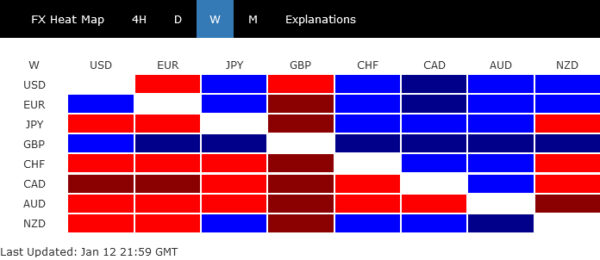

Dollar demonstrated a distinct lack of decisiveness in its trading last week, encapsulating a theme of uncertainty that has become characteristic since the start of the year. The greenback has indeed close the week within prior week’s range against most major counterparts, with Canadian Dollar being the only exception.

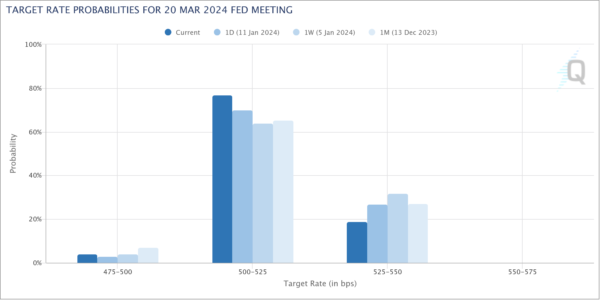

This pattern of indecision is largely rooted in the lack of clarity over Fed’s rate path, even though monetary easing is widely expected this year. The stronger-than-expected inflation data has not deterred market participants from bettering on a rate cut in March. However, this viewpoint is not uniformly held, as economists present a divided front.

The overall development also led to cautious and subdued risk sentiment across financial markets. This ongoing ambiguity could continue to maintain a low volatility environment for Dollar in the near term.

Meanwhile, Japanese Yen experienced varied fortunes, initially facing downward pressure due to receding speculation of an imminent rate hike by BoJ. The week was riddled with mixed messages from various media sources regarding BoJ’s stance, contributing to market confusion and volatility. Despite this, Yen managed to mount a recovery towards the week’s end, benefiting from decline in global benchmark treasury yields.

The broader currency markets saw British Pound emerged as the standout performer, receiving a mild boost from GDP data that surpassed expectations. Euro followed closely as the second strongest, trailed by Dollar.

Conversely, Australian Dollar bore the brunt of market skepticism, ending the week as the weakest link. Its performance was influenced by the downturn in Chinese stock markets and a tepid response to slightly better-than-expected Chinese economic data. Canadian Dollar and the Swiss Franc also found themselves on the weaker end of the spectrum.

Dollar’s indecision persists amid Fed’s policy uncertainty

Dollar has been characterized by a notable lack of clear direction, oscillating between brief rallies and selloffs without establishing a sustained trend. This indecision in greenback’s movement is largely attributed to the mixed signals from recent economic data and the uncertainty surrounding Fed’s monetary policy path for the year ahead.

Despite an initial surge at the outset of 2023, Dollar has struggled to sustain its momentum. Recent economic releases, including the surprisingly strong CPI and solid non-farm payroll data, failed to catalyze a lasting rally. Equally, weaker-than-anticipated ISM services data did not trigger a significant downturn.

The anticipation of Fed’s monetary policy path remains a central theme. Fed fund futures have been aggressive, pricing in over 80% likelihood of a rate cut as early as March, with an expected total easing of 1.50% by the end of 2024. This aggressive stance contrasts with more conservative forecasts from some economists, who anticipate the initiation of rate cuts in June, followed by potentially two more within the year, aligning more closely with Fed’s own projections

Federal Reserve officials have maintained a balanced stance in their recent communications. While acknowledging the forecasts for rate cuts in 2024, they have emphasized the prematurity of fixing a timeline and pace for policy adjustments, especially considering the current month is only January. The lack of clear expectations on Fed’s path could keep Dollar’s movement indecisive for some time.

Dollar index stayed in tight range below 103.10 temporary top last week. Overall outlook is unchanged that fall from 107.34 is seen as the second leg of the consolidation pattern from 99.57. Below 101.90 minor support would bring deeper selloff through 100.61. But downside should be contained by 99.57 low to bring rebound. Meanwhile, break of 55 D EMA (now at 103.24) is the first sign that fall from 107.34 has completed. Sustained trading above 104.26 resistance will argue that rise from 100.61 is already the third leg of the pattern and target 107.34.

