Dollar continues its strong rally in early U.S. session, making an attempt to surpass January high against Euro. The market appears to be ignoring surprisingly poor results of Empire State Manufacturing survey. Instead, mild risk-off sentiment is prevailing, offering some support to the greenback.

New Zealand and Australian Dollars are the weakest performers so far in the day’s trading, with the Japanese Yen also underperforming. On the other hand, Canadian Dollar emerges as the second strongest currency, buoyed by higher-than-expected CPI data. Euro and Swiss Franc are also showing some strength, while British Pound is mixed. Sterling dipped against Euro earlier today after data showing slowdown in UK wages growth, but there was no follow through momentum.

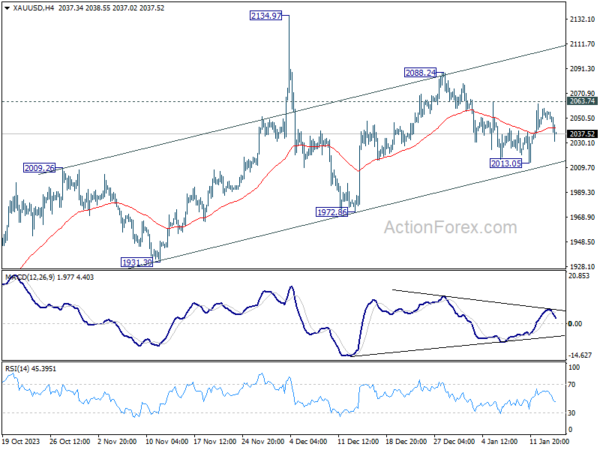

Technically, Gold fall sharply on Dollar strength today. The rejection by 2063.73 minor resistance argues that fall from 2088.24 might not be over yet. Break of 2013.05 will raise the chance of larger correction, and target 1972.86 support and below. Nevertheless, break of 2063.74 will retain near term bullishness for 2088.24 and above.

In Europe, at the time of writing, FTSE is down -0.47%. DAX is down -0.55%. CAC is down -0.43%. Germany 10-year yield is down -0.0103 at 2.228. UK 10-year yield is down -0.0070 at 3.796. Earlier in Asia, Nikkei fell -0.79%. Hong Kong HSI fell -2.16%. China Shanghai SSE rose 0.27%. Singapore Strait Times fell -0.45%. Japan 10-year JGB yield rose 0.0397 to 0.597.

Canada’s CPI rises to 3.4% in Nov on gasoline base-year effect

Canada’s CPI accelerated from 3.1% yoy to 3.4% yoy in November, above expectation of 3.3% yoy. The acceleration was largely due to base-year effect on gasoline prices. Excluding gasoline, CPI slowed slightly from 3.6% yoy to 3.5% yoy. On a monthly basis, CPI was down -0.3% mom, matched expected.

CPI median, which represents the middle point of price changes, remained steady at 3.6% yoy, exceeding the forecast of 3.4%. CPI trimmed, which excludes certain extreme price movements, rose from 3.5% yoy to 3.7%, also surpassing the expected 3.5%. Meanwhile, CPI Common, which is often viewed as the BoC’s preferred measure of core inflation due to its stability, remained unchanged at 3.9% yoy, again higher than the anticipated 3.8%.

US Empire State manufacturing dives to -43.7, lowest since May 2020

US Empire State Manufacturing general business conditions index fell sharply from -14.5 to -43.7 in January, hitting the lowest level since May 2020. Looking at some details, new orders fell from -11.3 to -49.4. Shipments fell from -6.4 to -31.3. Prices paid rose from 16.7 to 23.2. Prices received fell from 11.5 to 9.5.

Richard Deitz, Economic Research Advisor at the New York Fed said, “this outsized drop suggests January was a difficult month for New York manufacturers, with employment and hours worked also contracting.”

German’s ZEW rises to 15.2 on rate cut expectations

Germany’s ZEW Economic Sentiment rose from 12.8 to 15.2 in January, above expectation of 12.7. Current Situation index fell slightly from -77.1 to -77.3, below expectation of -77.0.

Eurozone ZEW Economic Sentiment fell from 23.0 to 22.7, above expectation of 21.9. Current Situation index rose 3.4 points to -59.3.

