Yen falls broadly in Asian session today, influenced by the dovish sentiments expressed BoJ’s Summary of Opinions of December meeting. The document indicated a lack of urgency among board members to tighten monetary policy, with a particular emphasis on the minimal risk associated with delaying the exit from negative interest rates. Conversely, the board expressed concerns about the potential risks of tightening too early. This cautious stance reflects the board’s ongoing focus on the establishment of a “virtuous” cycle between wages and prices, a key prerequisite for any consideration of a rate hike. The spring wage negotiations are set to be a pivotal moment for the BoJ to evaluate the emergence of this cycle. Despite this dovish outlook, Yen’s retreat in the forex market was notably restrained.

Conversely, Australian Dollar is having a robust bounce, buoyed by risk-on sentiment prevalent in major Asian stock markets. This upbeat mood was partly driven by encouraging economic data from China, where industrial profits saw a substantial year-on-year jump of 29.5% in November, a significant acceleration from the modest October’s 2.7% growth. This data indicates a notable recovery in industrial earnings, even though the cumulative profits for the first 11 months of the year show a contraction of -4.4% compared to the previous year. This decrease, however, is less severe than the -7.8% decline reported for the first ten months. Despite this positive data, concerns remain about the sustainability of this growth momentum, particularly in the face of weak external demand. Nevertheless, for the moment, the upbeat sentiment is lifting both Asian equities and Australian Dollar.

Elsewhere in the currency markets, New Zealand Dollar and Canadian Dollar are trailing Aussie as the next strongest currencies. In contrast, Euro and US Dollar are weaker, closely following Yen. Sterling and Swiss Franc are showing mixed performances, positioned in the middle of the currency spectrum.

Technically, Gold’s rebound from 1972.86 is still in progress. The strong support from from rising 55 D EMA is a bullish sign, and further rally is expected as long as 2015.40 support holds. If the spike higher to 2134.97 record high is neglected due to low liquidity during that day, the key hurdle for Gold is now on channel resistance (now at 2082). Sustained break there should trigger upside acceleration through 2134.97 easily to resume the long term up trend.

In Asia, at the time of writing, Nikkei is up 1.13%. Hong Kong HSI is up 1.53%. China Shanghai SSE is up 0.44%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield is down -0.0203 at 0.613.

BoJ’s Ueda: Policy adjustment possible with strengthened wage-price relationship

BoJ Governor Kazuo Ueda, in a speech yesterday, acknowledged that while the probability of achieving the central bank’s price target is gradually increasing, it is still not high enough to justify a change in the current monetary policy.

Ueda highlighted, “The likelihood of Japan’s economy getting out of the low-inflation environment and achieving our price target is gradually rising, though the likelihood is still not sufficiently high at this point.”

The Governor pointed out the significant uncertainties surrounding economic and price conditions both domestically and internationally. He emphasized the importance of observing how firms’ wage- and price-setting behaviors evolve in response to these conditions.

Ueda also mentioned that “we will likely considering changing policy,” if there is significant strengthening of the virtuous cycle between wages and prices, leading to a sustainable and stable likelihood of achieving BoJ’s price target.

BoJ’s Dec meeting highlights lack of urgency in tightening

Summary of Opinions of BoJ’s December 18-19 meeting revealed a prevailing view among the board members on a lack of urgency in tightening monetary policy. The consensus was that delaying the decision to tighten poses minimal risk. This general sentiment indicates BoJ’s preference for a measured approach, prioritizing stability and sufficient data before considering changes.

The summary acknowledged that the sustainable and stable achievement of price stability target, set at 2%, is not yet certain. In considering whether to end the negative interest rate policy and yield curve control framework, the board stressed the importance of confirming a virtuous cycle between wages and prices.

To reach the 2% inflation target sustainably, one member noted that “growth momentum in nominal wages needs to strengthen further”. It’s also noted that wage growth has not kept pace with inflation. And, even with potentially higher wage hikes in the spring, the risk of inflation significantly surpassing 2% remains “low”. Current policy approach does not risk “falling behind the curve” in response to inflation dynamics.

The summary also noted that acknowledged that the need to “rapidly tighten monetary policy is small”. At the same time, “the cost incurred if this risk materializes would be significant.”

Looking ahead

The economic calendar is light today, with Swiss Credit Suisse economic expectations featured in European session.

AUD/USD Daily Report

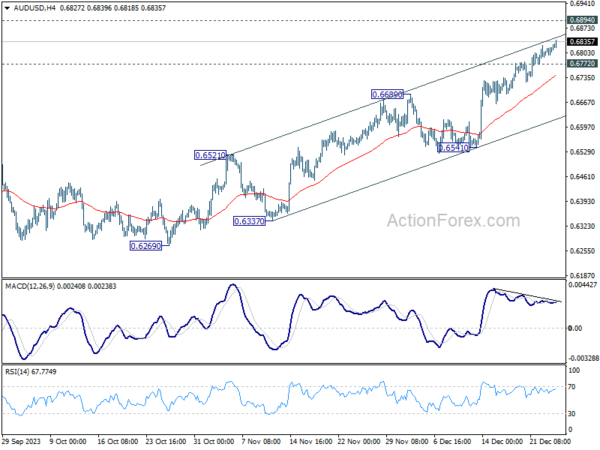

Daily Pivots: (S1) 0.6801; (P) 0.6815; (R1) 0.6837; More…

AUD/USD’s rally from 0.6269 continues today and hits as high as 0.6839 so far. Intraday bias remains on the upside for 0.6894 resistance first. Sustained break there will target 0.7156 next. On the downside, below 0.6772 minor support will turn intraday bias neutral first. But outlook will remain bullish as long as 0.6689 resistance turned support holds, in case of retreat.

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. Price actions from 0.6169 (2022 low) could be just a medium term corrective pattern. Rise from 0.6269 is seen as the third leg of the pattern. For now, range trading should be seen between 0.6169 and 0.7156 (2023 high), until further developments.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 05:00 | JPY | Housing Starts Y/Y Nov | -8.50% | -4.30% | -6.30% | |

| 09:00 | CHF | Credit Suisse Economic Expectations Dec | -29.6 |