Dollar rises broadly on risk-off sentiment today, as as Hong Kong stocks led the region lower. The greenback’s strength comes despite growing calls for Fed to initiate policy loosening earlier. Notably, Goldman Sachs has joined this chorus, predicting an initial rate cut as early as March and a total of five cuts throughout the year. Concurrently, US 10-year yield has also breached the 4% mark, riding on the overall market sentiment.

The greenback’s surge was particularly pronounced against risk-sensitive currencies. Australian and New Zealand Dollar led the decline, with Aussie facing additional pressure from disappointing consumer sentiment data. Canadian Dollar, though showed relative resilience as markets eagerly await Canada’s CPI data. On the other hand, Japanese Yen emerged as the second strongest after the Dollar, supported partly by Japan’s PPI reading, which, despite falling to its lowest level in nearly two years, still exceeded market expectations.

In the European currency space, Sterling is currently the weakest performer. Market participants are closely watching the upcoming UK employment data, with particular focus on wages growth. Given UK’s current CPI level of 3.9%, robust wages growth could potentially hinder the disinflation progress and compel BoE to maintain its current interest rate for a longer period.

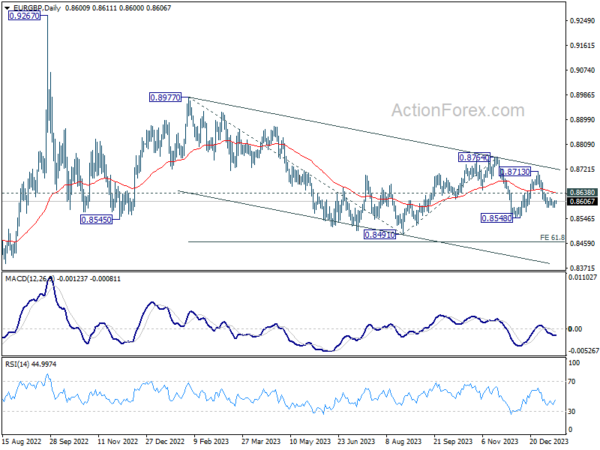

From a technical analysis standpoint, EUR/GBP is a pair to watch as Sterling reacts to UK job data. For now, the favored case is that fall from 0.8713 is resuming the larger down trend. As long as 0.8638 minor resistance holds, deeper decline is expected to 0.8548 support first. Firm break there will push EUR/GBP through 0.8491 low to 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464 next. This week’s UK economic data will be pivotal in either reinforcing or challenging this bearish outlook for Sterling.

In Asia, at the time of writing, Nikkei is down -0.62%. Hong Kong HSI is down -1.90%. China Shanghai SSE is down -0.67%. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is up 0.0258 at 0.583.

Japan’s PPI slowed to 0.0% yoy in Dec, reflecting subsidy effects

Japan’s PPI records a slowdown from 0.3% yoy to 0.0% yoy in December, above expectation of -0.3% yoy. Nevertheless, this figure represents the lowest PPI reading since -0.9% yoy decline in February 2021.

The deceleration in Japan’s wholesale prices can be attributed partially to the government’s intervention in the form of subsidies aimed at curbing petrol and utility bills. According to a BoJ official, these subsidies reduced wholesale inflation rate by approximately 0.9 percentage points.

In terms of trade-related price indices, there was a slight increase in export price index from 1.0% yoy to 1.1% yoy. Import price index improved from -10.1% yoy to -9.5% yoy.

On a month-over-month basis, the PPI rose by 0.3% mom, Meanwhile, export price index saw a marginal decline of -0.1% mom, and import price index was flat.

Australia’s Westpac consumer sentiment plunges to 81, bleakest start since 90s

Australia’s Westpac Consumer Sentiment index dropped by -1.3% mom to 81 in January. This figure is especially significant as it ranks in the bottom 7% of all observations since the inception of the survey in the mid-1970s. The only other instances of more pessimistic starts to the year were observed during the severe recession of the early 1990s.

Westpac attributed this “intense pressure” on consumers to surging cost of living, significantly higher interest rates, and increased tax burden, all of which are collectively impacting consumer incomes.

Despite the subdued consumer sentiment, Westpac highlighted that high inflation remains the primary concern for RBA. This focus on inflation suggests that the upcoming quarterly CPI release at the end of January will be a crucial determinant of RBA’s policy decision in February.

“On balance, we expect the RBA to leave rates unchanged in February, and to be unlikely to raise rates further from here,” Westpac noted. However, it also cautioned that an unexpected surge in inflation could complicate the decision, making it “a more finely balanced decision”.

NZIER survey reveals improved business outlook and steady RBNZ policy anticipated

The latest quarterly survey of business opinion by New Zealand Institute of Economic Research revealed notable improvement in business sentiment. Only a net 2% of firms now expect general business conditions to deteriorate, compared to the 52% pessimism recorded in the previous quarter.

