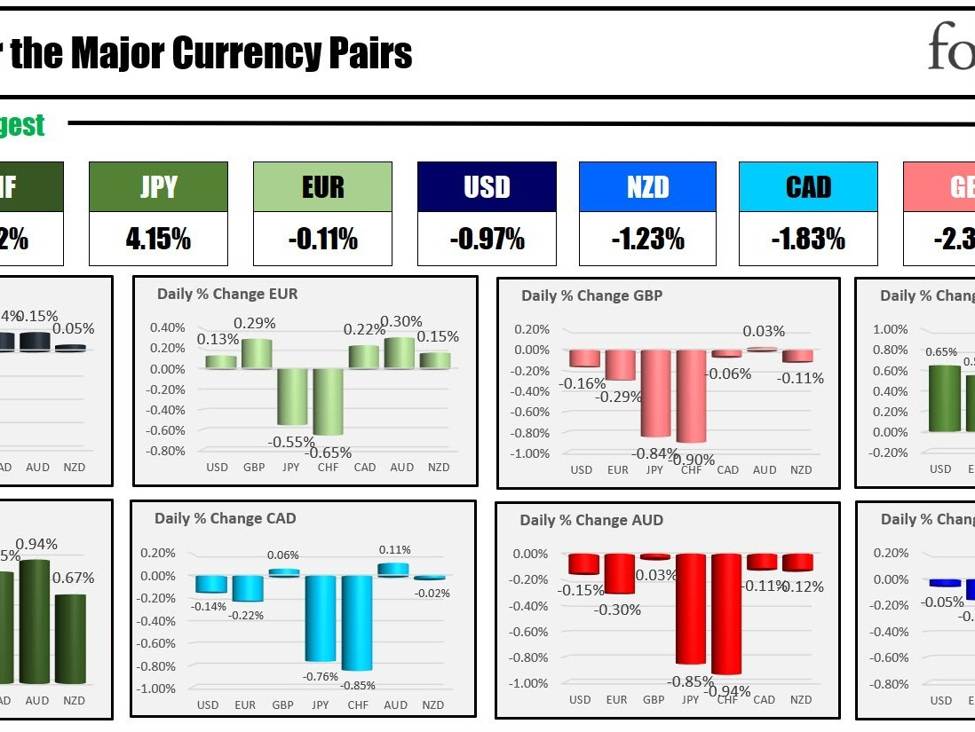

The strongest to the weakest of the major currencies

The CHF is the strongest and the AUD is the weakest as the NA session begins. The USD is mixed to lower thanks to declines vs the JPY and CHF. There are modest gains vs the GBP, CAD, AUD and NZD.

Today, US initial jobless claims and US goods trade balance will be released with preliminary wholesale inventories at 8:30 AM ET. Pending home sales will be released at 10 AM ET.

US yields are modestly higher. US stocks are mixed after gains yesterday. The price of gold is trading modestly lower after closing at an all-time high yesterday.

A snapshot of the market currently shows:

- Crude oil is $-0.83 or -1.16% at $3.25. At this time yesterday, it was trading at $74.49

- Gold is trading down $-1.55 or -0.07% at $2076.04 . At this time yesterday, it was trading at $2068.10

- Silver is up 5.9 cents or 0.26% at $24.32. At this time yesterday, it was trading at $24.08.

- Bitcoin is trading at $42,829. At this time yesterday, it was trading at $42,890

In the premarket for US stocks, the major indices are marginally mixed. Yesterday the major indices all closed higher for the second day in row this week:

- Dow Industrial Average futures are implying a decline of -26 points. Yesterday the index rose 111.19 points or 0.30% at 37656.53

- S&P futures are implying a gain of 2.6 points points. Yesterday the index rose 6.85 points or 0.14% at 478159. The all-time high closing level at 4796.57.

- Nasdaq futures are implying a gain of 53.25 points. Yesterday the index rose 24.60 points or 0.16% at 1509.18

In the European equity market, major indices are lower:

- German DAX -0.22%

- France CAC -0.41%

- UK FTSE 100 -0.04%

- Spain’s Ibex -0.19%

- Italy’s FTSE MIB -0.23% (10 minute delay)

In the Asian-Pacific market major indices were mixed:

- Japan’s Nikkei 225, -0.42%

- China’s Shanghai composite index rose 1.32%

- Hong Kong’s Hang Seng index rose 2.52%

- Australia S&P/ASX +0.70%

Looking at the US debt market, yields are lower:

- 2-year yield 4.262% +2.0 basis points. Yesterday at this time, the yield was at 4.282%

- 5-year yield 3.8.2 percent +2.4 basis points. Yesterday at this time, the yield was at 3.854%.

- 10-year yield 3.8.8 percent +2.9 basis points. Yesterday at this time, the yield was at 3.50%.

- 30-year yield 3.96% +2.5 basis points. Yesterday this time, the yield was at 4.001%

In the European debt market, the benchmark 10-year yields are mixed:

European benchmark 10-year yield