Sterling fell broadly today following weaker-than-expected retail sales data. Despite this, the British currency’s losses have been somewhat contained, indicating a degree of resilience. Concurrently, Japanese Yen and Australian Dollar are showing attempts to recover, but these efforts lack significant follow-through momentum. The day’s activities seem more reflective of temporary consolidations rather than indicative of any major shifts in market trends.

As the week draws to a close, Dollar is on track to finish as the strongest performer. Euro and Sterling, which had been contending for the second place, have now given way to Canadian Dollar. However, there is still room for some last-minute adjustments in the rankings. Yen, on the other hand, is poised to be the weakest performer for the week, followed closely by New Zealand Dollar and Swiss Franc. Australian Dollar, which was previously languishing at the bottom, has managed to climb out of the lowest ranks and is set to end the week with mixed performance.

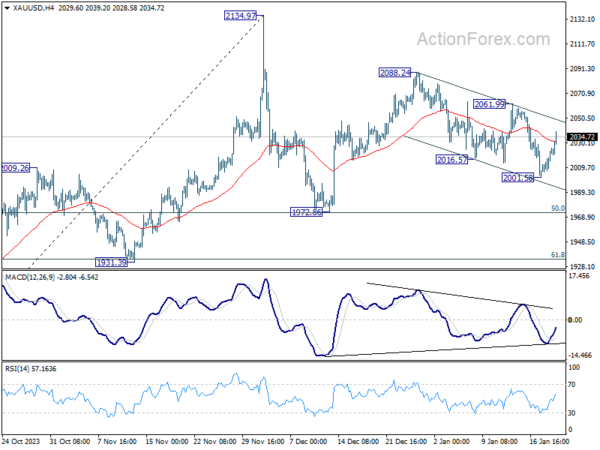

Technically, Gold surprisingly rebounded after defending 2000 handle. But overall outlook is unchanged. Price actions from 2134.97 are viewed as a corrective pattern. Rebound from 1972.86, as the second leg, might not be over yet. Break of 2061.99 will target 2088.24 and above. Nevertheless, another decline and break of 2001.58 will extend the fall from 2088.24 to 1972.86 support instead.

In Europe, at the time of writing, FTSE is up 0.36%. DAX is up 0.14%. CAC is down -0.08%. UK 10-year yield is down -0.351 at 3.905. Germany 10-year yield is down -0.023 at 2.329. Earlier in Asia, Nikkei rose 1.40%. Hong Kong HSI fell -0.54%. China Shanghai SSE fell -0.47%. Singapore Strait Times rose 0.40%. Japan 10-year JGB yield rose 0.0143 at 0.669.

Canada’s retail sales falls -0.2% mom in Nov, ex-auto sales down -0.5% mom

Canada’s retail sales fell -0.2% mom to CAD 66.6B in November, worse than expectation of 0.0% mom. Sales declined in four of nine subsectors, led by contraction in food and beverage at -1.4% mom. Excluding autos, sales were down -0.5% mom, much worse than expectation of -0.1% mom.

Advance estimate suggests that sales rose 0.8% mom in December.

UK retail sales volume down -3.2% mom in Dec, sales value falls -3.6% mom

UK retail sales volume fell -3.2% mom in December, much worse than expectation of -0.5% mom. That’s also the largest monthly fall since January 2021. Excluding fuel, sales volume fell -3.3% mom. Automotive fuel sales volumes fell by -1.9% mom. On an annual basis, sales volumes fell by 2.8% in 2023 and were their lowest level since 2018.

In value term, Retail sales value fell -3.6% mom. Ex-fuel sales value fell -3.6% mom.

Japan’s CPI core dips to 2.3%, remains above BoJ’s target for 21st month

Japan’s CPI core, excluding fresh food, decelerated slightly in December, moving from 2.5% yoy to 2.3% yoy, aligning with market expectations. This slowdown brings core inflation rate to its lowest since June 2022, yet it notably remains above BoJ’s 2% target for the 21st consecutive month.

Overall headline CPI also showed a slowdown, decreasing from 2.8% yoy to 2.6% yoy. Additionally, CPI core-core, which excludes both food and energy, saw a modest decline, moving from 3.8% yoy to 3.7% yoy.

A notable aspect of CPI data is the stability of services prices, which rose by 2.3% yoy, maintaining the pace from the previous month. This rate marks the fastest increase in services prices in three decades when periods affected by sales tax hikes are excluded.

A significant factor contributing to the slowdown in inflation was the substantial drop in energy prices, which decreased by -11.6% yoy. This decline was driven by reductions in electricity and city gas prices, which fell by -20.5% yoy and -20.6% yoy, respectively, largely due to government subsidies.

