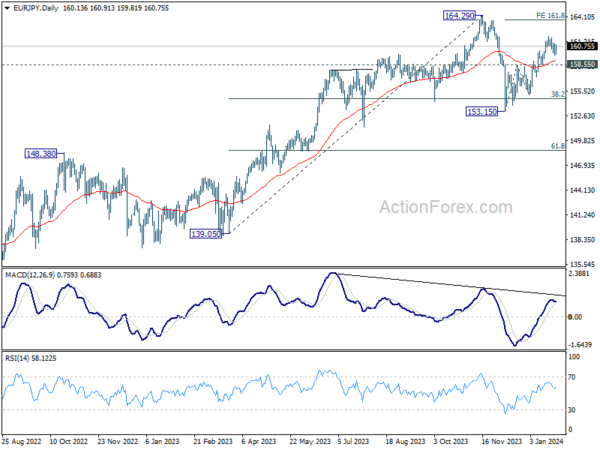

While EUR/JPY extended the retreat from 161.84, it’s holding above 158.55 resistance turned support so far. Further rise is in favor towards 164.29 resistance. But similar to CAD/JPY’s outlook, the rise from 153.15 could be the second leg of the consolidation pattern from 164.29 only. Rejection by this high, followed by break of 158.55 support, will start the third leg to 153.15 support.

China’s stock market rebounded on PBoC’s RRR cut and rumored state intervention

There was significant turnaround for Chinese and Hong Kong stock markets during the week. Both Shanghai SSE and HSI, which had been on a downward trajectory for much of this year, staged a significant rebound. This turnaround can be attributed to a series of surprise moves aimed at bolstering market confidence.

PBoC announced to cut reserve requirement ratio by 50bps, a decision that is expected to inject nearly USD 140B in long-term capital into the economy. This move has been interpreted as a direct effort by the central bank to support market liquidity and confidence.

In the background, Bloomberg reported that the Chinese authorities are considering instructing state-owned enterprises to invest funds from their offshore accounts in purchasing shares. The reported sum amounts to as much as USD 282B, a substantial intervention aimed at stabilizing the stock markets.

Shanghai SSE staged a strong rebound to close at 2910.22, after initial dive to 2724.15. Technically, this suggests that downtrend from 3418.95 might have concluded with a five-wave decline. The focus now shifts to 3000 psychological level, which is close to 38.2% retracement of 3418.95 to 2724.15 at 2989.56

The key resistance near 3000 will be critical to watch. Rejection at this level would maintain medium-term bearishness, leading to another fall through 2724.15 later on. Conversely, firm break of 3000 should bring stronger rally to 3089.77 resistance, or further to 61.8% retracement at 3151.53, even as a corrective move.

A tug-of-war between economic resilience and Fed cut uncertainties

The current state of US financial markets reflects a dynamic tug-of-war or encouraging signs of economic resilience and cautious on delayed Fed rate cuts. On one hand, DOW continues its up trend, hitting yet another record high, signaling robust market confidence. However, this ascent is accompanied by signs of waning momentum, suggesting that investors are cautiously weighing their options. This cautious sentiment extends to 10-year yield and Dollar index, both of which have been fluctuating within a tight range.

The ambiguity in the market’s direction is further evidenced by the fluctuating predictions regarding a March Fed rate cut, flip-flopping around 50% likelihood as indicated by fed fund futures. The robustness of the US economy, especially in the consumer sector, suggests a challenging “last mile” to lowering core inflation to Fed’s 2% target. This economic resilience could prompt Fed to maintain a vigilant stance, potentially delaying any rate cuts.

The possibility of a pullback in the stock market and a shift in risk sentiment looms if market participants start doubting the imminence of Fed rate cut, even delayed to Q2. Such a scenario could bolster Dollar, as investors recalibrate their expectations in light of the prevailing economic conditions and Fed’s policy outlook.

Technically, DOW continued to lose upside momentum as seen in D MACD. While further rally could still be seen, 100% projection of 28660.94 to 34712.28 from 32327.20 at 38378.54 might give strong resistance to trigger a correction. Break of 37122.95 will start the correction phase for 55 D EMA (now at 36688.75) and below.

