Dollar saw notable decline against most major currencies, maintaining its softer tone in the Asian trading session today, with the exception of its performance against Yen. This selloff amidst a backdrop of improving risk sentiment, reflected by the uptick in major US stock indexes. Investors’ attention is now squarely focused on the forthcoming release of US inflation data for December, which is poised to significantly influence market expectations and monetary policy forecasts.

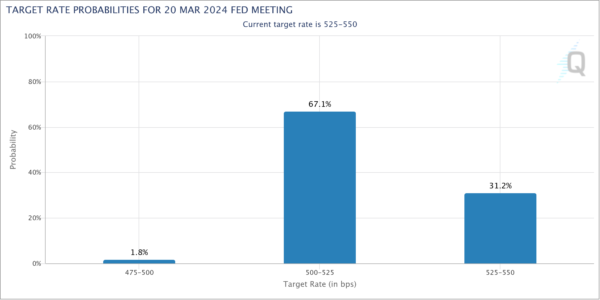

US headline CPI is expected to show a marginal increase in from 3.1% to 3.2%. More critically, the core CPI, is anticipated to demonstrate further deceleration from 4% to 3.8%. Investors and analysts will parse through these numbers to gauge when Fed might initiate a cycle of rate cuts. Recent market movements suggest a slight pullback in expectations for early rate reductions. Current projections from Fed funds futures are indicating just under 70% likelihood of a 25 bps rate cut in March. However, this sentiment remains fluid and subject to change, especially if CPI data diverges from forecasts.

In the broader currency market, Yen continues its streak as the weakest performer of the week, with Dollar and Canadian Dollar following suit. Conversely, British Pound has emerged as a front-runner, exhibiting considerable strength, closely trailed by Euro. Australian and New Zealand Dollars are also showing signs of resilience, though they are yet to demonstrate robust momentum. Swiss Franc finds itself in a neutral position, exhibiting mixed performance.

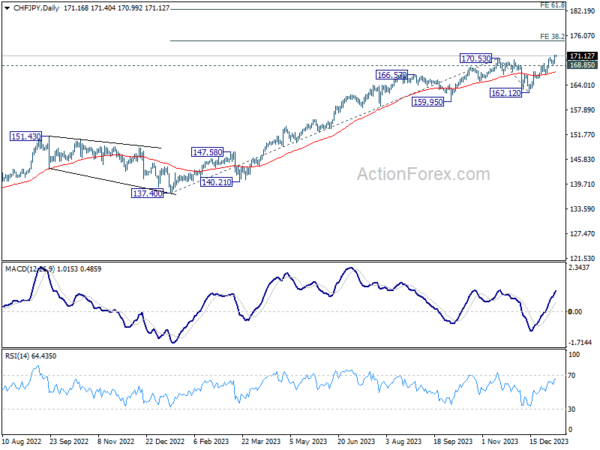

Technically, CHF/JPY’s up trend continued this week, with another rally yesterday following broad-based weakness in Yen. Further rally is now expected as long as 168.85 support holds. Next target is 38.2% projection of 137.40 to 170.53 from 162.12 at 174.77. Firm break there could prompt upside acceleration to 61.8% projection at 182.59.

In Asia, Nikkei closed up 1.84%, making another 3-decade high. Hong Kong HSI is up 1.98%. China Shanghai SSE is up 0.43%. Singapore Strait Times is up 0.61%. Japan 10-year JGB yield is up 0.0202 at 0.607. Overnight, DOW rose 0.45%. S&P 500 rose 0.57%. NASDAQ rose 0.75%. 10-year yield rose 0.011 to 4.030.

Fed’s Williams on inflation progress: Our work is not done

New York Fed President John Williams acknowledged the “meaningful progress” made in balancing the economy and “bringing inflation down.” But he also emphasized that the Fed’s is far from over with the assertion. “Our work is not done” he said in a speech overnight.

Williams highlighted the need for continued restrictive stance in monetary policy “for some time”. He added, “it will only be appropriate to dial back the degree of policy restraint when we are confident that inflation is moving toward 2% on a sustained basis.”

Addressing the economic outlook, Williams described it as “highly uncertain” and stressed that Fed’s policy decisions will be made on a meeting-by-meeting basis. These decisions will be grounded in “the totality of the incoming data, the evolving outlook, and the balance of risks.”

Williams refrained from predicting when a rate cut might occur, stating, “I’m not making a prediction.” However, he also noted that the Fed is currently in a “good place” to assimilate incoming data and deliberate on future policy moves.

ECB’s de Cos warns of policy transmission strength and economic uncertainty

ECB Governing Council member Pablo Hernandez de Cos highlighted the surprising strength of monetary policy transmission and cautioned that this could lead to lower growth. Despite the current economic downturn, de Cos emphasized the need for ECB to remain vigilant to avoid the pitfalls of “insufficient tightening” and “unnecessarily harming activity and employment.”

De Cos described the current state of economic activity in Europe as showing “clear weakness,” with expectations of only a gradual increase in dynamism. He also highlighted that “risks to economic growth remain skewed to the downside,” pointing to geopolitical developments as a key factor.

Additionally, de Cos was surprised by the strength of the monetary policy’s impact, saying, “The transmission of monetary policy has been surprising us for its strength, which, if extended in the coming years, would translate into lower growth.”

Looking forward, de Cos emphasized the need for careful monitoring of various developments that could influence inflation and, consequently, ECB’s monetary policy actions. He asserted, “We’ll have to pay attention in the coming months to different developments that may condition the trajectory of inflation and, therefore, our monetary policy action.”

