The financial markets’ initial reactions to stronger than expected US CPI readings are relatively subdued. While there was an immediate response with Dollar and yields rising, and stock futures dipping, these movements lacked significant follow-through. The exception in the currency markets was USD/JPY, which broke through last week’s high. However, this move is attributed to a combination of Dollar’s strength and Yen’s ongoing weakness. The restrained market response suggests that traders and investors may require more time to reassess their views on Fed’s path toward policy loosening and adjust their market positions accordingly.

As for the week, Euro is currently leading as the strongest currency, followed by British Pound and Dollar. However, the greenback holds potential to surpass others and take the top position. Conversely, Japanese Yen remains the weakest performer, with Australian Dollar and New Zealand Dollar also trailing. Swiss Franc is showing signs of weakness against European majors today, indicating a possible shift down in its relative market position.

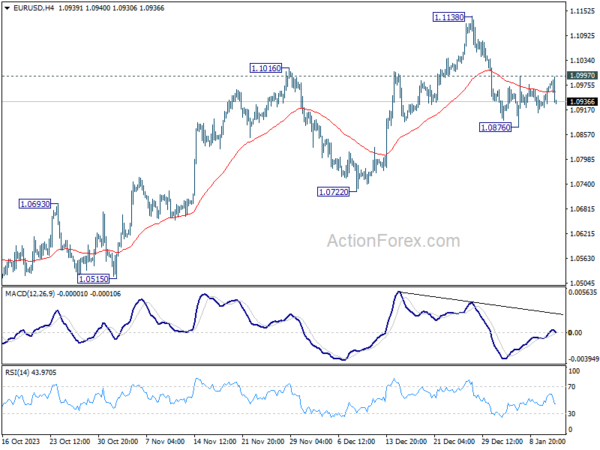

Technically, EUR/USD’s failure to surpass 1.0997 minor resistance earlier today suggests a mild bias towards a potential break below 1.0876 support level. Should this occur, the decline from 1.1138 should then target 1.0722 support. Ideally, for the bearish scenario to strengthen, GBP/USD and AUD/USD should also follow suit, breaking through their respective supports at 1.2611 and 0.6639.

In Europe, at the time of writing, FTSE is down -0.06%. DAX is up 0.05%. CAC is up 0.17%. Germany 10-year yield is up 0.0049 at 2.220. UK 10-year yield is up 0.018 at 3.845. Earlier in Asia, Nikkei surged 1.77%. Hong Kong HSI rose 1.27%. China Shanghai SSE rose 0.31%. Singapore Strait Times rose 0.67%. Japan 10-year yield rose 0.0189 to 0.606.

US CPI rises to 3.4%, CPI core down to 3.9%, both above expectations

In December, US CPI rose 0.3% mom, up from prior month’s 0.1% mom, above expectation of 0.2% mom. CPI core (all items less food and energy) rose 0.3% mom, unchanged from prior month’s, above expectation of 0.2% mom. Energy index rose 0.4% mom while food index rose 0.2% mom.

For the 12 months period, CPI accelerated from 3.1% yoy to 3.4% yoy, above expectation of 3.2% yoy. CPI core slowed from 4.0% yoy to 3.9% yoy, above expectation of 3.8% yoy. Energy index fell -2.0% yoy while food index rose 2.7% yoy.

US initial jobless claims down slightly to 202k, vs exp 215k

US initial jobless claims fell -1k to 202k in the week ending January 6, lower than expectation of 215k. Four-week moving average of initial claims fell -250 to 207.75k.

Continuing claims fell -34k to 1834k in the week ending December 30. Four-week moving average of continuing claims fell -8k to 1862k.

BoJ Regional Report: Mixed economic recovery and varied wage hike plans

BoJ’s latest Regional Economic Report noted that all nine regions have experienced an uptick in their economies, albeit with variations in pace and extent. This improvement is happening despite challenges posed by the global economic slowdown and domestic price increases. The report categorizes the regional economies as either picking up, recovering moderately, or steadily improving.

Notably, Tokai and Kyushu-Okinawa regions received upgrades in their economic assessments. Kinki region, on the other hand, was downgraded, noted for showing “some weakness in part.”