ZEW President Achim Wambach noted that “Economic expectations for Germany have improved again,” attributing this positivity partly to expectations that ECB will cut interest rate in the first half of the year. This expectation is shared by “more than half of the respondents ”

Furthermore, Wambach highlighted that there are even more pronounced shifts in US interest rate expectations. He stated, “More than two-thirds of the respondents predict interest rate cuts by the US Federal Reserve in the next six months.”

Wambach also pointed out that the recent rise in inflation in Germany and Eurozone in December does not seem to have influenced the monetary policy expectations of the respondents.

ECB’s Centeno: Inflation trajectory is very positive

At the World Economic Forum in Davos, ECB Governing Council member Mario Centeno highlighted the positive direction of medium-term inflation, noting that its “trajectory is very positive right now.” He further told CNBC that “we don’t need to do more than is needed”

On the topic of rate cuts, Centeno noted “once inflation starts going down sustainably, with an economy … that is not growing, where the challenges are huge, we need to be open to get all data on board and decide upon that.”

Meanwhile, another ECB Governing Council member, Francois Villeroy de Galhau, speaking at a panel in Davos, cautioned against premature declarations of victory over inflation. However, he admitted that “our next move will be a cut, probably this year” even though he refrained from commenting on the timing.

ECB’s Valimaki addresses market uncertainty rate and inflation outlook

In a Reuters interview, ECB Governing Council Member Tuomas Valimaki addressed the disparity between market pricing, which suggests a 150 basis points rate cut this year, and the views of economists.

He pointed out that the expectations reflected in money markets do not always align with economists’ projections, indicating a significant level of uncertainty among market participants. The wide distribution around market prices, as mentioned by Valimaki, underscores the existing ambiguity and varied interpretations of future monetary policy directions.

Valimaki further elaborated on the implications of market expectations versus the ECB’s baseline forecasts. He pointed out that if market rates were to fall more rapidly than projected, and the ECB’s forecasts prove more accurate, it could lead to higher inflation. This scenario, he explained, “could delay monetary easing.”

UK payrolled employment falls -24k in Dec, unemployment rate at 4.2% in Nov

UK payrolled employment fell -0.1% mom, or -24k, in December. Annual growth in employees fell from 1.3% yoy to 1.0% yoy. Median monthly pay increased by 6.6% yoy, up from prior month’s 6.5% yoy. Claimant count rose 11.7k, below expectation of 18.1k.

In three months to November, unemployment rate rose to 4.2%, up 0.5% from the previous three month period. Employment rate fell to 75.5%, down -0.5%. Total weekly hours also fell -18.5 to 1040. Average earnings excluding bonus slowed from 7.3% 3moy to 6.6%, matched expectations. Average earnings including bonus fell from 7.2% 3moy to 6.5%, below expectation of 6.8%.

Japan’s PPI slowed to 0.0% yoy in Dec, reflecting subsidy effects

Japan’s PPI records a slowdown from 0.3% yoy to 0.0% yoy in December, above expectation of -0.3% yoy. Nevertheless, this figure represents the lowest PPI reading since -0.9% yoy decline in February 2021.

The deceleration in Japan’s wholesale prices can be attributed partially to the government’s intervention in the form of subsidies aimed at curbing petrol and utility bills. According to a BoJ official, these subsidies reduced wholesale inflation rate by approximately 0.9 percentage points.

In terms of trade-related price indices, there was a slight increase in export price index from 1.0% yoy to 1.1% yoy. Import price index improved from -10.1% yoy to -9.5% yoy.

On a month-over-month basis, the PPI rose by 0.3% mom, Meanwhile, export price index saw a marginal decline of -0.1% mom, and import price index was flat.

Australia’s Westpac consumer sentiment plunges to 81, bleakest start since 90s

Australia’s Westpac Consumer Sentiment index dropped by -1.3% mom to 81 in January. This figure is especially significant as it ranks in the bottom 7% of all observations since the inception of the survey in the mid-1970s. The only other instances of more pessimistic starts to the year were observed during the severe recession of the early 1990s.

Westpac attributed this “intense pressure” on consumers to surging cost of living, significantly higher interest rates, and increased tax burden, all of which are collectively impacting consumer incomes.

Despite the subdued consumer sentiment, Westpac highlighted that high inflation remains the primary concern for RBA. This focus on inflation suggests that the upcoming quarterly CPI release at the end of January will be a crucial determinant of RBA’s policy decision in February.