NZ BNZ manufacturing falls to 43.1, 10th month of contraction

New Zealand’s BusinessNZ Performance of Manufacturing Index fell from 46.5 to 43.1 in December. This latest figure marks a continued contraction in the manufacturing sector, which has now been shrinking for ten consecutive months.

The index components reveal a widespread decline across various manufacturing activities. Production fell from 43.5 to 40.5. Employment decreased from 47.9 to 46.7. New orders dropped from 47.4 to 44.0. Similarly, finished stocks and deliveries both saw declines, from 50.4 to 45.9 and 47.8 to 43.4, respectively.

Manufacturers’ feedback further underscored the industry’s challenges, with 61% of the comments in December being negative. This is a slight increase from 58.7% in November, though an improvement from 65.1% in October. The predominant concerns revolved around a lack of demand and sales, which have been significant hurdles for many manufacturers.

Stephen Toplis, BNZ’s Head of Research, echoed these sentiments in his assessment of the PMI data. “The December PMI reaffirms our view that economic conditions remain very difficult,” he stated. Toplis anticipates that while the economy and the manufacturing sector might gain some momentum by the end of 2024, the immediate future appears challenging, particularly with pressures in retail spending and construction activity.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2666; (P) 1.2688; (R1) 1.2727; More…

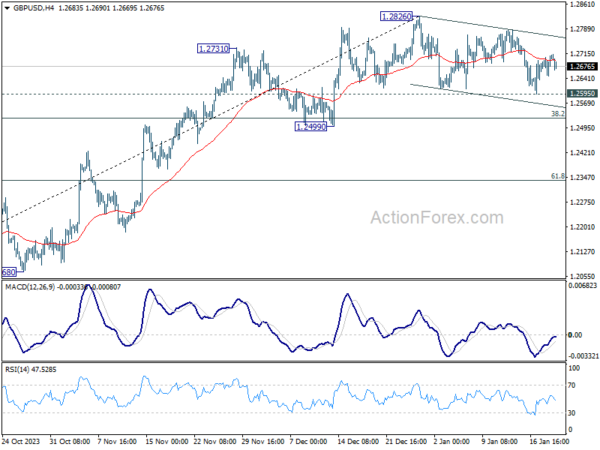

GBP/USD is staying in range above 1.2595 support and intraday bias remains neutral. On the downside, firm break of 1.2595 will resume the decline from 1.2826 to 1.2499 support. Nevertheless, strong rebound from current level will retain near term bullishness. Decisive break of 1.2826 will resume whole rally from 1.2036.

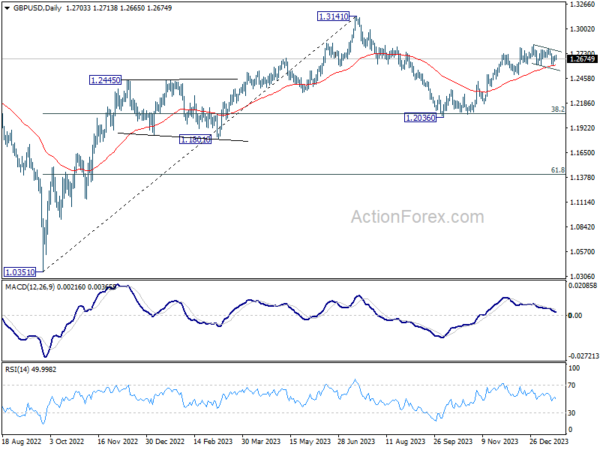

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg that’s in progress. Upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2499 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Dec | 43.1 | 46.7 | 46.5 | |

| 23:30 | JPY | National CPI Y/Y Dec | 2.60% | 2.80% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y Dec | 2.30% | 2.30% | 2.50% | |

| 23:30 | JPY | National CPI ex Food & Energy Y/Y Dec | 3.70% | 3.80% | ||

| 04:30 | JPY | Tertiary Industry Index M/M Nov | -0.70% | 0.20% | -0.80% | -0.20% |

| 07:00 | GBP | Retail Sales M/M Dec | -3.20% | -0.50% | 1.30% | 1.40% |

| 07:00 | EUR | Germany PPI M/M Dec | -1.20% | -0.50% | -0.50% | |

| 07:00 | EUR | Germany PPI Y/Y Dec | -8.60% | -7.90% | -7.90% | |

| 07:30 | CHF | Producer and Import Prices M/M Dec | -0.60% | -0.60% | -0.90% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Dec | -1.10% | -1.30% | ||

| 13:30 | CAD | Retail Sales M/M Nov | -0.20% | 0.00% | 0.70% | 0.50% |

| 13:30 | CAD | Retail Sales ex Autos M/M Nov | -0.50% | -0.10% | 0.60% | 0.40% |

| 15:00 | USD | Existing Home Sales Dec | 3.82M | 3.82M | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Jan P | 69.6 | 69.7 |