Regarding wages, BoJ report highlights a divergence in approaches among firms. It acknowledges that “some big firms have already announced plans to hike wages this year at or above the pace of last year,” suggesting a proactive response to inflation and economic recovery.

However, the situation is not uniform across all business sizes. The report points out that “many firms have yet to firm up their plans on the pace of wage hikes.” This uncertainty is particularly pronounced among small and medium-sized enterprises, which remain cautious about increasing wages due to profit constraints.

OECD calls for BoJ rate hike and flexible YCC

OECD has suggested that BoJ should consider implementing a gradual rise in short-term interest rates and introduce more flexibility into its Yield Curve Control policy. This recommendation comes at a time when Japan appears to be at a crucial economic juncture, with inflation trends potentially stabilizing around BoJ’s 2% target, a goal set in 2013 but not consistently achieved since then.

In its report, OECD stated, “Japan is at a turning point, with inflation more likely to settle durably around the 2% inflation target than at any time since its inception.” To adapt to this changing economic landscape, OECD advised that “greater flexibility in the conduct of yield curve control and a gradual modest increase in the short-term policy interest rate are warranted.” This advice is predicated on projections of sustained inflation and evolving wage dynamics in Japan.

However, OECD also issued a cautionary note regarding the uncertainty surrounding Japan’s inflation outlook, which it described as “exceptionally large.” This uncertainty presents a significant challenge for BoJ as it navigates toward its inflation target. OECD emphasized the delicate balance BoJ must maintain, stating, “The key challenge facing the BoJ is how to durably achieve its inflation target without significantly overshooting.”

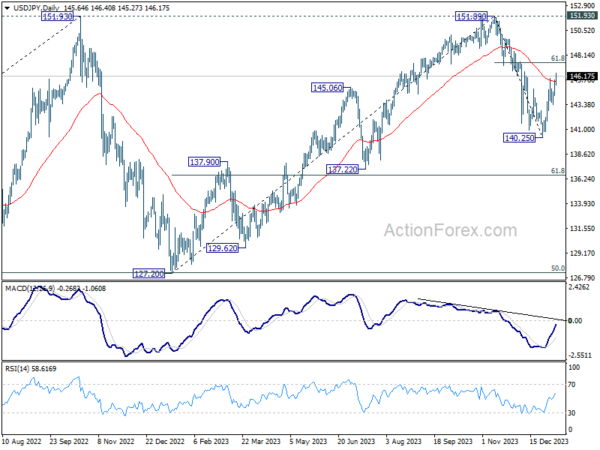

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 144.78; (P) 145.31; (R1) 146.29; More…

USD/JPY’s rebound from 140.25 resumed by breaking through 145.97. Intraday bias is back on the upside for 61.8% retracement of 151.89 to 140.25 at 147.44. Upside should be limited there to bring reversal. On the downside, below 145.27 minor support will turn intraday bias neutral first.

In the bigger picture, for now, fall from 151.89 is still seen as the third leg of the corrective pattern from 151.89. Another decline through 140.25 will target 61.8% retracement of 127.20 to 151.89 at 136.63. Sustained break there will pave the way to 127.20 support (2022 low). However, firm break of 147.44 fibonacci resistance will dampen this view and bring retest of 151.89 instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Nov | -10.60% | 8.70% | 8.50% | |

| 00:30 | AUD | Trade Balance (AUD) Dec | 11.44B | 7.50B | 7.13B | 7.66B |

| 05:00 | JPY | Leading Economic Index Nov P | 107.7 | 107.9 | 108.9 | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Initial Jobless Claims (Jan 5) | 202K | 215K | 202K | 203K |

| 13:30 | USD | CPI M/M Dec | 0.30% | 0.20% | 0.10% | |

| 13:30 | USD | CPI Y/Y Dec | 3.40% | 3.20% | 3.10% | |

| 13:30 | USD | CPI Core M/M Dec | 0.30% | 0.20% | 0.30% | |

| 13:30 | USD | CPI Core Y/Y Dec | 3.90% | 3.80% | 4.00% | |

| 15:30 | USD | Natural Gas Storage | -120B | -14B |