Meanwhile, 10-year yield closed notably lower at 3.95 last week after failing to stay firm above 4% handle. Nevertheless, outlook is unchanged that a short term bottom was formed at 3.785 and the consolidation pattern from there is going to extend for a while. Any retreat at this stage should be contained above 3.785. Another rise is expected to 55 D EMA (now at 4.170), and possibly higher, until meeting strong resistance from 38.2% retracement of 4.997 to 3.785 at 4.247.

Nikkei soars to 30-year high amid speculation of BoJ’s hesitance on rate hike

Japanese financial market has seen significant movements this week, with Nikkei index reaching its highest level in over three decades. This surge is primarily attributed to growing speculation around BoJ’s monetary policy, as latest reports of unexpectedly muted wage growth in November have fueled doubts about the emergence of a wage-price cycle robust enough for the central bank to consider an interest rate increase.

Several media reports have further influenced market perceptions. Bloomberg, citing unnamed sources, reported that BoJ officials might be contemplating a downward revision of core CPI forecast for the fiscal year starting April 2024. The forecast could be adjusted from the previous 2.8% to 2.5%, owing to the recent decline in oil prices.

Channel News Asia also provided insights from their sources, suggesting that while core inflation forecast for fiscal 2024 might be lowered, CPI core-core forecast would likely remain close to 2% target, at 1.9% for both fiscal 2024 and 2025. According to CNA’s sources, consumer spending is holding up well, and there is a growing conviction that wage hikes will continue and possibly broaden this year. Another source indicated that the overall uptrend in inflation and wages remains intact.

These conflicting reports and the ambiguity they bring could limit any significant recovery attempts by Yen in the short term. The market is keenly awaiting BoJ’s updated quarterly projections, scheduled to be released during its meeting on January 22-23. Moreover, the outcomes of Spring wages negotiations will play a crucial role in shaping BoJ’s decision-making, particularly regarding a potential rate hike in April.

In the meantime, Nikkei finally broke out of its six-month range and surged to highest level in more than three decades, on speculation that BoJ is not ready to hike interest soon. For the near term, outlook in Nikkei will stay bullish as long as 33853.25 resistance turned support holds. Sustained trading above 100% projection of 30538.28 to 33853.46 from 32205.38 would prompt upside acceleration to 61.8% projection at 37651.22.

In the currency markets, GBP/JPY’s strong rally confirmed that corrective fall from 188.63 has completed at 178.32 already. Rise from there could be the second leg of the corrective pattern from 188.63. But even in this less bullish case, further rally is expected as long as 182.73 support holds. Above 186.14 will resume the rebound to retest 188.63 high.

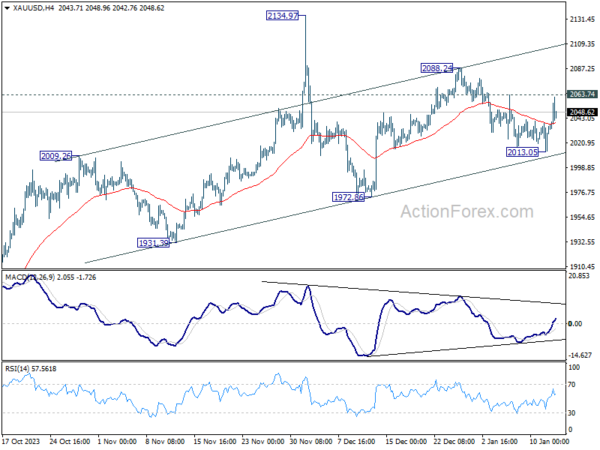

Safe haven demand boosts Gold in wake of US-led Yemen strikes

Gold rebound strongly, driven by escalating geopolitical tensions in the Middle East. The pivotal catalyst for this rally was the US and UK-led military actions against Houthi rebel targets in Yemen. The airstrikes, involving approximately 70 strikes, aimed to disrupt the Iran-backed Houthi group’s aggressive activities in the critical Red Sea shipping lanes.