BoJ Regional Report: Mixed economic recovery and varied wage hike plans

BoJ’s latest Regional Economic Report noted that all nine regions have experienced an uptick in their economies, albeit with variations in pace and extent. This improvement is happening despite challenges posed by the global economic slowdown and domestic price increases. The report categorizes the regional economies as either picking up, recovering moderately, or steadily improving.

Notably, Tokai and Kyushu-Okinawa regions received upgrades in their economic assessments. Kinki region, on the other hand, was downgraded, noted for showing “some weakness in part.”

Regarding wages, BoJ report highlights a divergence in approaches among firms. It acknowledges that “some big firms have already announced plans to hike wages this year at or above the pace of last year,” suggesting a proactive response to inflation and economic recovery.

However, the situation is not uniform across all business sizes. The report points out that “many firms have yet to firm up their plans on the pace of wage hikes.” This uncertainty is particularly pronounced among small and medium-sized enterprises, which remain cautious about increasing wages due to profit constraints.

OECD calls for BoJ rate hike and flexible YCC

OECD has suggested that BoJ should consider implementing a gradual rise in short-term interest rates and introduce more flexibility into its Yield Curve Control policy. This recommendation comes at a time when Japan appears to be at a crucial economic juncture, with inflation trends potentially stabilizing around BoJ’s 2% target, a goal set in 2013 but not consistently achieved since then.

In its report, OECD stated, “Japan is at a turning point, with inflation more likely to settle durably around the 2% inflation target than at any time since its inception.” To adapt to this changing economic landscape, OECD advised that “greater flexibility in the conduct of yield curve control and a gradual modest increase in the short-term policy interest rate are warranted.” This advice is predicated on projections of sustained inflation and evolving wage dynamics in Japan.

However, OECD also issued a cautionary note regarding the uncertainty surrounding Japan’s inflation outlook, which it described as “exceptionally large.” This uncertainty presents a significant challenge for BoJ as it navigates toward its inflation target. OECD emphasized the delicate balance BoJ must maintain, stating, “The key challenge facing the BoJ is how to durably achieve its inflation target without significantly overshooting.”

Looking ahead

ECB’s monthly economic bulletin and Italy industrial production will be released in European session. Later in the day, US CPI will take center stage while jobless claims will be published too.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0939; (P) 1.0957; (R1) 1.0990; More…

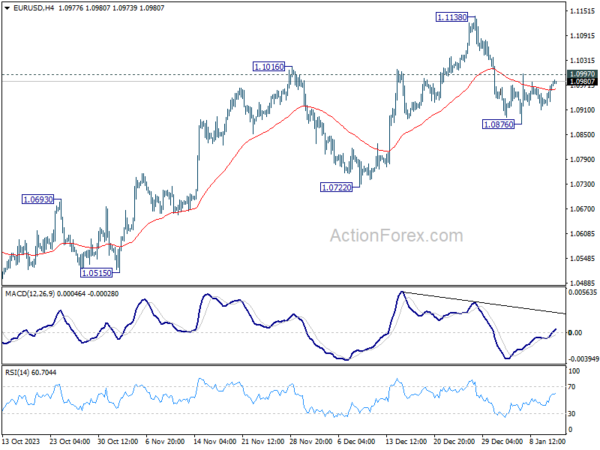

EUR/USD recovers mildly overnight and stays firm in Asian session. Nevertheless, it’s still capped below 1.0997 minor resistance. Intraday bias stays neutral at this point. On the downside break of 1.0876 will resume the fall from 1.1138 short term top to 1.0722 support next. However, break of 1.0997 will turn bias back to the upside for retesting 1.1138 high instead.

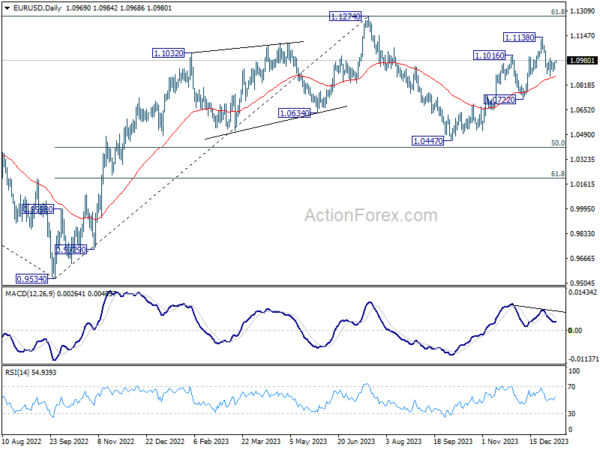

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Nov | -10.60% | 8.70% | 8.50% | |

| 00:30 | AUD | Trade Balance (AUD) Dec | 11.44B | 7.50B | 7.13B | 7.66B |

| 05:00 | JPY | Leading Economic Index Nov P | 107.7 | 107.9 | 108.9 | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Initial Jobless Claims (Jan 5) | 215K | 202K | ||

| 13:30 | USD | CPI M/M Dec | 0.20% | 0.10% | ||

| 13:30 | USD | CPI Y/Y Dec | 3.20% | 3.10% | ||

| 13:30 | USD | CPI Core M/M Dec | 0.20% | 0.30% | ||

| 13:30 | USD | CPI Core Y/Y Dec | 3.80% | 4.00% | ||

| 15:30 | USD | Natural Gas Storage | -120B | -14B |