“On balance, we expect the RBA to leave rates unchanged in February, and to be unlikely to raise rates further from here,” Westpac noted. However, it also cautioned that an unexpected surge in inflation could complicate the decision, making it “a more finely balanced decision”.

NZIER survey reveals improved business outlook and steady RBNZ policy anticipated

The latest quarterly survey of business opinion by New Zealand Institute of Economic Research revealed notable improvement in business sentiment. Only a net 2% of firms now expect general business conditions to deteriorate, compared to the 52% pessimism recorded in the previous quarter.

Christina Leung, principal economist at NZIER, expressed confidence that inflation in New Zealand is on track to return to RBNZ’s target range of 1% to 3% by the second half of 2024, with a projection of reaching 2% in the first half of 2025.

“It’s a pretty encouraging picture for the Reserve Bank and it reinforces our expectations that there won’t be further increases,” in interest rate, Leung stated.

However, Leung also mentioned that NZIER does not anticipate a reduction in the cash rate until the middle of the next year, advocating for a “wait and see approach.” This cautious stance reflects a recognition of the need to monitor economic trends before making significant policy changes.

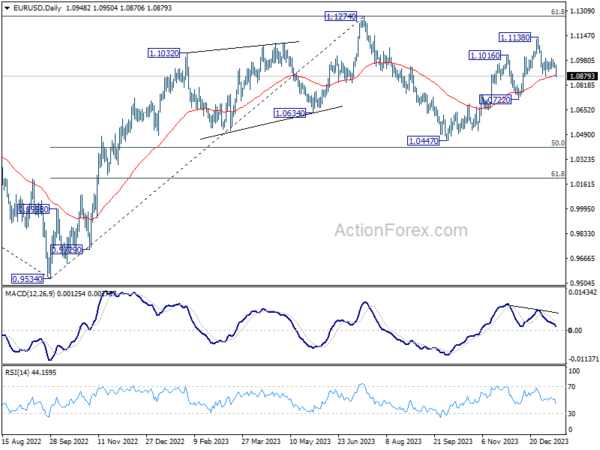

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0934; (P) 1.0951; (R1) 1.0968; More…

EUR/USD’s fall from 1.1138 short term top is trying to resume be breaching 1.0876. Intraday bias is back on the downside for 1.0722 support. Sustained break there will argue that whole rise from 1.0447 has completed, and target this low. For now, risk will stay on the downside as long as 1.0995 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q4 | -2 | -52 | ||

| 23:30 | AUD | Westpac Consumer Confidence Jan | -1.30% | 2.70% | ||

| 23:50 | JPY | PPI Y/Y Dec | 0.00% | -0.30% | 0.30% | |

| 07:00 | GBP | Claimant Count Change Dec | 11.7K | 18.1K | 16K | 0.6K |

| 07:00 | GBP | ILO Unemployment Rate (3M) Nov | 4.20% | 4.20% | 4.20% | |

| 07:00 | GBP | Average Earnings Excluding Bonus 3M/Y Nov | 6.60% | 6.60% | 7.30% | 7.20% |

| 07:00 | GBP | Average Earnings Including Bonus 3M/Y Nov | 6.50% | 6.80% | 7.20% | |

| 07:00 | EUR | Germany CPI M/M Dec F | 0.10% | 0.10% | 0.10% | |

| 07:00 | EUR | Germany CPI Y/Y Dec F | 3.70% | 3.70% | 3.70% | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | 15.2 | 12.7 | 12.8 | |

| 10:00 | EUR | Germany ZEW Current Situation Jan | -77.3 | -77 | -77.1 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | 22.7 | 21.9 | 23 | |

| 13:15 | CAD | Housing Starts Dec | 249K | 244K | 213K | 211K |

| 13:30 | CAD | CPI M/M Dec | -0.30% | -0.30% | 0.10% | |

| 13:30 | CAD | CPI Y/Y Dec | 3.40% | 3.30% | 3.10% | |

| 13:30 | CAD | CPI Median Y/Y Dec | 3.60% | 3.40% | 3.40% | 3.60% |

| 13:30 | CAD | CPI Trimmed Y/Y Dec | 3.70% | 3.50% | 3.50% | |

| 13:30 | CAD | CPI Common Y/Y Dec | 3.90% | 3.80% | 3.90% | |

| 13:30 | USD | Empire State Manufacturing Index Jan | -43.7 | -5 | -14.5 |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)