The response from the Houthis was one of defiance, as they threatened to intensify their attacks and declared all US and UK interests as “legitimate targets.” This bold declaration raises the specter of a broader conflict, potentially drawing Western powers further into the complex Middle East situation.

From a technical analysis standpoint, Gold’s rebound argues that corrective pull back from 2088.24 has completed at 2013.05 already, after defending near term rising channel support. Immediate focus is now on 2063.74 resistance. Firm break there should push Gold through 2088.24 to retest 2134.97 record high.

In the bigger picture, upside momentum hasn’t been convincing as seen in D MACD. But Gold is holding above rising 55 D EMA, and maintaining near term bullishness. Current up trend is still in favor to continue to 100% projection of 1614.6o t0 2062.95 from 1810.26 at 2258.61.

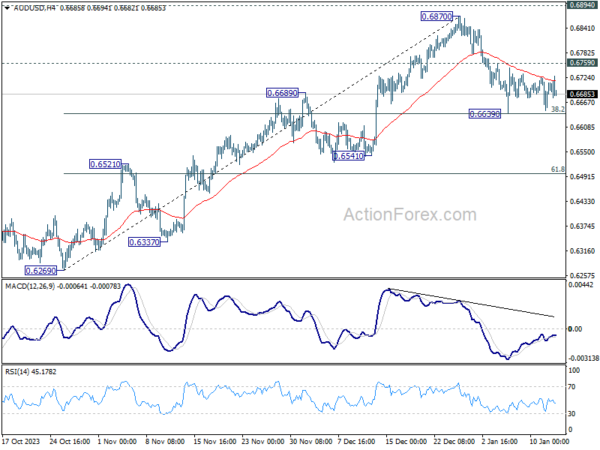

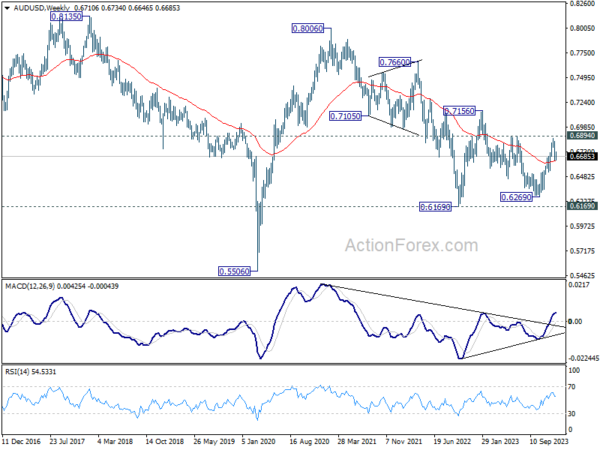

AUD/USD Weekly Report

AUD/USD turned into sideway trading above 0.6639 last week. Initial bias remains neutral this week and further decline is expected as long as 0.6759 minor resistance holds. Firm break of 0.6639 will resume the fall from 0.6870 to 61.8% retracement of 0.6269 to 0.6870 at 0.6497 next. On the upside, break of 0.6759 will bring retest of 0.6870 resistance instead.

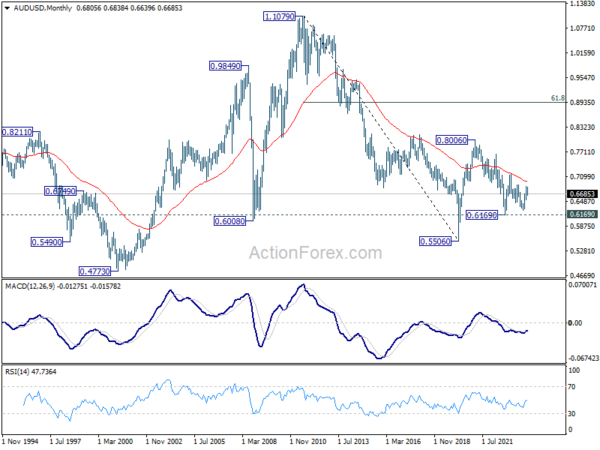

In the bigger picture, price actions from 0.6169 (2022 low) could be just a medium term corrective pattern to the down trend from 0.8006 (2021 high). Rise from 0.6269 is seen as the third leg of the pattern that could target 0.7156 on break of 0.6894 resistance. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, downside strong support should emerge above 0.5506 to bring reversal.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)