10-year yield struggled in tight range around 55 EMA (now at 4.160). Strong resistance is still expected from 38.2% retracement of 4.997 to 3.785 at 4.247 to complete the rebound from 3.785. Firm break of 4% handle will indicate the rebound is over, and bring retest of 3.785 low.

Dollar index also struggled in tight range around 55 D EMA (now at 103.28). At this point, the favored case is still that rise from 100.61 is the third leg of the consolidation pattern from 99.57. Break of 104.26 resistance will strength this bullish case and target 107.334 next. However, break of 102.08 will argue that the rebound is over and bring another fall to 100.61, and possibly below.

AUD/USD Weekly Report

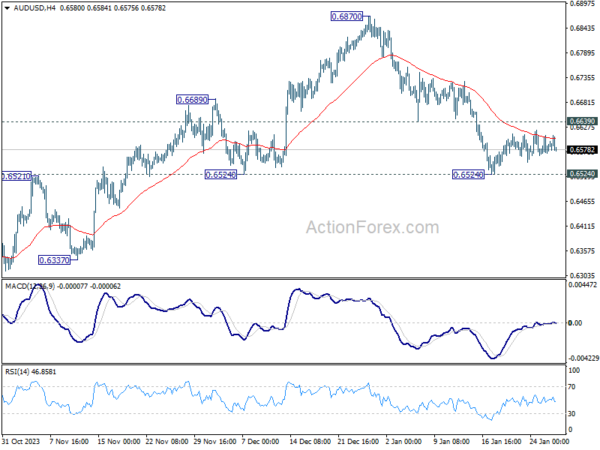

AUD/USD stayed in consolidation above 0.6524 last week and outlook is unchanged. Initial bias remains neutral this week and further fall is expected. On the downside, firm break of 0.6524 support will argue that whole rebound from 0.6269 has completed, and bring deeper fall to this support. On the upside, break of 0.6639 will turn bias back to the upside for stronger rebound.

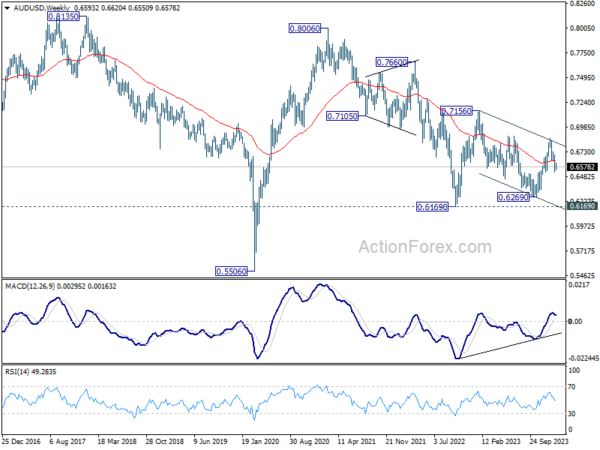

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

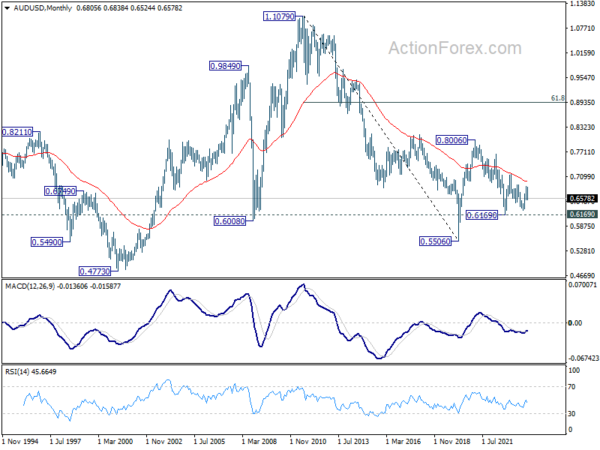

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, downside strong support should emerge above 0.5506 to bring reversal.