Christina Leung, principal economist at NZIER, expressed confidence that inflation in New Zealand is on track to return to RBNZ’s target range of 1% to 3% by the second half of 2024, with a projection of reaching 2% in the first half of 2025.

“It’s a pretty encouraging picture for the Reserve Bank and it reinforces our expectations that there won’t be further increases,” in interest rate, Leung stated.

However, Leung also mentioned that NZIER does not anticipate a reduction in the cash rate until the middle of the next year, advocating for a “wait and see approach.” This cautious stance reflects a recognition of the need to monitor economic trends before making significant policy changes.

Looking ahead

UK employment data and German ZEW economic sentiment are the main focuses in European sesion. Later in the day, Canada CPI and US Empire statemanufacturing index will take center stage.

AUD/USD Daily Report

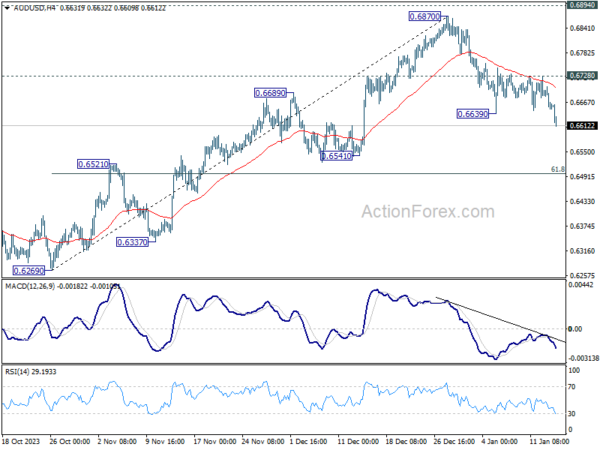

Daily Pivots: (S1) 0.6638; (P) 0.6672; (R1) 0.6693; More…

AUD/USD’s decline from 0.6870 resumed by breaking through 0.6639 support. Intraday bias is back on the downside. Deeper fall should be seen to 61.8% retracement of 0.6269 to 0.6870 at 0.6497 next. On the upside, break of 0.6728 is needed to indicate completion of the decline. Otherwise, further fall would remain in favor in case of recovery.

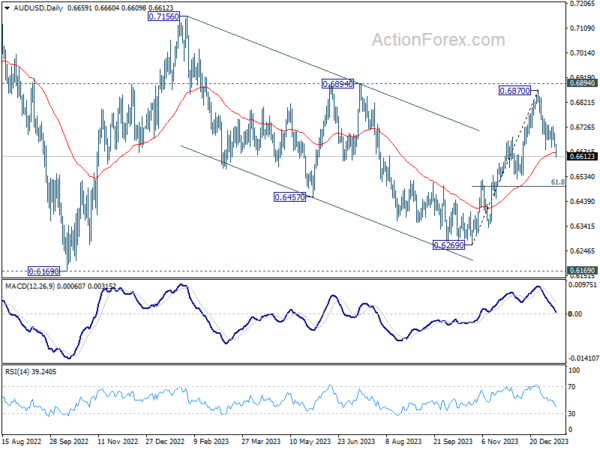

In the bigger picture, price actions from 0.6169 (2022 low) could be just a medium term corrective pattern to the down trend from 0.8006 (2021 high). Rise from 0.6269 is seen as the third leg of the pattern that could target 0.7156 on break of 0.6894 resistance. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q4 | -2 | -52 | ||

| 23:30 | AUD | Westpac Consumer Confidence Jan | -1.30% | 2.70% | ||

| 23:50 | JPY | PPI Y/Y Dec | 0.00% | -0.30% | 0.30% | |

| 07:00 | GBP | Claimant Count Change Dec | 18.1K | 16K | ||

| 07:00 | GBP | ILO Unemployment Rate (3M) Nov | 4.30% | 4.20% | ||

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Nov | 6.60% | 7.30% | ||

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Nov | 6.80% | 7.20% | ||

| 07:00 | EUR | Germany CPI M/M Dec F | 0.10% | 0.10% | ||

| 07:00 | EUR | Germany CPI Y/Y Dec F | 3.70% | 3.70% | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | 12.7 | 12.8 | ||

| 10:00 | EUR | Germany ZEW Current Situation Jan | -77 | -77.1 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | 21.9 | 23 | ||

| 13:15 | CAD | Housing Starts Dec | 244K | 213K | ||

| 13:30 | CAD | CPI M/M Dec | -0.30% | 0.10% | ||

| 13:30 | CAD | CPI Y/Y Dec | 3.30% | 3.10% | ||

| 13:30 | CAD | CPI Median Y/Y Dec | 3.40% | 3.40% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Dec | 3.50% | 3.50% | ||

| 13:30 | CAD | CPI Common Y/Y Dec | 3.80% | 3.90% | ||

| 13:30 | USD | Empire State Manufacturing Index Jan | -5 | -14.5 |